A Beginner’s Guide to Swing Trading Strategy

The Intent of Every Trade

The core intent of every trade is to gain regardless of nature, time or location. Such gains might be monetary or non-monetary. In every case, there's always a required amount of hard work for desired results. This would include full-roof trading goals from the onset of the trade to step-by-step strategies to achieve each milestone in the big goal picture of the transaction.

This is the same in crypto trading. Traders set early goals and back them up with strategic moves to achieve them. While there's no trade without its accompanying risks, well-placed strategies minimize losses and maximize gain.

What is a Swing Trading Strategy?

Swing trading is a crypto trading strategy that focuses on profiting off changing trends in price action over relatively short timeframes. The plan is to seize a market swing by holding positions that will last for a few days, weeks, or, in exceptional instances, months - if the trade remains profitable. Traders who swing trade crypto find trading opportunities using a variety of technical indicators to identify patterns, trend direction, and potential short-term changes in trend.

Swing trading is a medium-term crypto trading that falls between day trading and HODL trading. Over time, it is strengthened by the drawbacks of both trading methods and risk-hedging tactics. Swing traders utilize several indicators to quickly enter and exit the market while using technical and fundamental analysis to identify trends and their trading positions.

How to Swing Trade

Finding trends is the key to using the swing method effectively. A swing trader purchases a position when a market value low is imminent and sells when the trend rises. In bullish swings, traders buy dips, while in negative swings, they sell rallies. For instance, when there is an upswing, you want to buy (go long) at the "swing lows." To take advantage of fleeting countertrends, sell (go short) at "swing highs," on the other hand.

Swing traders can utilize fundamental analysis to forecast the value movement of cryptocurrencies by looking at crypto updates, news, events, and other economic activity. However, most cryptocurrency traders use technical analysis since it directly uses market charts and is not affected by news about the cryptocurrency market. Knowledge of both is needed nonetheless for successful swing trading.

Technical Indicators Used in Swing Trading Strategy

Swing strategy gives a great result if well planned and utilized. However, lacking the required technical knowledge to use indicators might cause as much loss as the benefits involved. Technical indicators used in swing trading strategy include:

- Moving averages

- Ease of movement

- Stochastic Oscillator

- Relative strength Index

- Simple moving average

- Volume Indicators

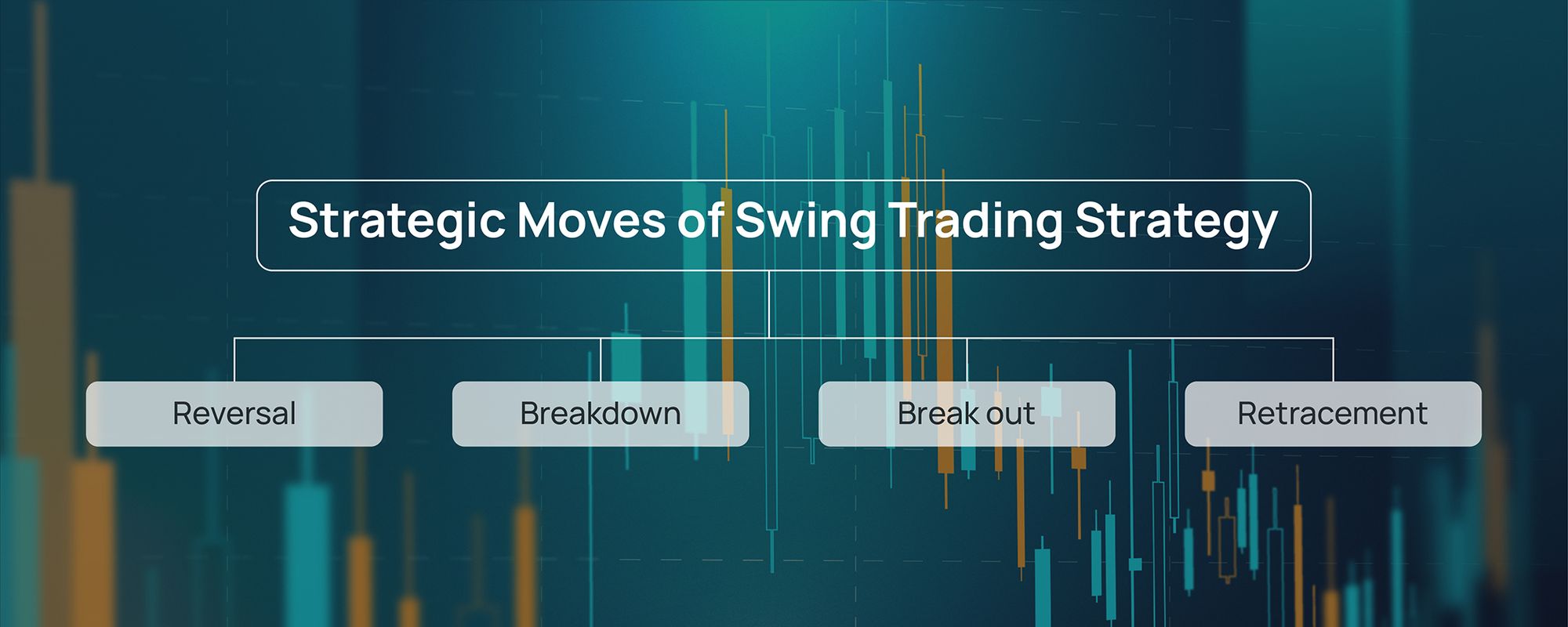

Strategic Moves of Swing Trading Strategy

As a swing trader, below are some strategic moves you should know:

- Reversal: This strategic move uses indicators to determine when upswing and down-swings are moving reversely. It indicates prices moving below average and points to a trader when to exit a position.

- Breakdown: This is a strategic move that uses technical indicators to determine when prices are going on a down-swing. It keeps swing traders vigilant to know when to exit a trading position.

- Break out: This is the opposite of the breakdown strategy. It uses indicators to determine when prices are on an Upswing and have broken resistance to reach their peaks. This gives a trader the go-ahead to open/trade positions.

- Retracement: This strategy focuses on when prices are about to enter temporary reversal mode. It detects such movements and indicates when a trader should exit his position.

Pros of Swing Trading Strategy

- Requires less time to trade compared to the Position strategy. This makes it a good alternative for part-time traders and makes this strategy a good source of income for prospective part-timers.

- It maximizes short-term profit, unlike day trading. The duration makes it perfect to benefit from medium-term trade swings that day-traders cannot tap into.

- It enables traders to set up a broader stop-loss order can be set to reduce the number of positions flooding prematurely.

- It can be a patterned trade, unlike day trading.

Cons of Swing Trading Strategy

- Just as it gains on being a medium-term duration trading, it loses out on long-term benefits that position trading enjoys.

- It is equally vulnerable to sudden market trend changes because of its duration.

- It requires adequate knowledge of technical analysis to understand the indicators and trade positions effectively.

- As a medium-term duration trade, holding positions for longer could increase the chances of loss just as it increases the chances of profit.

Conclusion

Swing trading is a full-proof strategy that beginners could use to trade profitable positions. However, it requires adequate knowledge of fundamental and technical analysis to prevent avoidable mistakes and identify indicators to trade positions. Its medium-term duration strengthens the weaknesses of short and long-term strategies.

Trade Crypto on Bit.com

With the mission to create an entire ecosystem for blockchain-based financial transactions, Bit.com stands as the world’s 2nd largest crypto options exchange.

Sign up on Bit.com, and switch on your future.