Bitcoin Primed for Six-Figure Surge in 2023, Experts Predict

Bitcoin is on the rise once again, with a fourth consecutive month of gains under its belt. This winning streak is the best since the six-month rally that took place through March 2021. According to data compiled by Bloomberg, four-month winning runs have resulted in an average Bitcoin surge of 260% over the following year. If this trend repeats itself, the largest digital asset could reach a record high of $105,000 from its current value of about $30,000.

Standard Chartered Also for a Six-Digit Bitcoin Price Tag

Meanwhile, Standard Chartered also anticipates a six-digit Bitcoin tag in the coming year, but for different reasons.

According to a recent report by the British-based multinational bank, this surge in Bitcoin value could be driven by a variety of factors, including the recent banking-sector crisis that helped to “re-establish Bitcoin’s use as a decentralized scarce digital asset." Analyst Geoff Kendrick wrote that "against this backdrop, bitcoin has benefited from its status as a branded safe haven, a perceived relative store of value, and a means of remittance.” In fact, Bitcoin has already gained about 80% since the start of the year, as of the time of writing.

The report also noted that the broader macro backdrop for risky assets is gradually improving as the Federal Reserve nears the end of its tightening cycle. Kendrick explained that “while BTC can trade well when risky assets suffer, correlations to the Nasdaq suggest that it should trade better if risky assets improve broadly.” This suggests that Bitcoin’s rise is not only due to internal factors within the crypto world but also due to external factors in the wider economy.

Bitcoin's Mining Difficulty on the Rise

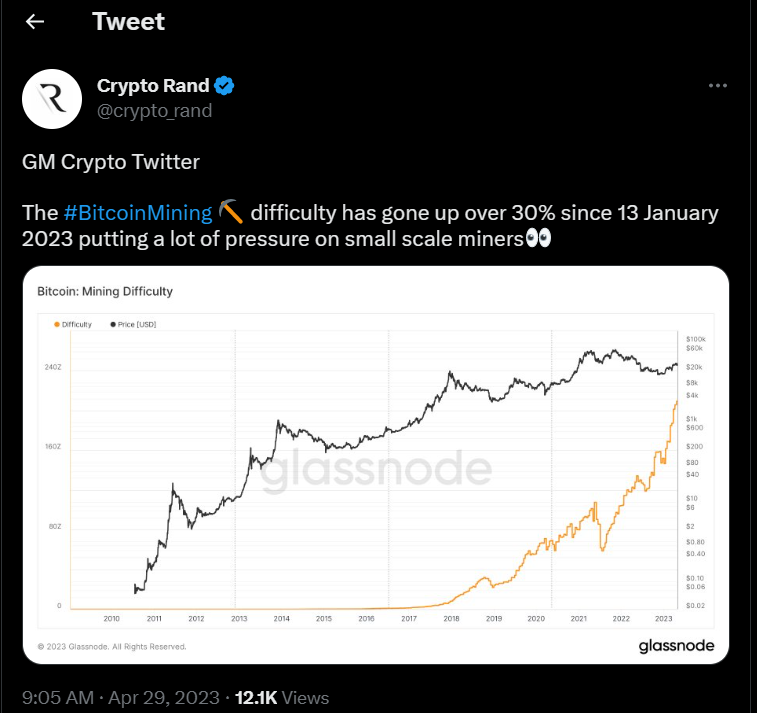

In other news, popular crypto analyst “Crypto Rand” recently reported a massive rise in Bitcoin mining difficulty, which has surged by over 30% since January 13, 2023. Other reports also showed that Bitcoin mining difficulty had reached an all-time high of 48.71 trillion.

The recent 30% surge in mining difficulty could be attributed to a variety of factors. That said, an influx in miners as a result of Bitcoin’s recent price rally could increase competition and raise difficulty even higher. Apart from that, advancements in mining hardware technology can also increase the network’s overall computational power needs, further inflating the difficulty level.

Bitcoin Gearing Up for More

As highlighted at the outset, Bitcoin has recorded its fourth consecutive bullish month as market sentiment improves by the week. At the moment, the benchmark cryptocurrency is fighting to regain its footing above the $30,000 round figure as the MACD indicator suggests that a bullish wave is just around the corner.

With the current trajectory, Bitcoin is likely going to see even more bullish price action in May, possibly adding another month to its streak. This, if actualized, will go a long way in dissipating the crypto winter and setting the stage for additional spikes ahead of the 2024 halving.

BTC Statistics Data

BTC Current Price: $29,400

BTC Market Cap: $568B

BTC Circulating Supply: 19.3M

BTC Total Supply: 21M

BTC Market Ranking: #1

Feeling confident? Trade your idea on BTC now.

Disclaimer

This article should not be taken as financial advice. It is essential to conduct research before making any investment decisions.