3 Predictions for the Crypto Market in 2022

A whole month into 2022, the entire crypto sentiment is utterly different from the end of December when everyone was waiting for the long-overdue bitcoin $100,000 hit.

People rarely spoke about it over the Chinese New Year 2022 holidays or pretended they ever believed the $100,000 story. What happened in the crypto market, and what will happen in the year of Tiger for the crypto market?

Usually, I am less inclined to talk about crypto trends over a short period. 3-5 years is a comfortable length when looking at the technological developments, use cases, investment cycles, and applications. However, I couldn't resist this time around, given the satisfaction and hope that a new year's new beginning feel gives.

So, here is what I foresee will happen in the year of Tiger, from Feb. 1, 2022.

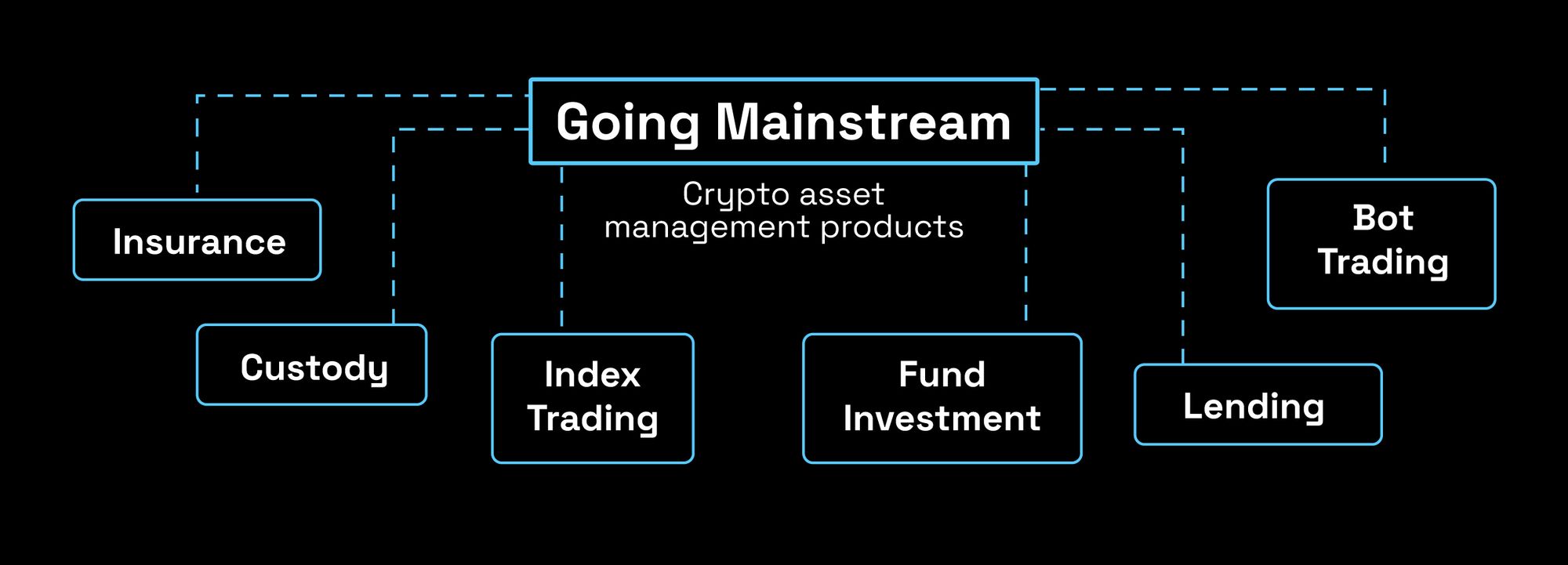

Going Mainstream - Crypto asset management products

As the price frenzy cools down, there are fewer and fewer 50X return legends to boost the spirit of crypto investors. Don't be dismayed; the primary market and IDOs are still hot, causing network congestions and more. However, it is only reflected in the decentralized exchanges with inefficient liquidity.

As a result, the crypto asset management products will go mainstream. They have existed for a while, mainly appealing to institutional investors previously, and have been evolving with the entire industry's advancement. Crypto asset management comprises several services: custody, insurance, index trading, bot trading, fund investment, lending, borrowing, etc.

This type of service will favor retail users, considering the secondary market's diminishing returns and investment strategy diversification. Crypto investors who went through the roller-coaster market in 2021 will be interested in allocating some assets in the less risky at the same time, passive revenue-generating products.

Examples as

Amber Group: Amber Group is a one-stop crypto finance service provider that provides liquidity provision, trading, and 24/7 asset management services. The company was valued at 1 billion dollars during its series B funding in 2021 June and recorded 100,000 registered users then.

Matrixport: Matrixport is Asia's fastest-growing one-stop digital asset financial services platform. With $10 billion in assets under management and custody, it provides one-stop crypto financial services with over $5 billion in average monthly trading volumes. The offerings include Cactus Custody™, spot OTC, fixed income, structured products, lending, and asset management.

Hextrust: Hex Trust is a fully licensed and insured provider of bank-grade custody for digital assets. It delivers custody, DeFi, brokerage, and financing solutions for financial institutions, digital asset organizations, corporate and private clients.

Opensea will have more and more competitors, but NFTs will be no longer be hot but a norm.

Even though Bitcoin's price slashed 30%, the lowest for January, the NFT trading volume reached another all-time high - 6.62 billion in total, which is almost 1.5 times higher than December 2021. Noticeably, from that 6.62 billion trading volume, 2.14 billion comes from Looks Rare, a rival marketplace.

Looks Rare targets Opensea for its customers, attracting users with fee rebates. Regardless of which platform, NFTs are continuing to attract users. Twitter influencer feeds and information sharing telegram announcement channels are filled with new NFT projects and Discord links. If you join 1 of the discord server, you will likely receive five more invitations to NFT projects every day.

The hype will end in a daze when at least 50% of the GameFi projects fail to deliver or survive this round of bear market. On the other hand, art and collectibles will continue to grow, and NFTs will become a market for artists' IPs. Global artists will explore NFTs as a format of their work and monetize it more easily. They will bring their existing fans or followers into the community, and thus the entire market enjoys organic growth.

Suppose the NFT market evolution - the disappearance of alpha - is fast enough. by the end of 2022, we will see NFT as nothing extraordinary other than a piece of digital merchandise. Like luxury bags, some will appreciate in price over the years, and some won't.

The trend manifests itself in the increasing number of niche NFT market places. Instead of anything with BoreApeYatchClub's (BAYC) level of prominence, they build a fan culture and encourage variety.

An explosion of DAO projects, the real challengers come

The DAO’s code has a bug but the idea does not. After almost six years of development, several DAO projects started to generate noise in the market. The concept of DAO itself is getting its own hashtag, just like DeFi and NFTs. It has been wildly acknowledged that 2022 would be the year that sees the massive emergence of DAO projects' and the market is prepared for the prosperity they bring.

The reasons are, firstly, the leaders have demonstrated success - Bankless DAO gave some best practices of how the DAO community operates. Constitution DAO explored the possibility of anonymous public funding for a specific purchase.

Secondly, the tools and infrastructure are being developed and will be available soon. Although the idea of DAO received a tremendous welcoming to make the governance experience friendly and accept mass participation, there is still plenty of room for improvement. For example, WithTally is a tool for on-chain voting, and Llama is for DAO treasury management.

Thirdly, DAO wouldn't be a good topic when there is little to explore in the permissionless space. The maturity of Web 3, DeFi, and GameFi are essential for introducing DAO to make tangible proposals, like investments, purchases, lending, borrowing, etc.

DAO (Decentralised Autonomous Organisation) is debatable but inevitable. DAO is a governance model, like democracy, socialism, autocracy, dictatorship, monarchy, etc. While we still couldn't find the best practice regarding nation governance, DAO adds on the options list for virtual communities governance. DAO's arrival is inevitable. Think of the premise of bitcoin, the starting point of the entire decentralization movement—Permissionless, anonymous, and token-proof. It seems DAO is the only answer for the governance of it all.

It is the next phase of this rebellious movement.

The exploration is admirable when you put aside the ideology debate and philosophical questions. I am curious about development and how it impacts human civilization. It is the real challenger, and it challenges everything that we are familiar with, fairness, equality, decision making, freedom.

Bonus prediction: Derivatives trading volume increases further.

Crypto exchanges serve as the backbone of the whole ecosystem, providing valuation, price discovery, and liquidity. It is like the heart of the complex financial system that needs to constantly pump the blood flow so the blood cells can circulate the whole body to complete their part of the job.

Because of the first prediction, there will be increasing demand for structured products that service providers must hedge in the options market. It will improve the options trading volume and the token variety in the options market.

Because of the second and third predictions, different indexes will be available together with futures products for indexes. As crypto moves away from pure speculation, it is indisputable many other traditional financial instruments will be introduced and derivatives can serve as a price discovery tool.