5 Trading Tips For Crypto Futures Trading

Futures trading is a high-risk, high-reward trading strategy. It is not a quick cash scheme, though it may appear so. You may think of futures as a game of chance, where you earn, provided your predictions are correct. Here, you’re speculating on the future value of a cryptocurrency.

In times of great dips where cryptocurrencies shell nearly half their value, investors often seek alternative ways to grow back their holdings. Futures trading is a strategy traders use to maximize their profit as cryptocurrencies go through high volatility.

Unlike spot trading, where a trader buys a digital asset and holds it for an extended period, futures involves capitalizing on market movements. A futures trader is said to long the market when he buys a crypto asset, anticipating price advances. But selling a crypto asset to wage on the price drop means shorting the market. Futures trading, therefore, allows an investor to benefit on either side of the market.

The remaining part of this article discusses 5 futures trading strategies you should implement in your futures trading journey.

5 Trading Tips For Crypto Futures Trading

1. Understand How Futures Work

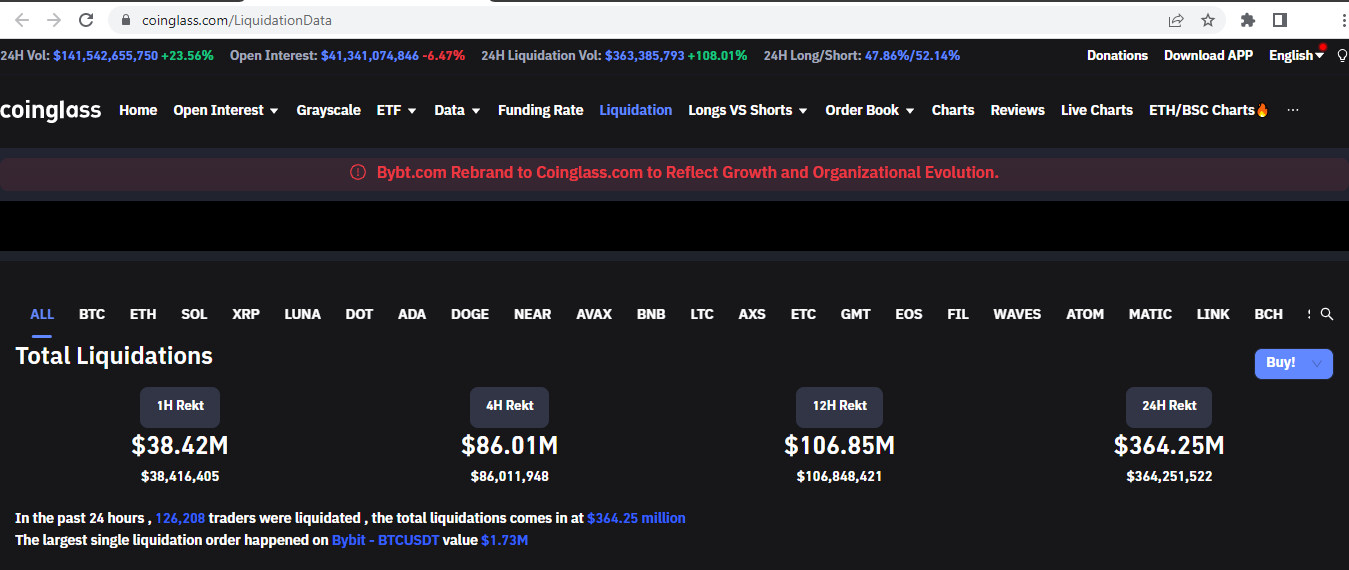

While some traders have made a fortune from futures trading, many others have lost their life savings to this form of trading. A screenshot from coinglass.com shows that, in twenty-four hours, nearly one hundred and twenty-eight thousand investors have lost above $374 million to futures trading. These losses go to their counterpart traders who traded in the opposite direction as profit.

A key feature of futures trading is leverage. Leverage is a lending tool for maximizing your initial deposit for better market exposure.

For example, when a trader with an initial account balance of $100 decides to use 10x leverage, entering a trading position of $1,000 for bitcoin, he just borrowed $900. After a 10% price increase, his account balance becomes $200. Likewise, after a 10% decrease, his initial capital liquidates to naught.

Liquidation means you have your initial balances no more, and your trade closes automatically. While leverage is a harmless tool promising inordinate profit, it also guarantees you lose your entire portfolio in a single sweep. This high risk of liquidation makes futures trading a challenging endeavor. It is, therefore, crucial to follow a strategic approach to every trade.

2. Choose Your Trading Methodology

Trading methodologies are on a specific style of trading. For example, do you trade based on technical analysis, trend following, growth investing, crypto news, etc.? Technical analysis means using price patterns from the past and technical indicators to analyze the market charts to predict future movements in price.

Choosing your trading methodology means personalizing standard trading strategies to suit your psychological traits, lifestyle, long-term goals, risk tolerance, etc. Replicating the profitability strategies you found online without vetting them may hurt your portfolio.

3. Develop a Trading Plan

A trading plan is a set of rules consistent with your chosen methodology, which describes how you execute your trades. The essence of developing a plan is to mitigate the risks of liquidation. It begins by simply setting bounds for what you deem is acceptable or unacceptable to lose in a trade. If your entire portfolio is worth $500, you should be wary of losing more than $5.

Your trading plan should include a detailed layout of the following:

4. Trade Responsibly

Avoid emotional and compulsive trading. Trading in an emotional state exposes you to far greater danger because you’re less rational in decisions. After losing substantial amounts in a trade, don’t try hard to regain the lost fund. Instead, take a break. Review your strategies. To mitigate the risk of these psychological traits, do the following:

Don’t trade with high leverages - your risk wiping out your capital faster. Decrease the number of trades you enter anytime things go south. Don’t trade with money you cannot afford to lose. Have backup funds.

5. Trade Leveraged Token on Spot

In futures trading, you own no token. You’re only betting on the future valuation of a particular cryptocurrency. So, you could potentially lose your entire holding even on 1x leverage. Your best bet for trading is in spot trading. In spot trading, though, you only benefit from the market when the prices of coins move upward. The only time you ultimately lose your capital is when you sell at a loss.

Cryptocurrency exchanges like Bit.com, Binance, Kucoin, etc., offer leveraged tokens in spot trading. These are derivative products that give you leveraged exposure to the underlying asset. For example, instead of longing or shorting bitcoin in the futures trade, you may buy BTCUP or BTCDOWN in the spot trade.

BTCUP and BTCDOWN are derivatives of BTC on the spot market. Their prices move along with the price changes of BTC on the spot market, moving up and down accordingly.

Disclaimer:

This article should not be taken as financial or investment advice. Making an investment or financial decision is a choice. Do your research!