Bitcoin Transaction Fees Record Sharp Decline; Mining Power Hits New Highs

In a week marked by intriguing shifts in the world of cryptocurrencies, Bitcoin transaction fees have shown a notable 15% drop, plummeting to a total of $3.3 million. These insights, gleaned from the data analytics firm IntoTheBlock, shed light on the evolving dynamics within the crypto realm.

However, this isn't the sole aspect undergoing change. The volume of Bitcoin transactions has also experienced a moderate dip over the past week. The seven-day average currently stands at 474,720 transactions, signifying a nuanced ebb in the bustling flow of the crypto market.

During this span, transaction metrics have oscillated, with transaction numbers peaking at 612,460 on August 20 and subsequently dipping to 399,150 on August 24. These oscillations serve as a vibrant reminder of the vibrant and unpredictable nature of the cryptocurrency arena.

Yet, these transaction fees serve a critical purpose. Acting as a driving force for miners, individuals, and entities responsible for verifying and recording transactions on the Bitcoin network, they provide an enticing incentive. Lower transaction fees might signal a potential decline in profitability for miners, but in turn, they offer users the boon of more affordable transactions.

Delving deeper into the transaction terrain, patterns begin to emerge, illuminating intriguing trends. Transactions of smaller denominations, spanning the $0.01 to $1.00 range, have surged remarkably by a striking 52% over the past month. This surge hints at a potential rise in microtransactions within the cryptocurrency ecosystem.

Contrastingly, transactions ranging from $1.01 to $10.00 have encountered a drop of about 28.5%, possibly signaling an intriguing shift in user behavior or preferences. This trend extends to larger transactions as well, with the $1,000 to $10,000 bracket witnessing a 21.7% decline, while transactions exceeding the $10 million mark have taken a substantial 42% nosedive.

One possible reason for this decline in transaction fees and activity is the seasonal slowdown in the crypto market, as many traders and investors take a break during the summer holidays. Another factor could be the increasing adoption of layer-two solutions, such as the Lightning Network, which enables faster and cheaper transactions off-chain.

Bitcoin Mining Reaches New Heights of Complexity

In other related news, the activities of Bitcoin miners, often viewed as a barometer of the cryptocurrency landscape's health, have garnered significant attention. These miners wield influence over network vitality and the mining sector's profitability.

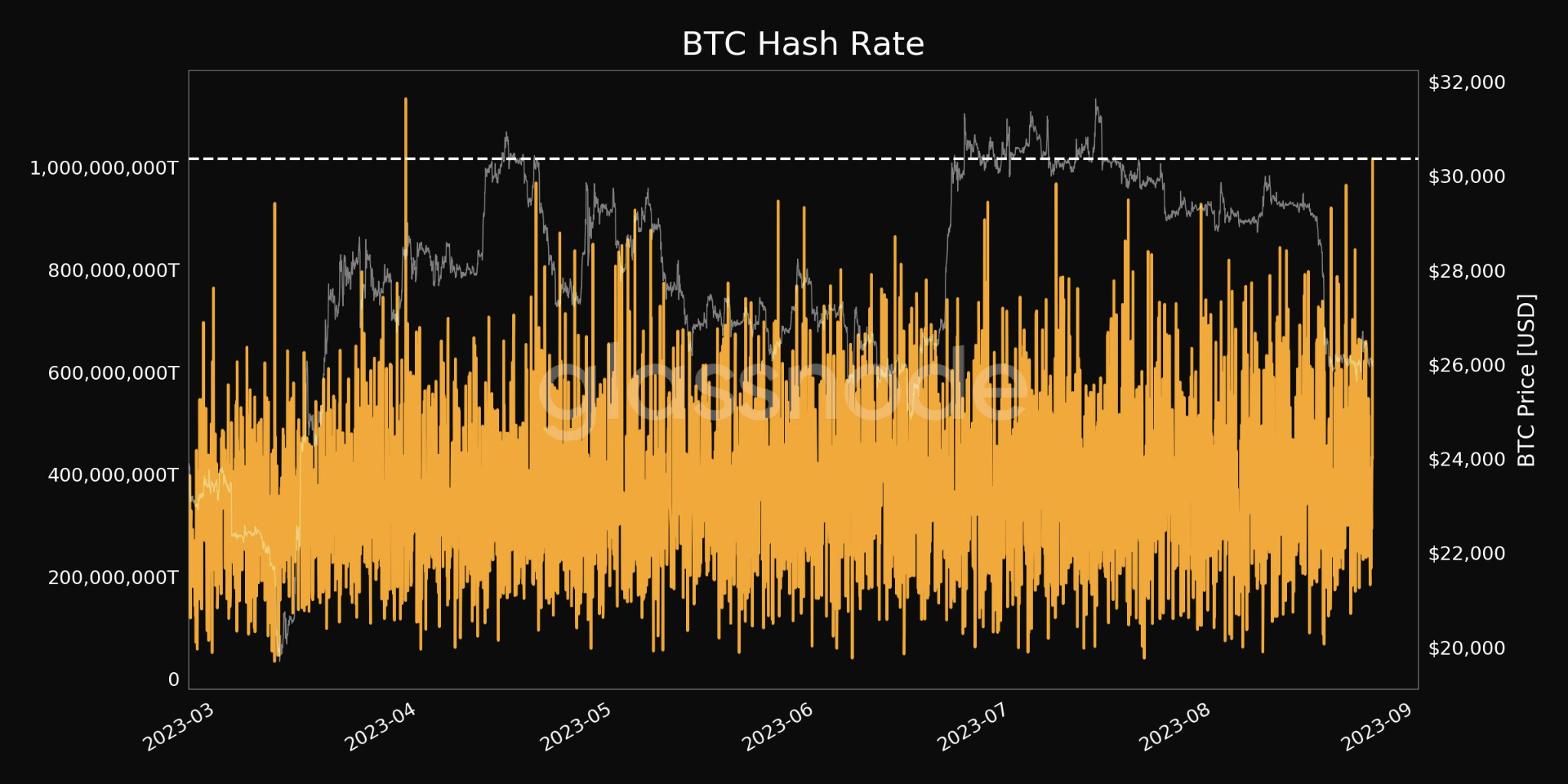

A recent exposé from Glassnode unveils a fascinating revelation: the network hash rate reached its zenith in a span of four months, achieving this milestone on August 26.

This surge is indicative of a heightened allocation of computing power towards verifying transactions and safeguarding the network. Such a boost often accompanies the entry of fresh miners or the integration of more efficient machinery, serving to fortify the network's security and decentralization.

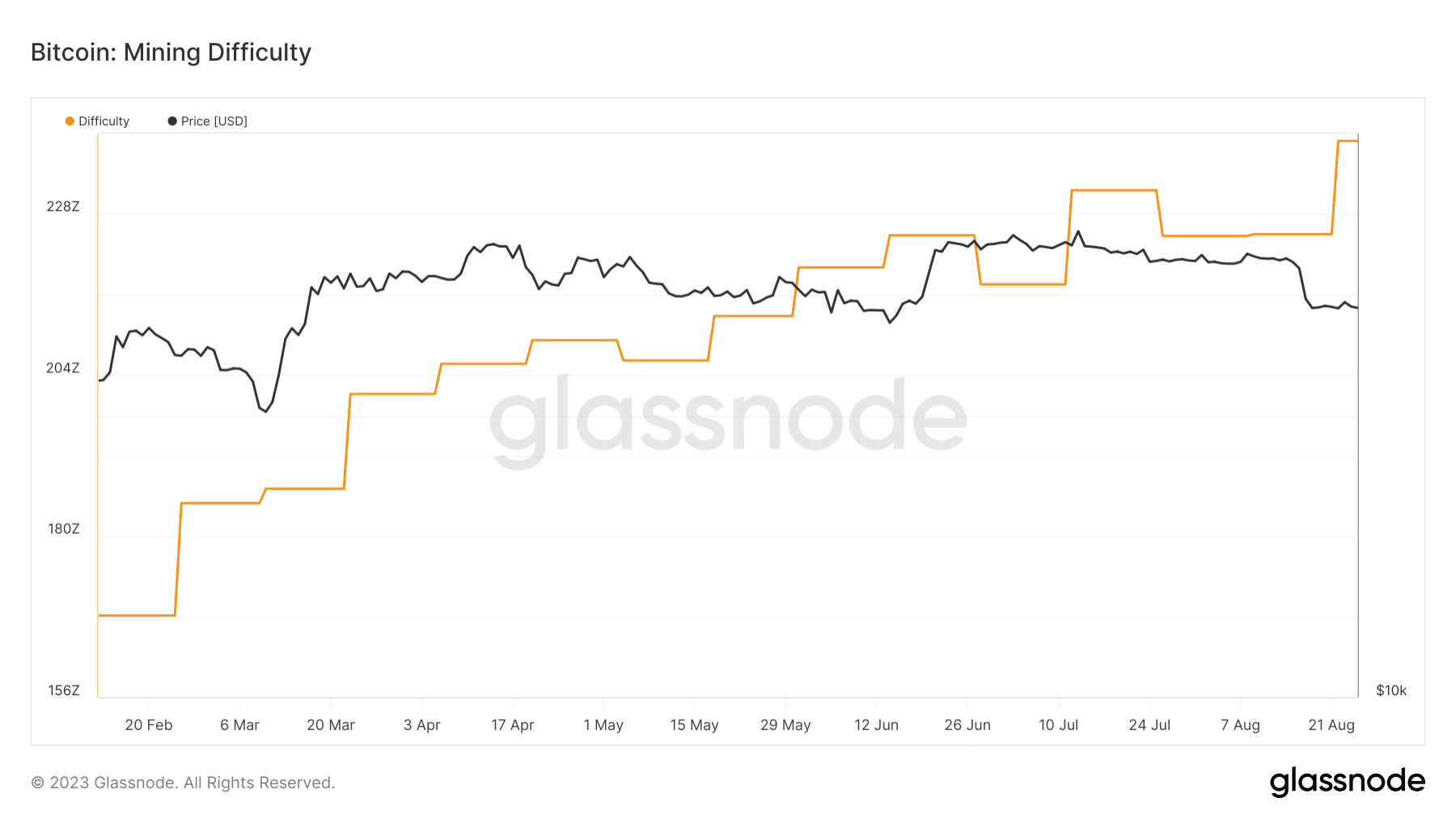

This surge in hash rate is concomitant with an unprecedented peak in mining difficulty over the past week. Mining difficulty, adjusted biweekly, plays a pivotal role in maintaining a steady 10-minute block time.

Analysts speculate that the hesitancy of miners to liquidate their assets might mirror their optimism regarding Bitcoin's growth potential. Glassnode's data bolsters this notion, revealing that the total supply stored in miner addresses reached a monthly zenith of 1.83 million on August 26.

Miners traditionally convert their assets to meet operational expenditures, and the delay in such conversions hints at the underlying anticipation of a more robust Bitcoin price in the near future.

BTC Stuck at $26,000

Bitcoin's momentum remains dampened as the price remains glued to the $26,000 round figure for over a week. At the moment, market morale is really low, so it would take some serious factor or event to spark a renewal of momentum in the near term. With the takeaways from the recent Jackson Hole event still fresh in the minds of investors, it’s unlikely that any macroeconomic factor could impact the price action of BTC this week.

As always, nothing is certain for now, especially with the gloomy cloud shrouding the market at the moment.

BTC Statistics Data

BTC Current Price: $26,100

BTC Market Cap: $508.9B

BTC Circulating Supply: 19.4M

BTC Total Supply: 21M

BTC Market Ranking: #1

Feeling confident? Trade your ideas on BTC now.

Disclaimer

This article should not be taken as financial advice. It is essential to conduct research before making any investment decisions.