Bitcoin Whales Refusing to Sell at a Profit as Miners’ Woes Continue

Recent on-chain data from cryptocurrency analytics provider CryptoQuant reveals that Bitcoin (BTC) whales who purchased a month ago have refused to cash out of their holdings, despite a decent profit margin.

According to the report by CryptoQuant, these whales purchased BTC at an average price of $19,000, which would put them at an unrealized profit level of about 8.5% with the current BTC price.

Bitcoin Mining Firms Standing on Shaky Grounds

While the price of Bitcoin has enjoyed some bullish momentum over the past few days, the situation in the BTC mining sector seems grim.

Over the past few months, many miners have been forced into a tough spot, with the price of Bitcoin dropping while operational costs continue to surge. As factors such as rising energy costs and increasing hash rates continue to cast a notable shadow over the mining space, several mining firms are staring down the barrel of bankruptcy. One such miner is behemoth blockchain mining company Core Scientific.

The mining company expects its cash reserves to be exhausted by the end of the year or even sooner if a bearish market momentum persists. Crypto miners have been one of the most affected parties by the persistent crypto winter.

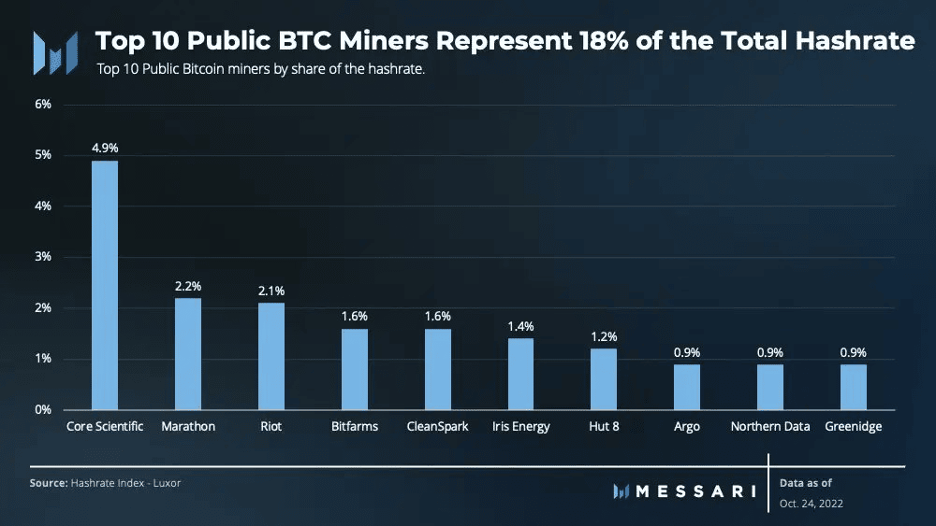

According to a report from crypto data provider Messari, the top 10 mining firms account for 18% of the total hashrate delivered to the Bitcoin network. That said, if energy prices and hash rates continue on their upward move in the near term, many miners would have no choice but to sell off their BTC holding to raise funds. Such a move will likely have a detrimental effect on the price of Bitcoin and force it lower.

Mining Revenue from Fees Rise

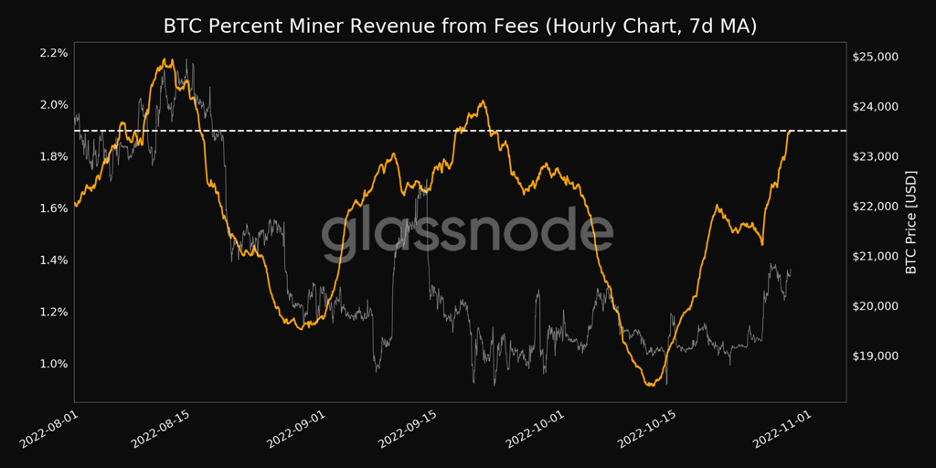

Moving away from the grim picture, despite the worsening operational requirements for miners, revenue generated from mining fees recorded a jump over the past few days.

According to crypto intelligence platform Glassnode, miner fee-generated revenue tapped a one-month-high on October 29. That said, analysts believe that the selling pressure on miners could temper a bit if this revenue continues to flow at its current pace.

Good News for Miners as Bitcoin Shows Notable Stability?

Statistics from Messari revealed that Bitcoin’s realized volatility has dropped significantly in recent times. Reports show that Bitcoin’s volatility has fallen by 67% since July, indicating that the benchmark cryptocurrency is less risky than usual. A recent report showed that Bitcoin has become less volatile than the S&P 500 and Nasdaq in the past few weeks.

This could be good news for miners considering mining revenue is dependent on Bitcoin’s growth.

Another positive factor for Bitcoin in the near term is that the overall supply of BTC in circulation has recorded some growth recently, with this metric tapping a one-month-high on October 29.

Bitcoin Enjoyed Some Bullish Momentum, but $21,000 Proves Difficult

Bitcoin recorded a volcanic rebound on October 25, which set it on course to retake the $21,000 mark. However, the flagship cryptocurrency has not had much luck with this, as it has suffered two rejections from this line within three days.

A breakout above this line will likely provide more fuel for bulls to challenge and possibly break other resistance levels. However, the primary resistance line for bulls to break in the near term is the elusive $25,000 mark. A break above this mark could cement bullish efforts and thaw the crypto winter.

BTC Statistics Data

BTC Current Price: $20,700

BTC Market Cap: $397B

BTC Circulating Supply: 19.17M

BTC Total Supply: 21M

BTC Market Ranking: #1

Feeling confident? Trade your idea on BTC now

Disclaimer

This article should not be taken as financial advice. It is essential to conduct your research before making investment decisions.