Bitcoin ETF Prospects in Flux: Miner Sell-Off and SEC Review Send Ripples Through the Market

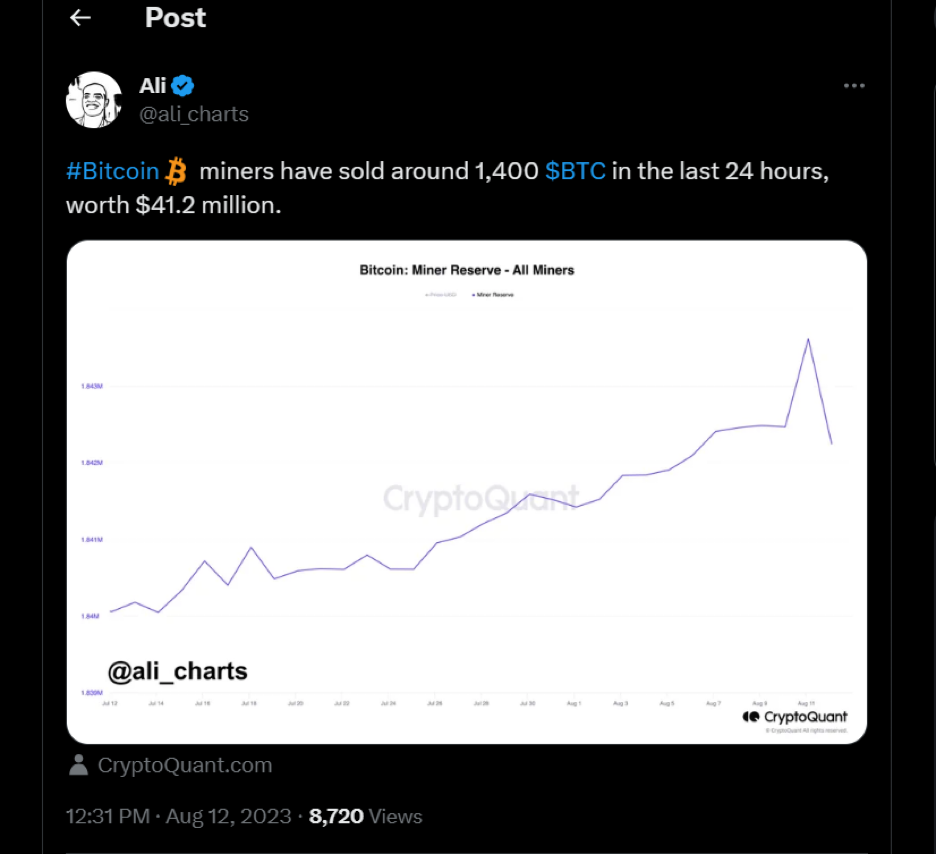

In a surprising twist of events that has captured the attention of the cryptocurrency community, the 24 hours ending on August 13 witnessed a significant downturn in the reserves of Bitcoin miners. Over 1400 BTC, translating to a staggering $41.2 million, was swiftly offloaded, according to reports. This unexpected move has sent shockwaves through the market, leaving enthusiasts and analysts alike pondering its implications.

Ali Martinez, a respected figure in the crypto analysis sphere, has lent credence to this sharp decline in miners' holdings, substantiating it with data sourced from CryptoQuant. This sudden and substantial sell-off has not only intensified selling pressure but has also cast a cloud of uncertainty over the market's trajectory.

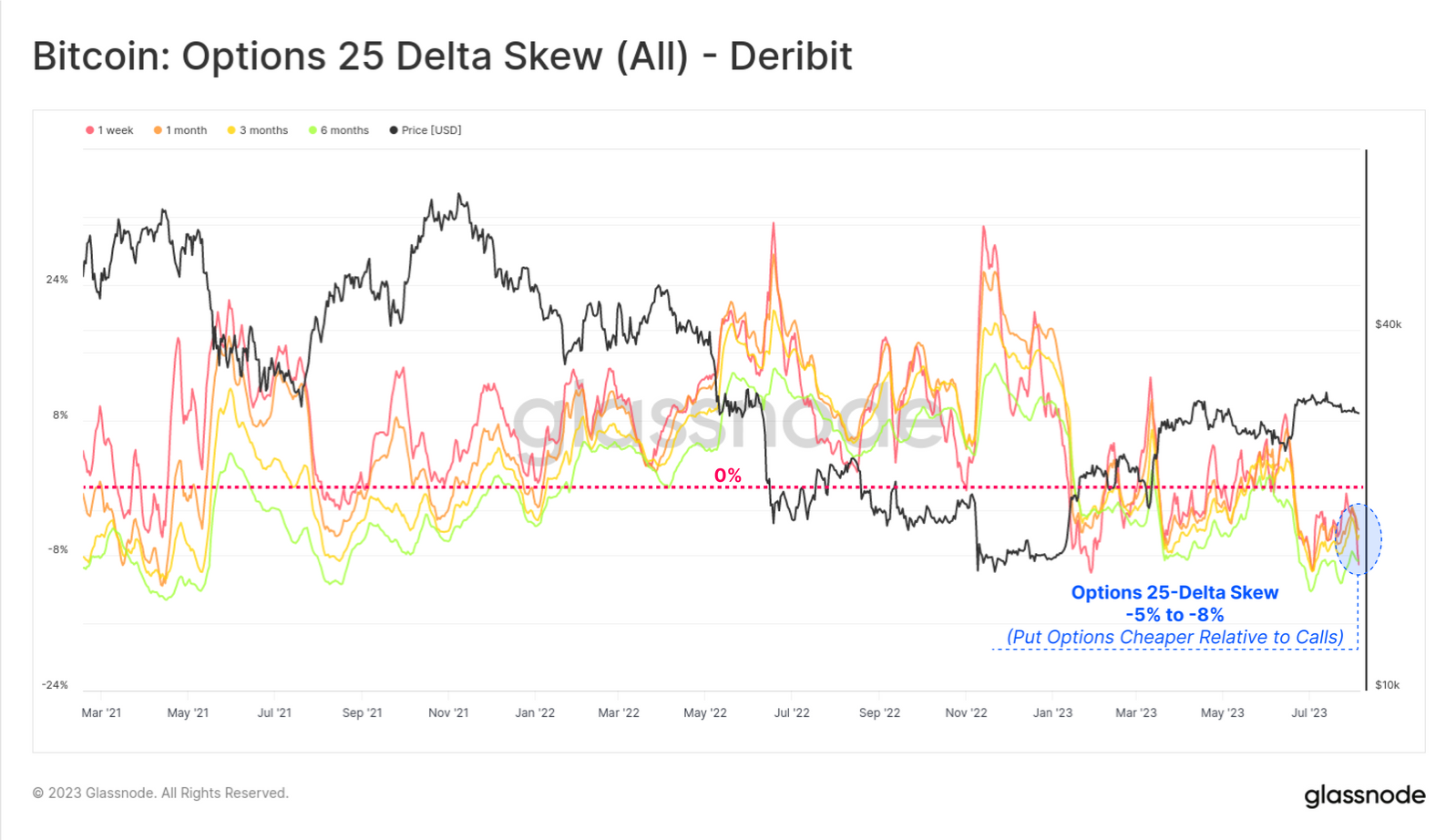

Intriguingly, BeInCrypto previously reported a notable development: Bitcoin's volatility has reached its lowest ebb in the last two years. Confirming this, the respected blockchain analytics firm Glassnode noted that a mere fraction—less than 5%—of Bitcoin's trading days have experienced such tight price ranges. This trend indicates an unprecedented convergence of various volatility metrics toward their historic nadirs.

SEC Stalls ARK Invest’s Bitcoin ETF Application

Shifting the focus to the regulatory landscape, the U.S. Securities and Exchange Commission (SEC) has taken center stage. The SEC has opted to extend its evaluation of the Ark 21Shares Bitcoin ETF application, a process concurrently involving other heavyweight financial contenders such as BlackRock and Fidelity Investments.

As part of its customary protocol, the SEC is inviting public input on the Ark 21Shares Bitcoin ETF proposal, thereby elongating the decision-making timeline by several weeks. Within this timeframe, the public has the opportunity to submit their perspectives on the application itself, followed by an additional five weeks to respond to the initial wave of comments.

Bitcoin ETF Prospects Slashed

Despite varying viewpoints on the possibility of a spot Bitcoin ETF approval, one voice has stood out. John Reed Stark, the former Office of Internet Enforcement chief at the SEC, has shared his skepticism regarding the current SEC's inclination to approve a Bitcoin spot ETF application.

However, Stark speculates that a Republican-led presidency in 2024 could usher in a more crypto-friendly regulatory environment, potentially opening the door for such approvals. He also points to potential shifts in SEC leadership dynamics that could influence the regulatory landscape.

BTC Is Stuck in Limbo

With the current volume of BTC being sold exceeding that being purchased, Bitcoin remains subdued below the $30,000 mark.

While the year started with promises of soaring heights for Bitcoin's value, recent price movements have been decidedly subdued. Attempts to breach the $30,000 level have been met with swift retreats, and the asset appears to have found a rather steadfast resting place around $29,000 for a sustained period. This is a phenomenon that, despite various market catalysts, seems reluctant to budge.

Over the coming days and weeks, traders and investors alike will remain on the lookout for momentum-supporting factors or events in the market that could possibly help the benchmark cryptocurrency finally breach the $30,000 mark. Until then, you can expect to see more ping-pong-like price patterns with BTC in the near term.

BTC Statistics Data

BTC Current Price: $29,300

BTC Market Cap: $570B

BTC Circulating Supply: 19.4M

BTC Total Supply: 21M

BTC Market Ranking: #1

Feeling confident? Trade your ideas on BTC now.

Disclaimer

This article should not be taken as financial advice. It is essential to conduct research before making any investment decisions.