Analysts' Insights

What are the most favorable crypto jurisdictions?

1) Most people think cryptocurrency prices move randomly. Others think the Bitcoin halving cycle is the key driver for the wide swings. But the critical reason crypto prices move up or down is often regulation.

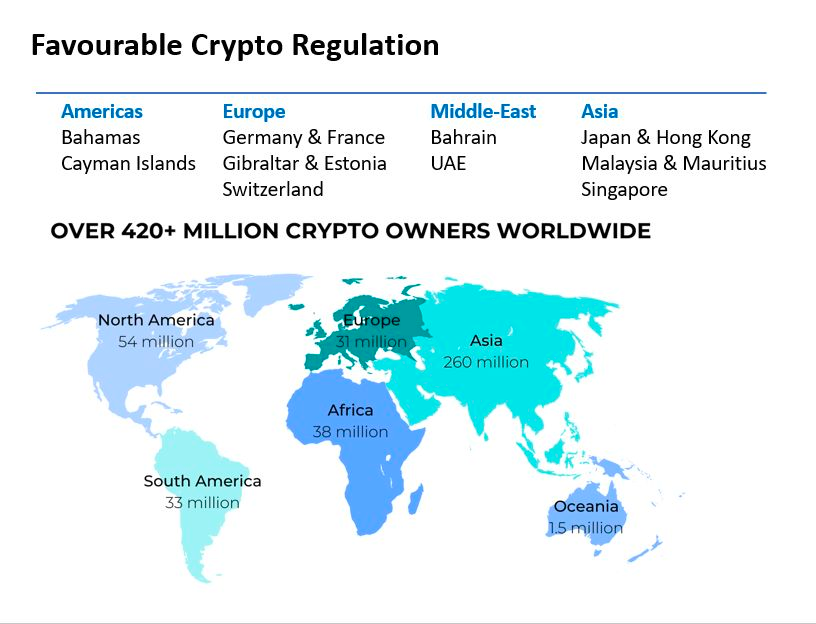

2) Bitcoin started in the U.S., but it was scaled in Asia. Not only because Asia has the most crypto users (260m now, or 61%) but also because U.S. regulation has pushed crypto offshore.

3) On March 18 2013, the Financial Crimes Enforcement Network issued guidance around the Bank Secrecy Act (BSA) to persons creating, obtaining, distributing, exchanging, accepting, or transmitting virtual currencies. Few people know this.

4) This BSA would cost Bitmex $100m in fines and Arthur Hayes – as the CEO of Bitmex $10m in fines and six months house arrest. This BSA act will eventually cost Binance billions of dollars in fines – at least.

5) At the same time, in 2013, there was positive regulation in Asia. The result was a massive Bitcoin rally driven by China that eventually moved to Hong Kong – again due to regulation – or in that case, a statement that Bitcoin does not need to be regulated. Again few people know this.

6) Understanding how these big policy decisions have driven innovation, adoption, and crypto use cases is essential. Policy decisions were instrumental in facilitating and ending the four crypto bull markets (2011, 2013, 2017 and 2021).

7) Expectations were high for the U.K. to become the number 1 crypto hub in the world. London is still the global financial center, connecting the East with the West and could be the channel for institutional capital.

8) But a panel of U.K. lawmakers is proposing classifying cryptocurrencies as gambling given “the significant risks they pose to consumers”. This statement will unlikely attract crypto entrepreneurs and they will search for other destinations.

9) The number of jurisdictions is indeed shrinking but my main takeaway from the ‘Crypto Titans’ book is that crypto is just not going away. The book does not try to convince the reader that crypto is inevitable, instead shows how the crypto industry unfolded and how jurisdictions have changed the landscape .

10) Crypto is like water and floats to the jurisdiction with the least resistance. There are pockets of favorable regulation in the Caribbean, Middle East and Asia. The history of cryptocurrencies shows that billions of dollars will flow to the jurisdiction most favorable...

Join now for more insights around crypto!