Bitcoin Network Stuck in Traffic Jam: Whales Seek Smooth Sailing Amid Market Turbulence

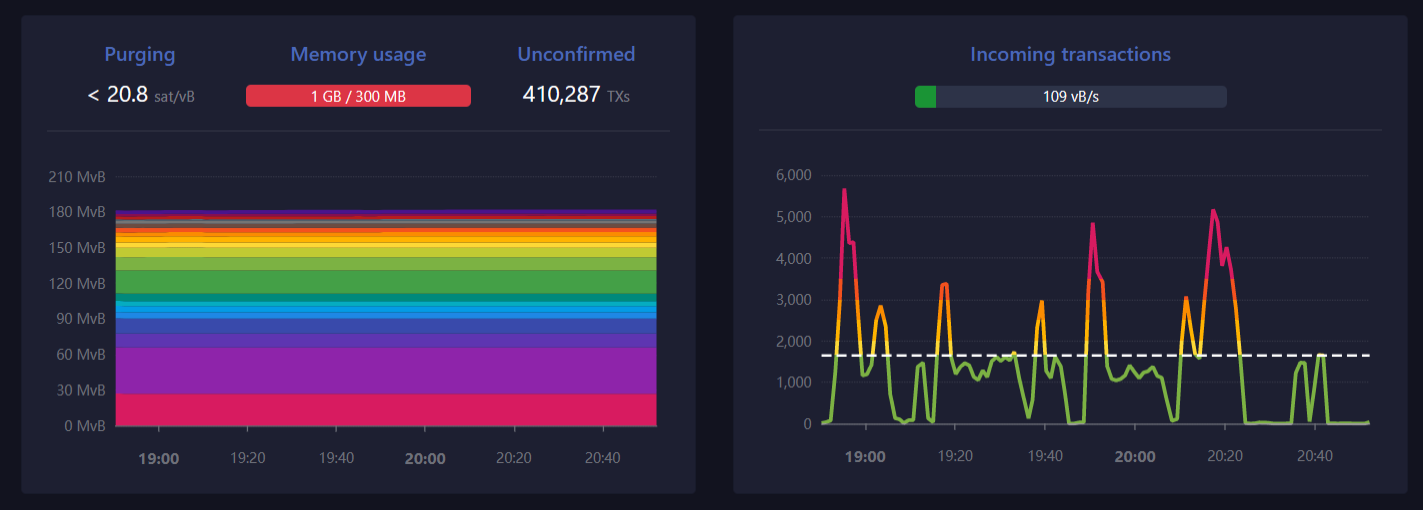

The Bitcoin network has found itself in a digital traffic jam as an avalanche of unconfirmed transactions overwhelms the system. The surge in Ordinal inscriptions and BRC20 tokens has flooded the blockchain, causing a backlog of over 410,000 transfers awaiting confirmation. This congestion has triggered a surge in transaction fees and frustrated users longing for a smooth Bitcoin experience.

The Bitcoin network is feeling the weight of an unprecedented number of unconfirmed transactions, stuck in a virtual limbo. With a staggering 390,000 transfers awaiting confirmation, the blockchain's capacity is being pushed to its limits. The influx of BRC20 tokens and Ordinal inscriptions has only worsened the situation, creating a digital gridlock that users are eager to navigate.

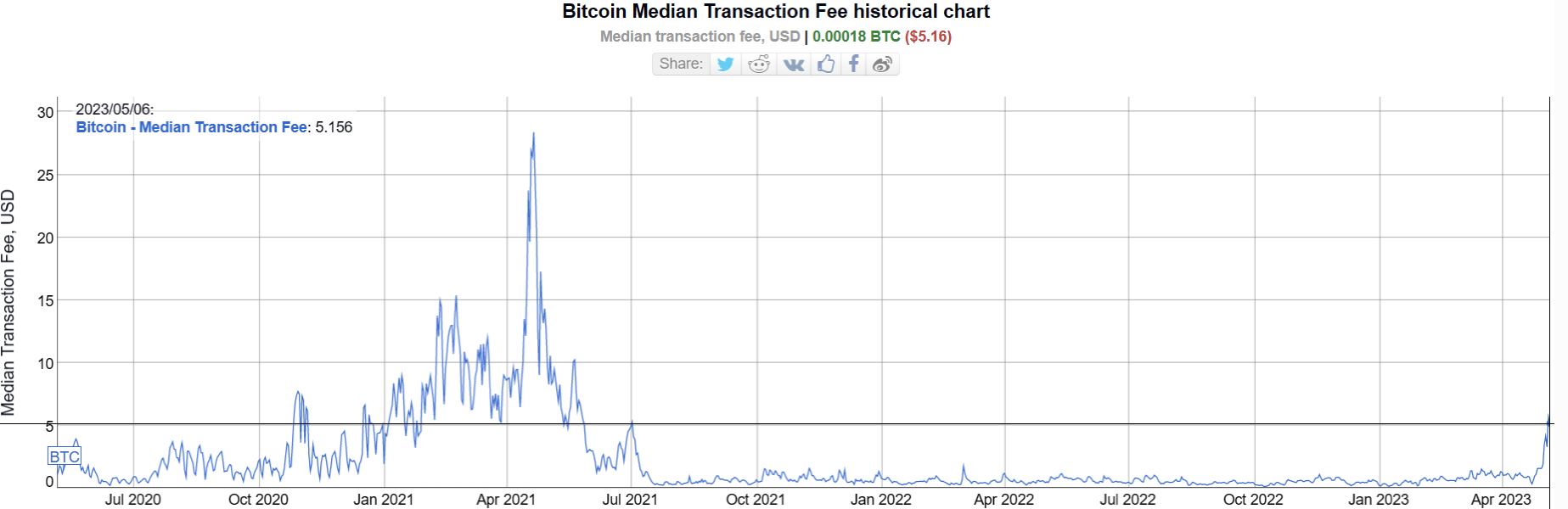

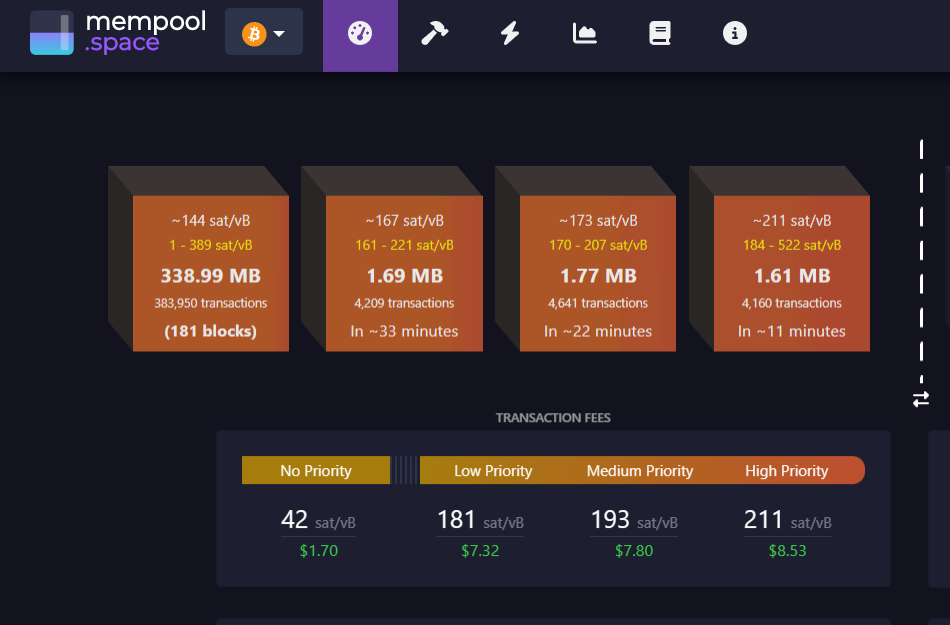

To unclog the system, a monumental effort is required. Approximately 179 blocks must be mined, which, at an average block time of 10 minutes, translates to a daunting 30 hours. As this backlog persists, transaction fees have skyrocketed by a staggering 343% over the past 11 days, leaving users reaching for their calculators. According to bitinfocharts.com, the average transaction fee stands at 0.00031 BTC, or $8.82 per transfer, a hefty toll for crossing the Bitcoin highway.

Wallets Suffer as Fees Hit the Roof

As the Bitcoin congestion grows, transaction fees are following suit, causing users to squirm in their digital seats. The current median-sized Bitcoin transaction fee amounts to 0.00018 BTC, or $5.16 per transfer. Unfortunately, the situation doesn't get any better when we peek at mempool.space. The website reveals that a low-priority fee will cost you $7.32, while a medium-priority fee puts a $7.80 dent in your virtual wallet. If you're in a hurry, brace yourself for a high-priority fee of $8.53 per transfer.

The clogged mempool has become the talk of the town on social media, with users expressing their opinions in a digital frenzy. Some users revel in the surge of activity, considering it an exhilarating rollercoaster ride. However, others don their tinfoil hats and label the rise of non-financial transactions as a sneaky DDoS attack. The debate rages on, adding a touch of drama to the already congested Bitcoin landscape.

Whales Withdraw Amid Market Turbulence

In the midst of this crypto chaos, the market witnessed a jaw-dropping event—a Bitcoin withdrawal of nearly $240 million on May 5, ranking as the sixth-largest this year. These significant outflows align with a period of wild volatility, particularly in the meme coin sector, which has seen rallies that could rival a rocket launch.

The recent surge in meme coin trading has introduced an element of unpredictability to the cryptocurrency market. It appears that the Bitcoin whales, unlike their sea-dwelling counterparts, prefer calm waters and steady winds. With the market brimming with uncertainty, these Bitcoin behemoths are wisely cashing in on their profits before any potential turbulence strikes. The Ethereum Foundation and its co-founder, Vitalik Buterin, have also joined the cash-out party, reinforcing the notion that caution is the name of the game.

Bullish Buildup Seen for Bitcoin

Despite all the frenzy going on in the market at this time, Bitcoin has held on to its hat seemingly well, with the price of the cryptocurrency maintaining a steady footing above the $28,500 area over the weekend. At the time of writing, the benchmark cryptocurrency trades at neutral levels, just under $29,000.

Meanwhile, the cryptocurrency has formed a wedge pattern that shows a possible consolidation over the coming days followed by a strong bullish breakout towards the $31,000 resistance level. This bullish sentiment or signal is further supported by the recent emergence of MA crossovers. It would be interesting to see how this all plays out in the coming days and weeks.

BTC Statistics Data

BTC Current Price: $28,900

BTC Market Cap: $560B

BTC Circulating Supply: 19.3M

BTC Total Supply: 21M

BTC Market Ranking: #1

Feeling confident? Trade your idea on BTC now.

Disclaimer

This article should not be taken as financial advice. It is essential to conduct research before making any investment decisions.