Analysts' Insights

Strong Liquidity and Upside Leverage

- by Markus Thielen

Bitcoin market dynamics changed, FOMO

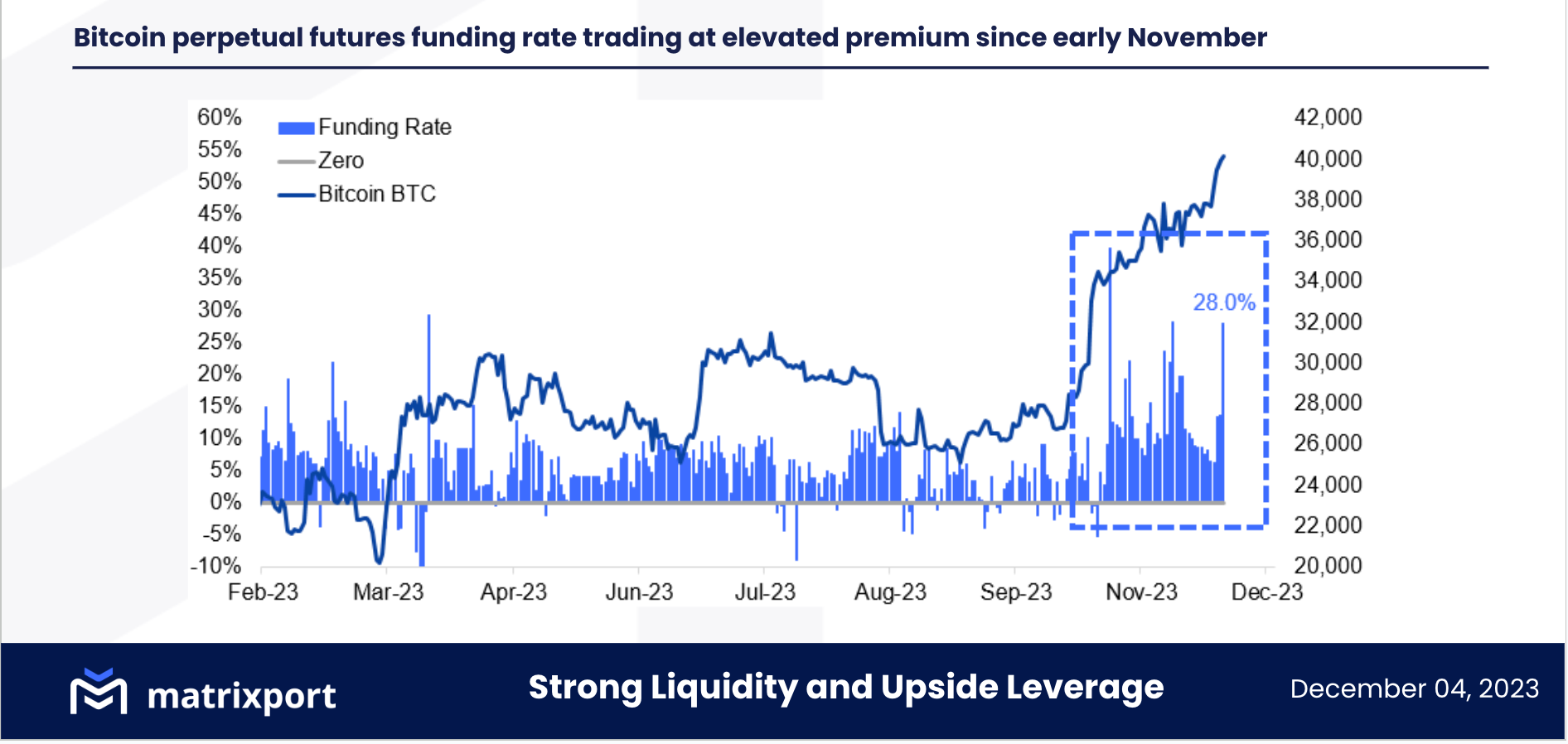

Traders do not have enough upside leverage, this is the conclusion from the elevated premium that perpetual futures are trading at. While for most of the year the perpetual futures traded at a 5-10% premium, since November, this has expended to 10-15% and occasionally trading with 20-30%. This shows panic buying from traders who are closing out shorts or increasing leveraged longs.

TradFi traders are squeezing crypto bros

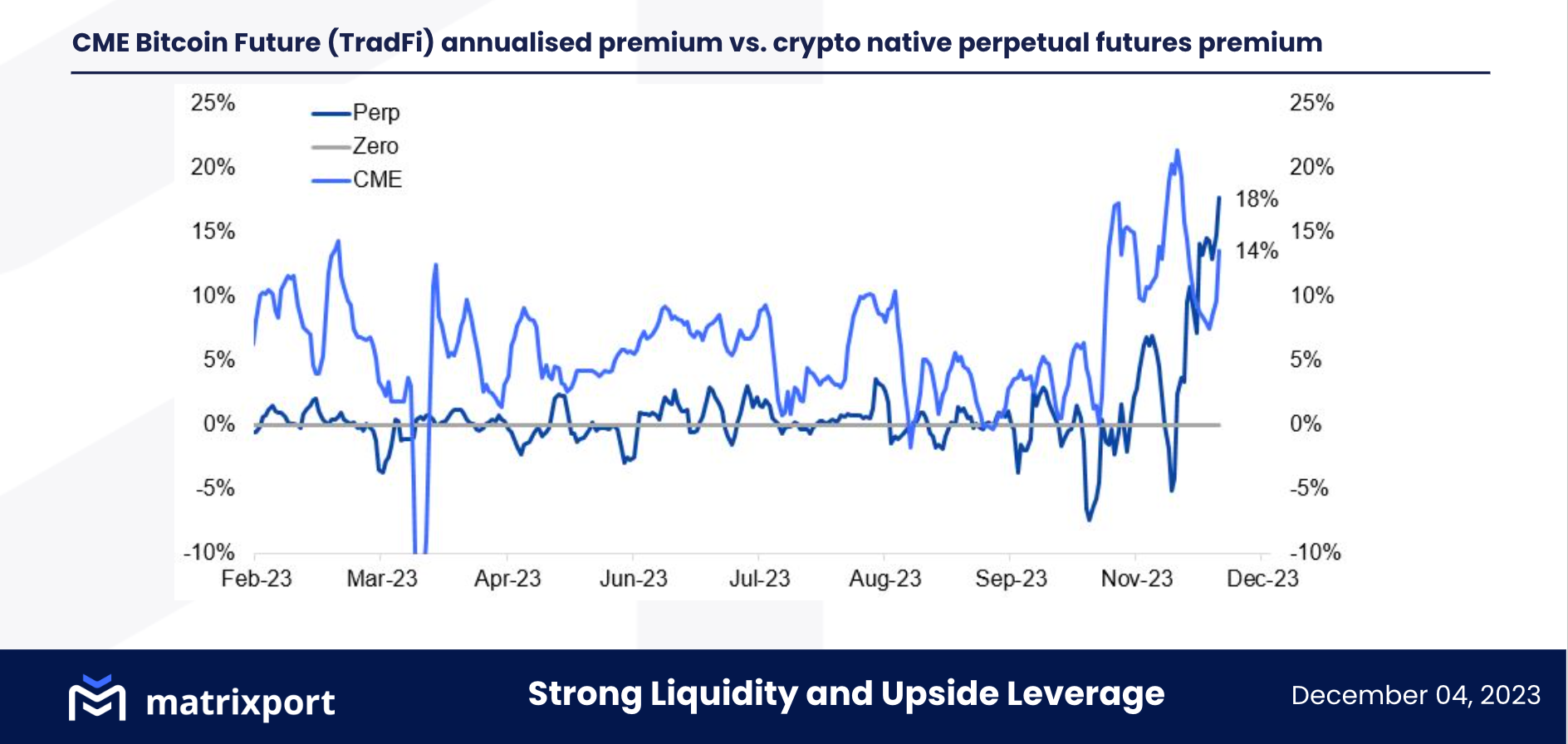

The perpetual Bitcoin futures premium has increased to +18% annualised (5-day avg.), compared to +14% for the TradFi CME Bitcoin futures. Hence, for the first time, crypto native traders have more FOMO than TradFi traders. Since early November, the CME premium started to skyrocket with perpetual futures premium only increasing during the last 2-3 weeks

$7bn of stablecoin inflows shows demand

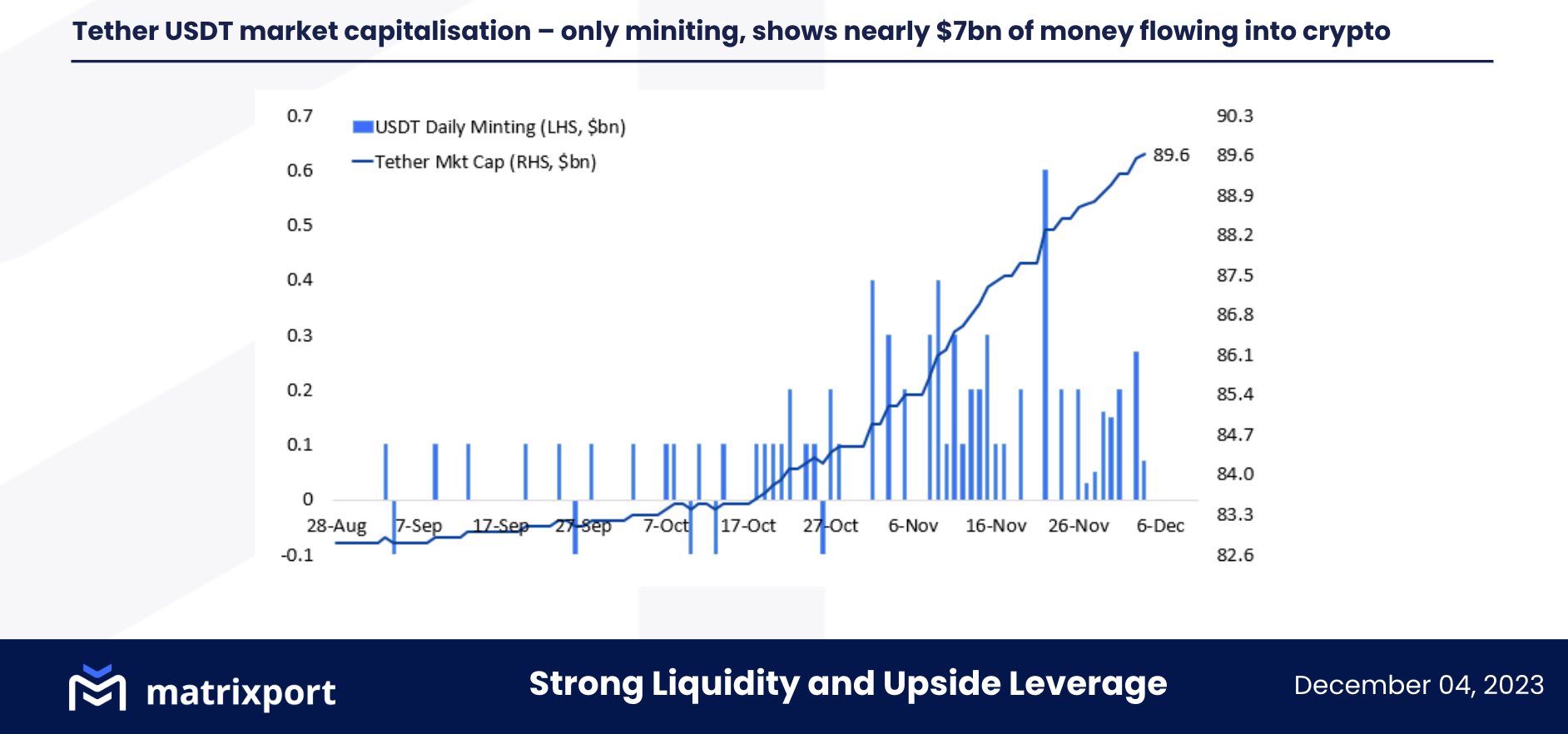

As we have been pointing out during the last few weeks - and many commentators are still not understanding or monitoring this data – the most important chart and signal is the daily minting from Tether, which shows that nearly $7bn is being moved into crypto. This flows is front running the Bitcoin spot ETF approval and driving crypto prices higher. Since mid-October, minting has picked up in a meaningful way.

Bitcoin dominance skyrocketing again

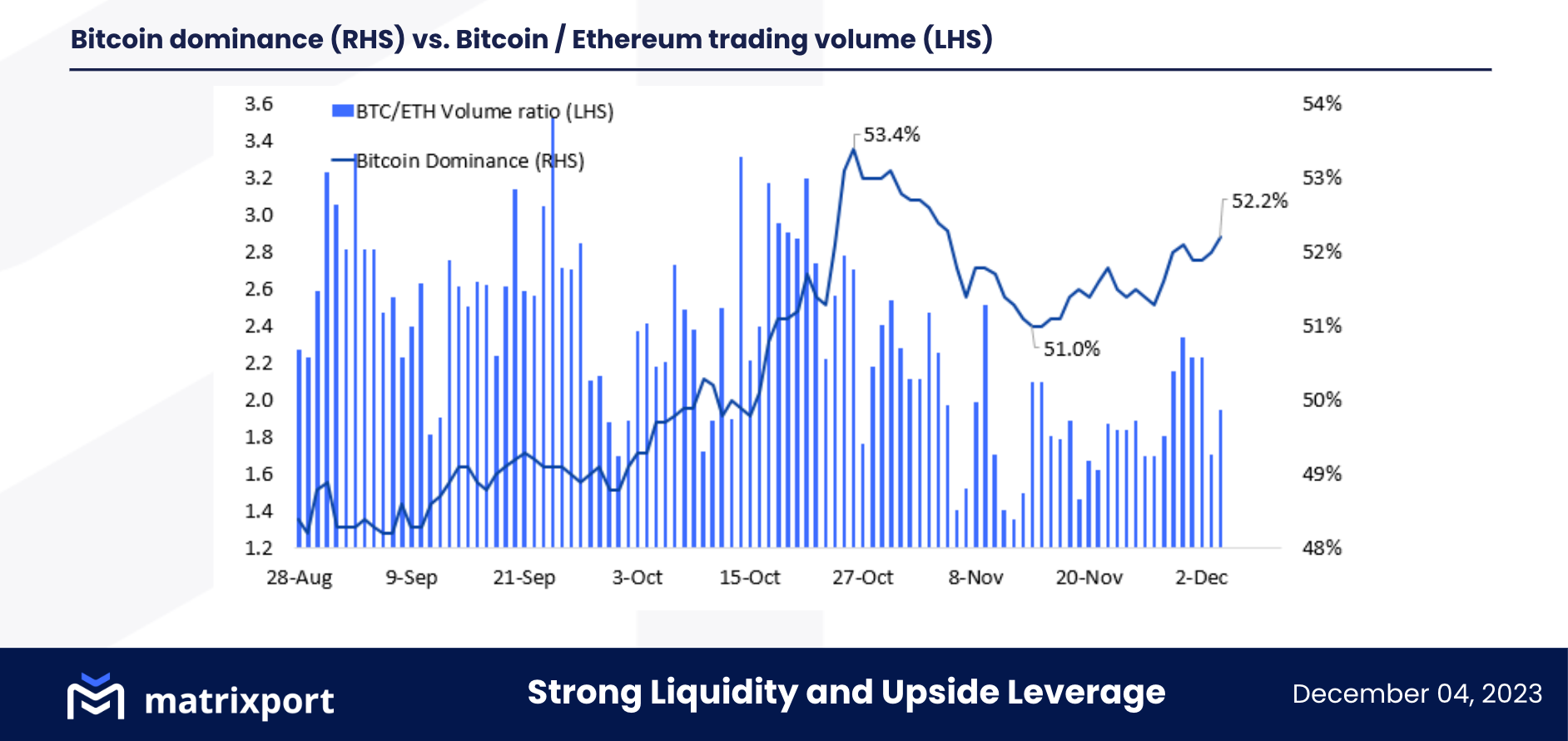

The focus remains on Bitcoin; the squeeze is on, and traders are chasing Bitcoin upside. The announcement that BlackRock also filed for an Ethereum Spot ETF caused a brief altcoin outperformance, but with the dominance rate rising again, Bitcoin remains the best risk-adjusted crypto asset.

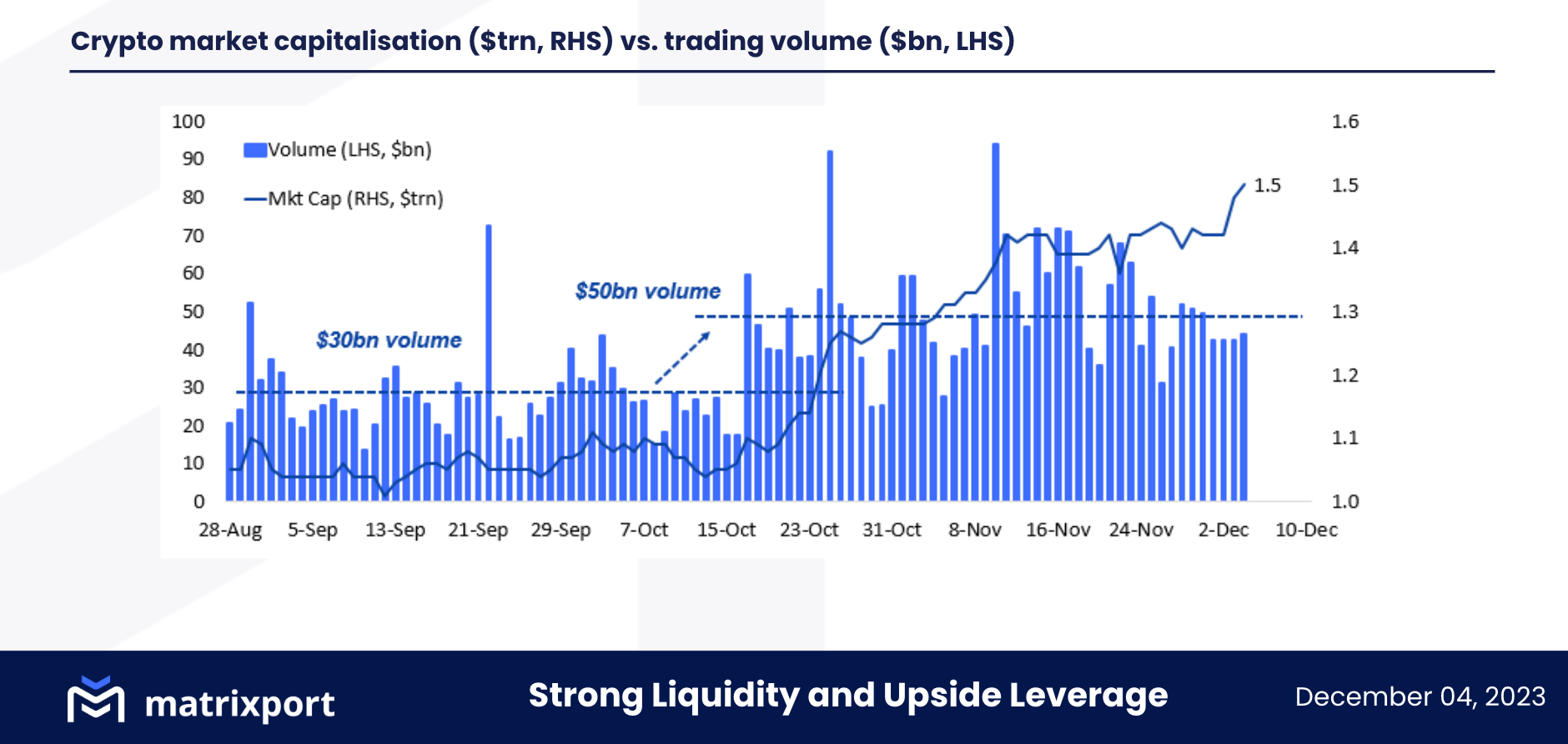

Crypto reclaimed $1.5trn in market cap

While volume has remained sub-$50 billion, the market capitalisation continues to increase, signaling an on-going bull market. At $1.5 trillion, crypto has also reached a level where TradFi can no longer ignore it, and that is why TradFi flows into crypto have remained exceptionally strong – even before the SEC has approved a Bitcoin Spot ETF.

Written by Markus Thielen, Head of Research & Strategy at Matrixport. Author of Crypto Titans.

Join now for more insights around crypto!

Industry views and information shared do not represent Matrixport's position and do not constitute any investment advice.