Bitcoin Rebounds as Million of Dollars in Shorts Get Liquidated

In an exciting turn of events, Bitcoin has made a remarkable comeback over the weekend, soaring by over 6%. This surge has propelled the cryptocurrency to its highest price level since June 8, reigniting optimism in the market. The surge, however, resulted in substantial liquidations, primarily affecting short positions, which accounted for nearly 80% of the total.

Recent events, such as the lawsuits filed by the SEC against major crypto exchanges, the CPI numbers, and the Federal Reserve's shift in interest rate hike policy, have dampened Bitcoin's performance. The leading digital asset had experienced a slump, reaching its lowest price in three months. Altcoins suffered even more, leading to a decline of $130 billion in the total crypto market cap within a brief two-week period.

Nevertheless, the bulls have reason to rejoice, as the past three days have brought significant gains for the entire market. Bitcoin regained lost ground and stabilized at $25,500 following BlackRock's filing for a Bitcoin Spot ETF. Despite a minor setback and a dip to $25,200, the cryptocurrency experienced a remarkable surge, reaching a 9-day high of $26,808 on Saturday.

As mentioned, this surge has resulted in substantial losses for short traders. Within a 24-hour span, the total value of liquidated positions surpassed $90 million, with short traders bearing the brunt, accounting for approximately $70 million, or 80% of the total liquidations. Bitcoin and Ethereum held the lion's share, with nearly $50 million liquidated out of the overall $90 million, as reported by Coinglass.

Bitcoin Loses Correlation with Stocks

In another interesting development, Bitcoin's inverse relationship with technology stocks has become more pronounced, with the cryptocurrency's 30-day correlation coefficient with popular indexes like the Nasdaq and S&P 500 turning negative. This means that as Bitcoin's price rises, stock prices tend to fall.

Traditionally positioned as a "safe haven asset," Bitcoin has been seen as a stable or appreciating investment during economic downturns. However, as cryptocurrencies gain broader adoption, they have become susceptible to geopolitical and macroeconomic triggers that affect the overall market.

Nonetheless, this narrative seems to be changing. The collapse of several banks earlier this year prompted investors to shift their funds into the crypto market, leading Bitcoin, the largest cryptocurrency by market capitalization, to surge by 52% until April and reach the year's peak. Meanwhile, stock indexes remained in relative stagnation during that period, indicating a growing divergence in the growth trajectories of the two asset classes.

Meanwhile, Bitcoin's divergence from gold has also become more apparent in recent months. Since the banking crisis in March, Bitcoin has outpaced gold in terms of value appreciation.

Bitcoin's Exchange Balance Hits New Low

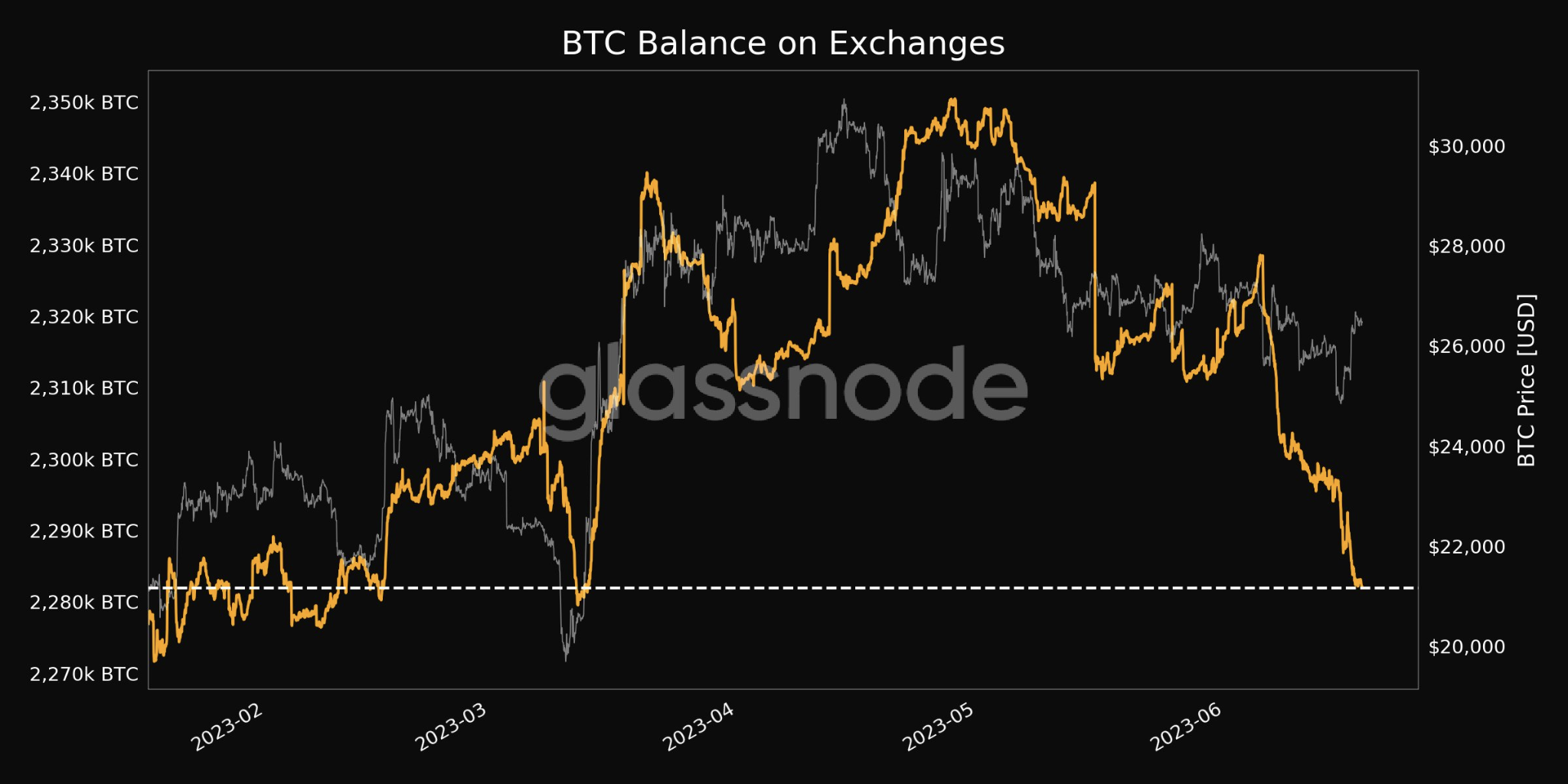

Bitcoin’s on-chain metrics also seem to be in good shape at the moment. According to Glassnode Alerts, an on-chain analysis platform, the balance of Bitcoin held on exchanges has reached a new three-month low, standing at 2,281,978.198 BTC. This follows the previous three-month low of 2,282,204.204 BTC recorded on June 17, 2023.

A decline in the BTC balance on exchanges typically indicates a significant number of holders withdrawing their funds from centralized platforms and opting for self-custody solutions. This trend suggests increased confidence among investors in Bitcoin, especially considering the recent SEC crackdowns on various crypto exchanges.

Despite the recent losses experienced in the past 24 hours, as recently discussed, the overall sentiment in the market has improved with Bitcoin's surge and the reduced balance of BTC on exchanges. Investors are cautiously optimistic about the future performance of the crypto market leader.

What’s to Come for BTC?

The recent bullish momentum seen in BTC has helped the cryptocurrency secure four consecutive days of gains. Keeping the previous trend—as highlighted in the chart below—in mind, Bitcoin could see a steady rise until it reaches the $27,300 axis. At this point, bulls will have to breach the upper band of the channel to end the persisting bearish cycle or conform to renewed bearish pressure and watch the process persist.

BTC Statistics Data

BTC Current Price: $26,620

BTC Market Cap: $516.1B

BTC Circulating Supply: 19.4M

BTC Total Supply: 21M

BTC Market Ranking: #1

Feeling confident? Trade your idea on BTC now.

Disclaimer

This article should not be taken as financial advice. It is essential to conduct research before making any investment decisions.