Analysts' Insights

Bitcoin Bulls Prevail: Sell-Off Defied, Market Celebrates Resilience

- by Markus Thielen

Inflation Data Unveiled: Forecasting Rate Cuts and Market Trends

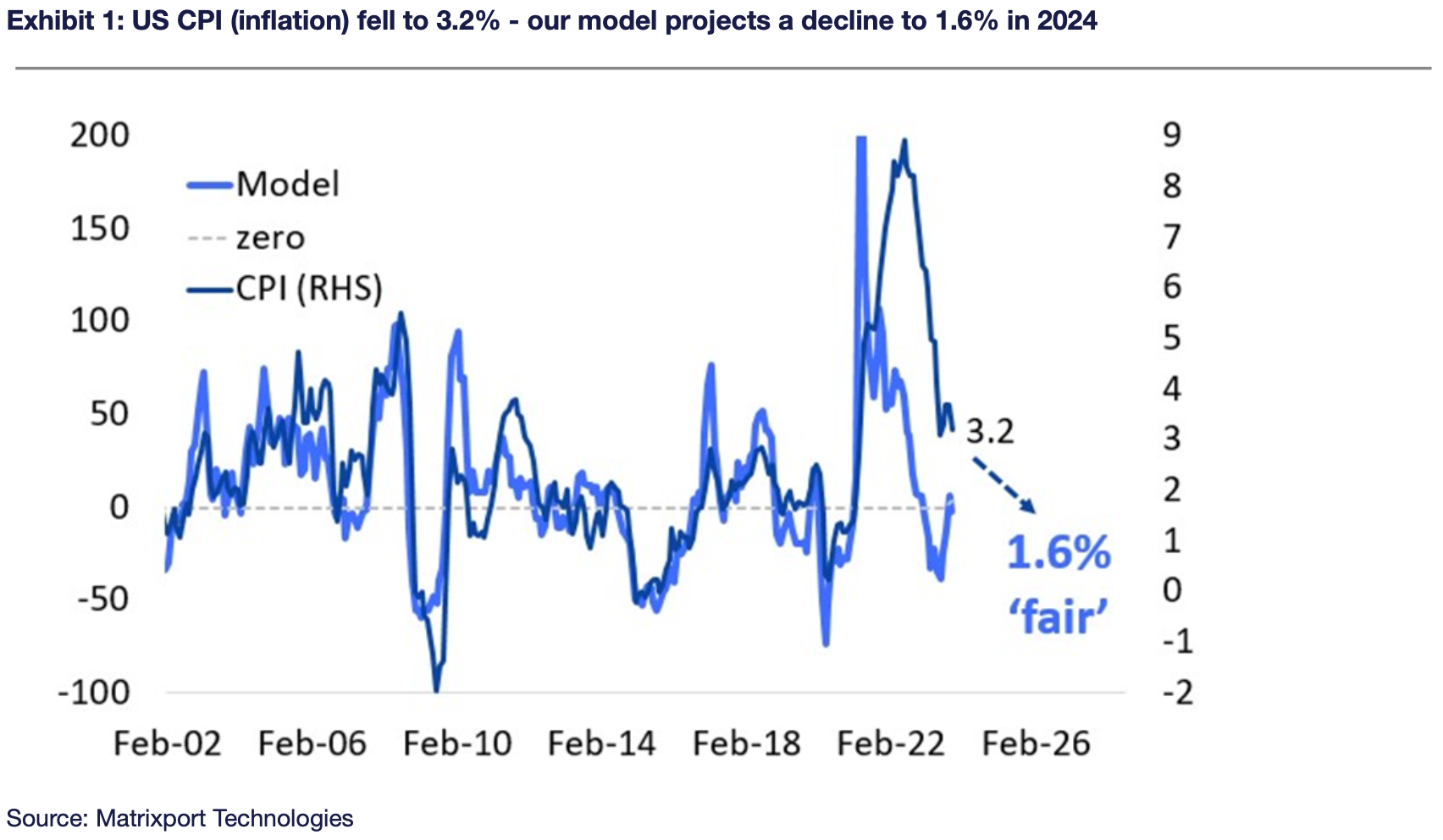

According to inflation data from November 14 (yesterday), US CPI declined below expectations from 3.7% to 3.2%. According to the model that had guided us for many years (notably a year ago when we published those bullish reports with confidence), US inflation could fall to 1.6% in 2024. Based on our analysis, this is a high-probability event and would allow the US Federal Reserve to cut interest rates materially (150-200 basis points).

The result would be an ongoing rally in risk-on assets, such as tech stocks and crypto. Bonds would also rally, turbocharging lower-quality tech stocks and second/third-tier crypto coins — a trend we have observed in the last two weeks. In response to the lower-than-expected inflation report from yesterday, we have seen traders bringing forward their estimates for when they expect the first rate cut — from June to May. While the March FOMC meeting might sound too early, we expect the rate cuts to be persistent as soon as inflation falls closer to 2.0%. Based on our analysis, we expect to see a ‘2-handle’ very soon.

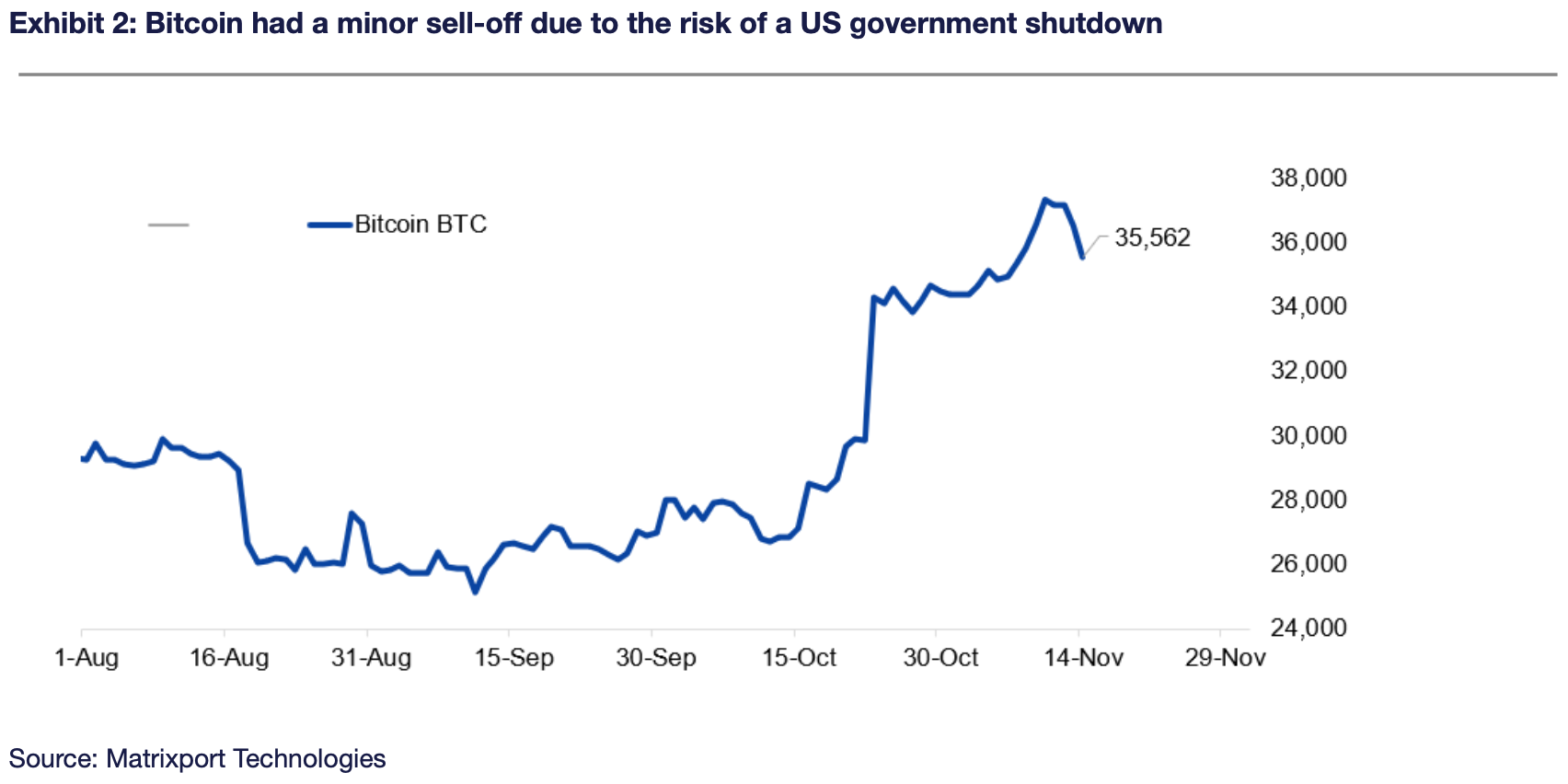

Despite our bullish outlook, there was some near-term risk, and it’s not surprising that Bitcoin sold off after last night’s bullish inflation number — which helped stocks but not crypto.

Averted Sell-Off: Navigating Near-Term Risks and Bitcoin's Resilience

The US House of Representatives has just passed the stopgap bill, securing funding for the government into the New Year. In the event of a shutdown, all non-essential government work would have paused, including the US Securities and Exchange Commission (SEC) work on any potential Bitcoin ETF approval. Previous shutdowns during the last decade lasted for an average of 17 days. With the previous government shutdown in December, no work was done for 34 days. This would have seriously jeopardised any Bitcoin approval, even in January 2024

The result would have been that Bitcoin might see some more profit-taking, potentially dropping by 10%, and implied volatility would have been crushed. We were also ready to give up on our long-held view that Bitcoin would rally to $45,000 by the end of this year. While this target appeared unreachable when we published it on February 2, 2023 (Bitcoin traded at $22,500), the House passing the government funding bill keeps this year-end price target alive.

A Bitcoin sell-off was averted, and the market could see a relief rally as expectations for a Bitcoin ETF approval occurring any moment are kept alive.

Explore Our Precise Forecasts for Further Insights

We turned bullish on Bitcoin a year ago and published several reports explaining our thesis. During presentations that stretched from Hong Kong to Singapore to Vietnam to Thailand, we described how Bitcoin tends to make a low 14-16 months before the halving event (which could justify a price target of $63,000 by May 2024). It was time to buy Bitcoin sub $20,000. Thousands have read our reports.

On December 2, 2022, we wrote, ‘With a macro tailwind, Bitcoin might be at $29,000 in 2023’. Crucially, this report correctly predicted that US inflation would decline materially, triggering a massive risk-on rally in stocks and crypto. The Nasdaq is up +35% year-to-date, and Bitcoin is up +114%. Notably, hardly anybody else predicted this.

Written by Markus Thielen, Head of Research & Strategy at Matrixport. Author of Crypto Titans.

Join now for more insights around crypto!

Industry views and information shared do not represent Matrixport's position and do not constitute any investment advice.