Aave (AAVE) - Borrow or lend crypto without a middleman

You might be wondering why we’re talking about African-American Vernacular English, but no. In the crypto world, Aave means something completely different.

Aave is a decentralized cryptocurrency borrowing and lending platform for crypto and real-world assets (RWAs), without a middleman or a bank. The word actually means “ghost” in Finnish, referring to the concept of a non-existent middleman.

This DeFi protocol is currently the world’s largest crypto loan provider. Lenders earn interest, and borrowers pay interest. Pretty simple.

It was initially built on the Ethereum blockchain, and uses its “smart contract” function that automatically executes the loan repayment plus interest when it is due. As of March 2022, with the launch of their new feature Portal, Aave has since expanded to other chains, including Solana, Avalanche, Fantom, and Harmony.

The Borrower

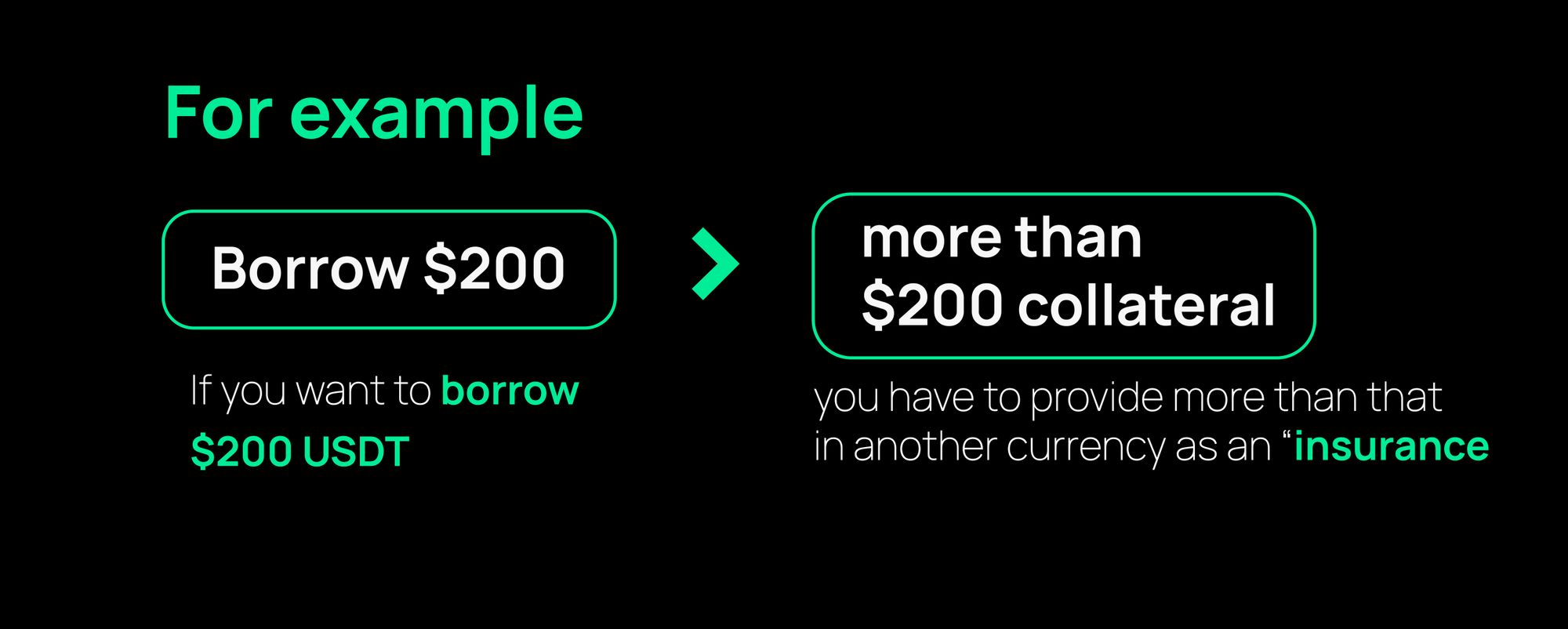

To borrow, you’ll have to put up collateral in another cryptocurrency, and usually higher in value than what you’d like to borrow. For example, if you want to borrow $200 USDT, you have to provide more than that in another currency as an “insurance”.

So if you don’t pay back your loan, Aave will take away your collateral to make sure that the lender gets their money plus interest back. So no collateral, no borrowing.

Once you’ve received your loan, you can choose to pay back in the same cryptocurrency you borrowed, or give up a part, or all of your collateral as payment. The good thing is, you don’t have to do it all at the same time, or do it at a fixed date. Of course, the longer you loan for, the more interest you have to pay over time.

The lender

As a lender, you don’t even need to trust a borrower to return what has been borrowed, the smart contract makes it happen automatically, plus the interest you earn. It’s not so much peer-to-peer lending, more like pool-to-peer lending.

In other words, to become a lender on the Aave platform, you deposit crypto tokens into a “liquidity pool”, which is a collective pool of tokens that the platform uses to give out loans. What you get back in interest is earned from how much you have put into the pool. Interest rates depend on demand and supply. High demand + low supply = High interest. Low demand + high supply = Low interest. And you can withdraw your funds anytime without charges.

Lender risks

The risks associated with Aave are just like those in any other crypto-based investment - price volatility. Borrowers have to give Aave collateral (something like insurance) in another currency, in an amount higher than what they want to borrow. This makes sure that if the borrower doesn’t return the “money”, Aave will then own the collateral. Sounds good so far.

But what if the coin deposited as collateral suddenly plummets in value and now even when Aave liquidates this, it’s not enough to “return” the loan? Aave will then dig into its Safety Module, a backup pool consisting of the crypto lenders have deposited, and liquidate some of that to make up for the shortfall. And that’s when you make a loss.

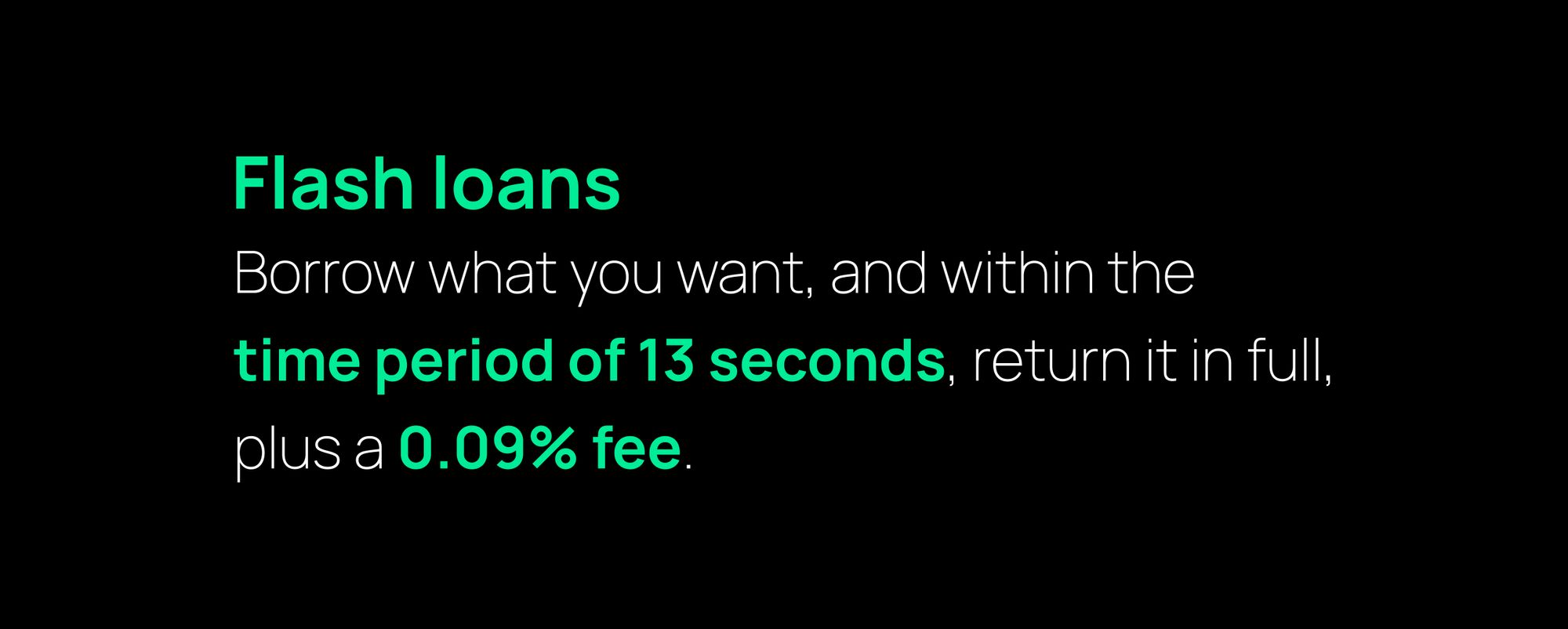

Flash loans - Borrow and return in 13 seconds

13 seconds? Well, that’s the time it takes for the Ethereum blockchain to add one block and finalize a transaction. In a flash loan, there’s no need for collateral. Borrow what you want, and within the time period of 13 seconds, return it in full, plus a 0.09% fee. If you don’t, the entire transaction is cancelled and it’ll be like nothing has happened.

So Aave doesn’t take any risks, and neither does the borrower.

What is it exactly that can be achieved in these 13 seconds to make flash loans an attractive idea? Automated commands can be performed so that what you borrowed can be instantly used to buy another currency, then use that to buy back the borrowed currency at a cheaper rate, which is used to repay to Aave. Loan repaid, profit made, all in 13 seconds.

Here’s an illustration. You want to borrow $10 from Mr. Aave and promise to return $11 to him in 13 seconds. You take that $10 to buy 5 golden rings from the stall beside his, then run to the market to sell the rings off for a total of $15. You then run back to Mr. Aave and return him his $10 plus the extra $1 you promised him. Congratulations, you just made $4.

Sounds like a lot of running. But since everything is automated and happens in a flash, it’s a lot less tedious, and blockchain technology works in a way that Aave doesn’t have to loan you any money if you can’t guarantee to return it. On the blockchain, a lot more can be done to maximise the Flash Loan function, involving many more “golden rings” and “markets”.

The AAVE token

The AAVE token is Aave’s own coin. Evey AAVE you own is a vote in how Aave does its business. It can be traded on exchanges such as Bit.com, and can also be deposited into the Aave Safety Module to earn you interest,

And then there are more perks. You don’t get charged a fee when you take out AAVE loans from the protocol. Borrowers who use AAVE as collateral also get a discount on fees, plus they get to borrow a higher amount than if you use another coin as collateral.

At the time of writing, AAVE ranks number 50 in the indexes, according to its market cap of slightly over USD 1 billion at the time of writing. If you’re looking to gain an advantage using AAVE and the Flash Loan functions, log in to Bit.com today. It’s time to Switch on to The Future.