Analysts' Insights

Staking is as exciting as buying bonds

1) If you think the U.S. has a long and prosperous future, you should lend the U.S. government at 3.53% per annum for the next ten years. This has become a hot topic in light of the U.S. debt ceiling.

2) Still, with the introduction of A.I. and other deflationary forces, investors might make some money not only on the annual interest that the U.S. government pays but also on the revaluation of the bond principal as interest will decline, and bond prices rise.

3) This strategy worked in the 2010s as quantitative easing provided enough capital to go around and as people needed to figure out what to do with all that money that eventually was moved into low-yielding sovereign bonds.

4) This sounds as exciting as staking Ethereum where a validator is responsible for storing data, processing transactions, and adding new blocks to the blockchain. The question now arises if people are staking ETH because they do not know what else to do in “defi”? Or maybe there is nothing else to do.

5) Staking is nothing else than storing your capital and making some 5% yield on your ETH. This is a far cry from the 10x returns people talked about a year or two ago or from the wild-west days of yield farming.

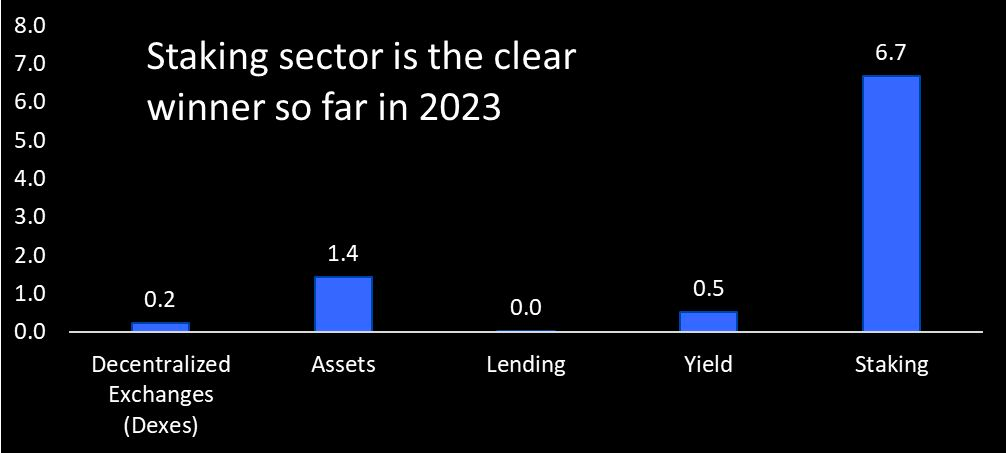

6) The crypto metric TVL – total value locked – measures the total value of digital assets locked or staked in DeFi. This year, TVL has increased by $8.8bn to $68bn – 75% of the TVL increase associated with the staking sector. Lending, Yield, and Dexes have seen near zero increases, while WBTC dominates the Assets sector. WBTC is wrapped Bitcoin, a token that mirrors the value of Bitcoins.

7) Crypto can only enter a new bull market with a clear theme driving it. We have had four crypto bull markets. But crypto can’t enter a bull market because people love a 5% yield. If everybody just stakes, who is innovating? Who is pushing the crypto industry forward?

8) Crypto needs to do more to attract money from institutional investors. It needs to do more to integrate with the real economy. Some believe it will be gaming. Some others believe it will be real world assets or remittances.

9) Whatever comes next, the current wave in staking as the only game in town shows that the industry has run out of ideas just like tradFi investors ran out of ideas in the 2010s when the amount of negative-yielding bonds peaked at $18.4 trillion in December 2020.

10) But just like in the 2010s, a small group of tech people were building new products and new crypto entrepreneurs will be building new projects. We will keep looking and finding projects/tokens to invest in. We will keep looking for the drivers of the fifth bull market.

Join now for more insights around crypto!