CRV Explained – Plain Talk

What is CRV – A stablecoin exchange

Curve (CRV) is a decentralized exchange for trading stablecoins. Stablecoins are very popular due to their low volatility. They are pegged to another real-world currency such as the USD, a commodity like gold, or other financial instruments, and are comparatively much more stable than other cryptocurrencies.

Curve is built on the Ethereum blockchain, like many other DeFi protocols. Users trade through their cryptocurrency pools. This means that whoever provides liquidity to the pools can be rewarded with CRV, Curve’s native token. Platform users can earn fees from their assets, while traders can exchange these assets at potentially better prices.

What makes Curve popular is its promise of minimized slippage – the difference between the expected price for a trade and what it will be executed at. Slippage is a common loss when it comes to crypto trading, and of course, users would welcome lower losses.

Automated Market Maker (AMM) tools

Curve uses automated market maker (AMM) tools. In crypto terms, this means that when you trade on the platform, you contribute coins to a liquidity pool, and smart contracts will ensure that your trade would be carried out automatically, even if there isn’t someone else to trade with.

The more assets in a pool and the more liquidity the pool has, the easier trading becomes on decentralized exchanges. With Curve, for example, you can earn CRV by providing DAI to the exchange’s liquidity pools, plus interest rates.

Why is Curve so popular?

Perhaps the greatest difference of Curve, compared to other crypto exchanges, is that it does not exchange to ETH. Other crypto exchanges exchange Token A for ETH, then ETH for Token B, which means that the user has to pay transaction fees twice.

Curve swaps your tokens in one transaction, which makes transaction costs lower. It’s a direct swap from Token A to Token B. Boom.

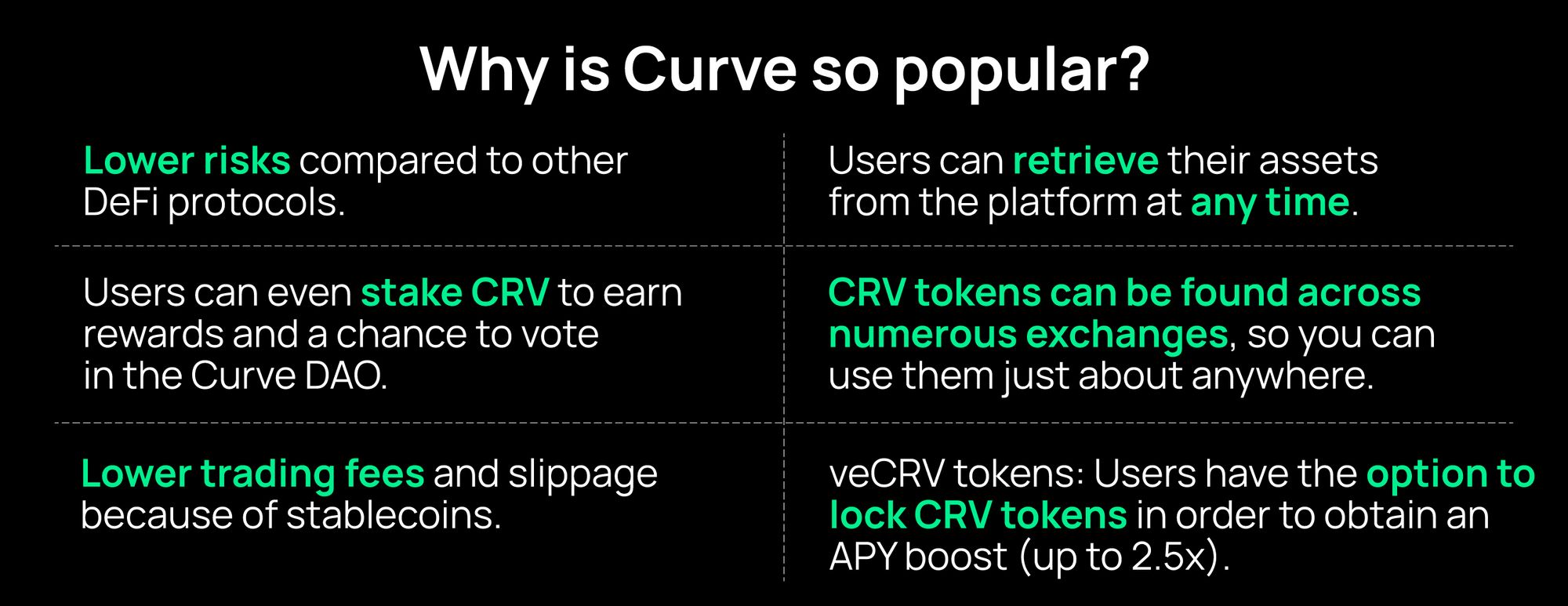

More benefits include:

- Lower risks compared to other DeFi protocols.

- Users can retrieve their assets from the platform at any time.

- Lower trading fees (0.04% per transaction) and slippage because of stablecoins.

- Users can even stake CRV to earn rewards and a chance to vote in the Curve DAO.

- CRV tokens can be found across numerous exchanges, so you can use them just about anywhere.

- veCRV tokens: users have the option to lock CRV tokens in order to obtain an APY boost (up to 2.5x). In exchange, they receive veCRV (vote-escrowed CRV), which entitles them 50% off trading fees on the platform.

CRV drama in its early days

The initial popularity of Curve created much anticipation when it announced that it was going to launch its own coin $CRV in “early August 2020”. However, an anonymous developer took its open source code from Github and launched the coin – without anyone, including the Curve team, knowing.

The news spread like wildfire and the Curve team was scrambling to keep it under wraps, calling it a scam at some point. However, when they discovered that the code contained no malicious content and functioned exactly as it should, they eventually declared it as the official launch.

Risks around the next Curve?

Like all DeFi protocols, there will always be risks associated with any crypto investments, even if Curve promises less volatility and slippage.

Curve is integrated with some other DeFi platforms, which means that it is also vulnerable to the security threats or hacks that these protocols face. To truly thrive by earning from depositing in the Curve pools, users have to have a very clear picture of the overall security of all these other platforms.

The Curve platform splits your investments across various pools, and as mentioned above, it is linked to external protocols. As a result, gas fees can become rather high. For a better chance at making a profit, users can be advised to play the long game – depositing tokens for the longer run to avoid high gas fees and slippage.

$CRV’s value can also be rather volatile, even though the platform is a relatively low risk one. To trade in $CRV, users have to note that it has been fluctuating from an all-time low of $0.35 to its highest at $6.50, and in recent months floating slightly above $1.

Interested in $CRV?

If you’re keen on looking into owning $CRV, besides the above described methods, you can also go on our app and buy some. Download Bit.com today and Turn On The Future.