Analysts' Insights

Most Crypto Hedge Funds SUCK…. not all of course…

If you are a successful crypto HF (& maybe want to raise more capital) OR if you want to invest in a crypto HF, let us know…. not all HFs suck of course…

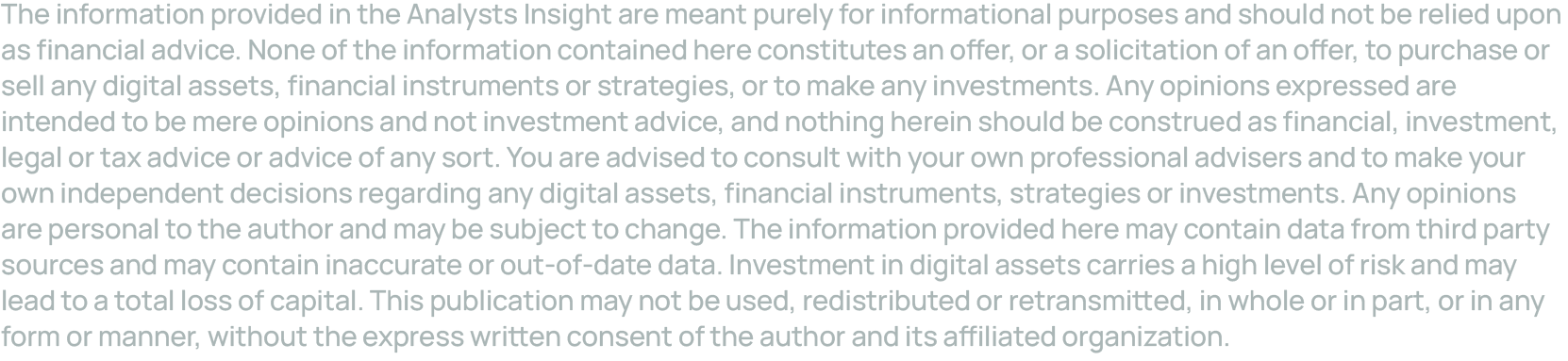

1) According to the Eurekahedge Cryptocurrency Index, a benchmark index with 14 equal-weighted constituents, crypto HFs are underperforming Bitcoin for the 5th year out of the last 8 years. This is a very poor representation of crypto fund managers. Even in 2023, they have underperformed in Jan and Mar — both months saw Bitcoin returns of +39% & +23% returns.

2) It seems that managers are simply tracking the price of Bitcoin; adding management costs & performance fees on top, et voila, the underperformance can easily be explained. In addition, as regulatory requirements increase, operating costs will increase and could hurt fund performance even more.

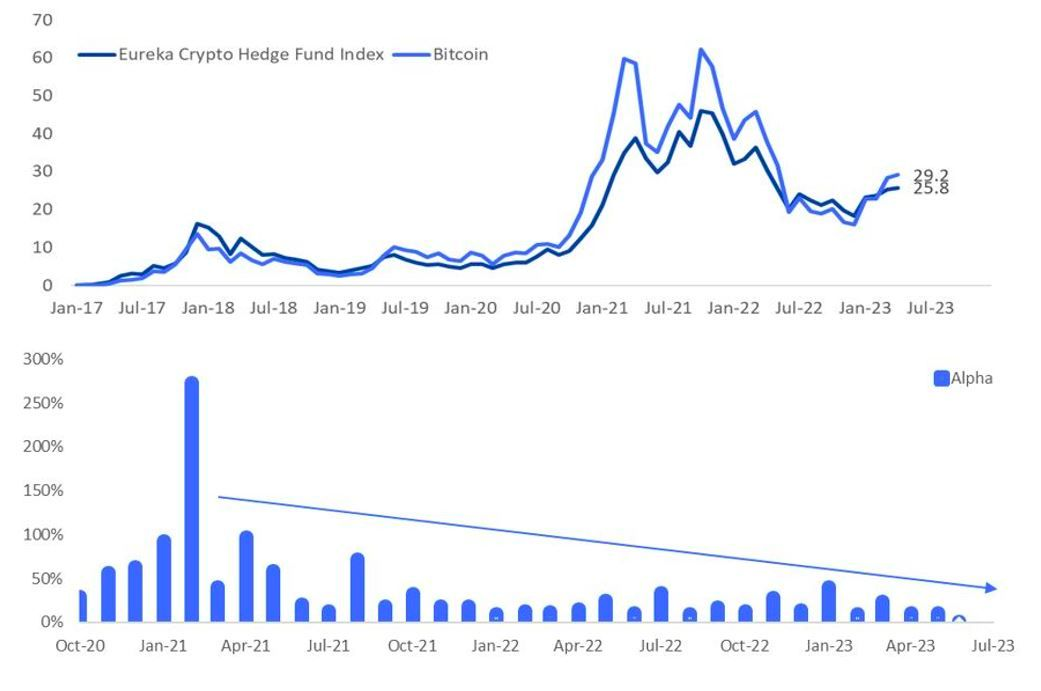

3) But understanding the cyclicality of digital assets, combined with a flexible mindset of riding the winners & selling the losers, investors could make sizable returns — not even in bull markets, but also in bear markets. True, the ‘Alpha’ has decreased over time, making active, discretionary crypto fund mgmt more difficult.

4) Running a strategy with the top 10 market cap weighted tokens, the difference (dispersion) between the average return of the top 5 vs. the bottom 5 crypto has continued to drop. It still offers 10-20% monthly returns IF the manager can buy the strongest performing 5 tokens ahead of the month and sell the 5 worst performing ones — before any costs etc. of course.

5) While this seems impossible, a skilled fund manager might be able to generate 2-5% per month with relatively low delta exposure (market neutral).

6) This requires implementing a Long / Short Crypto Hedge Fund strategy where the manager & his team buy the winners and short the losers.

7) The Eurekahedge performance data indicates that crypto HFs are too dependent on the direction of the price of Bitcoin and are not managing their downside well. Shadowing the large drawdowns of 60-80% that Bitcoin tends to experience every 3-4 years is simply unacceptable for institutional investors.

8) Interest rate & liquidity considerations have become an important part in predicting where crypto prices are going & correctly predicting those variables could determine if the fund should be market neutral, slightly bearish, or slightly bullish positioned tactically. This could be another source of ‘Alpha’.

9) The disappearance of ‘Alpha’ appears to be a shifting market structure narrative whereas macro factors have become more important as the liquidity within the crypto universe fails to expand. This itself is due to the regulatory overhang & the lack of sizeable capital that institutions were expected to provide.

10) In that environment, there should be more focus on winners and losers, instead of broad exposure that depends on a rally in the Bitcoin price. This is the time for active crypto fund mgmt.

Join now for more insights around crypto!