DeFi 2.0 – How is it better?

When Version 2.0 of something is launched, we generally assume that it’s an improvement over the first version. Strictly speaking, Decentralized Finance (DeFi) 2.0, isn’t exactly a “relaunch” of the entire blockchain-based decentralized finance ecosystem. It’s a collective movement for several important improvements.

For those not familiar with DeFi, it is a collection of decentralized applications that use smart contracts and secure networks to conduct financial transactions without any middlemen such as banks or large institutions. DeFi is based on blockchain technology and boasts lower transaction costs, total transparency, high efficiency, and strong security for every transaction being performed on the blockchain.

Since its introduction, apps on DeFi 1.0, while revolutionary, came with their own set of challenges. And that’s why developers are working to implement some significant improvements to the infrastructure, bringing about DeFi 2.0.

For us to truly appreciate the proposed changes in DeFi 2.0, we’ll need a closer look at some of the features of DeFi, and the limitations experienced by many of its users and developers.

What are the issues with DeFi 1.0? And what’s being done to make it better?

The first wave of decentralized finance gave people a way to sell, buy, trade, lend, or borrow cryptocurrency without the need for financial institutions or banks as intermediaries.

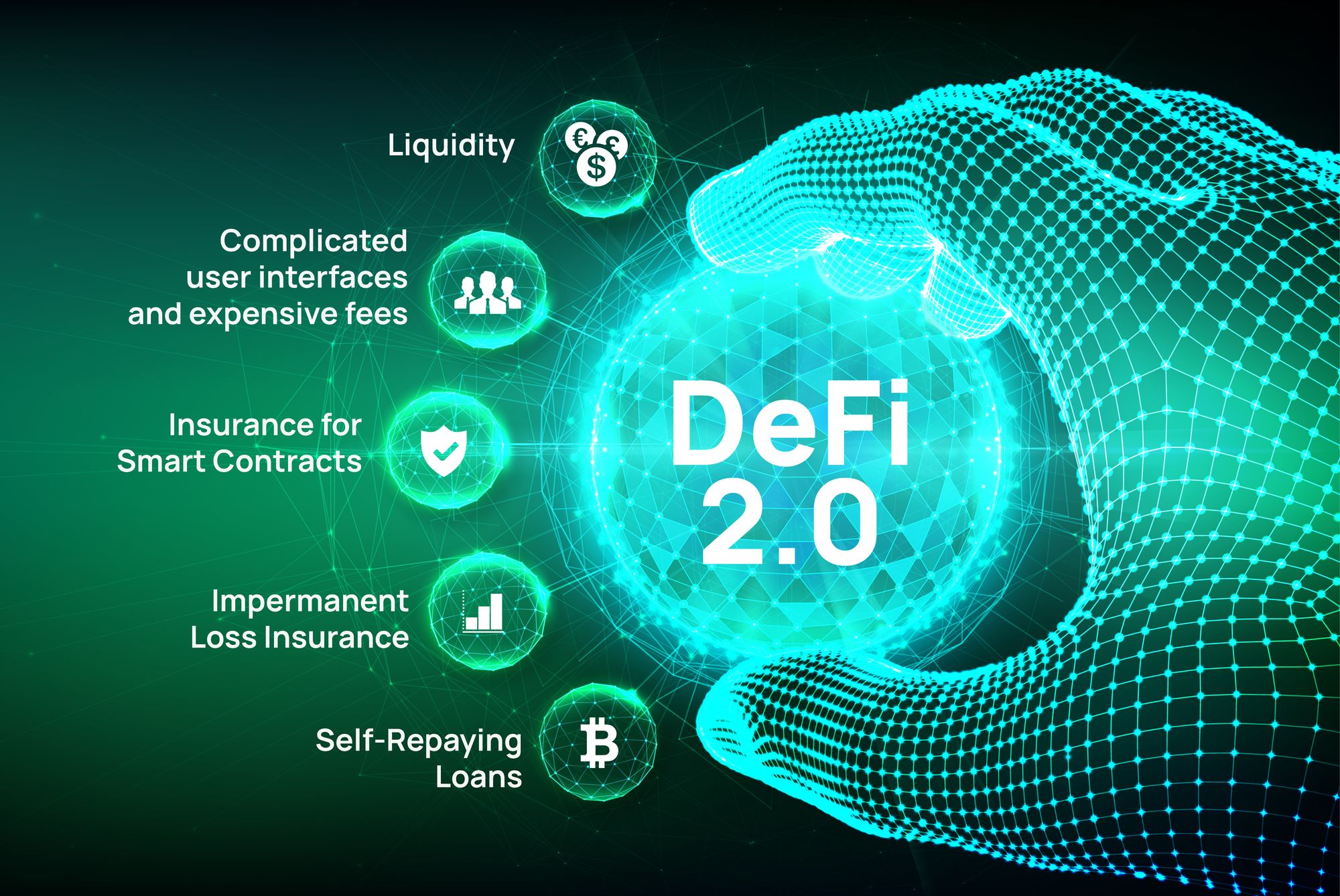

1. Liquidity

For any financial application to continue running, liquidity is crucial. This means that there has to be a substantial amount of cryptocurrency available for applications. To get liquidity, the DeFi platforms in 2020 relied on liquidity mining – rewarding users with their own native token in return for depositing crypto that some other user may trade or borrow.

But the problem with this is that users generally don’t deposit their tokens with these protocols permanently. They come in, commit their tokens, reap the benefits, then withdraw everything and leave once that’s done. So most of the tokens in DeFi are still owned and used at the discretion of users, and if enough of them withdraw their funds, it will essentially cause the protocol to collapse.

Solution in DeFi 2.0

New projects are abandoning the above concept of liquidity mining and exploring substitutes to get liquidity. Olympus DAO, one of the pioneers in DeFi 2.0, is using staking and bonds in order to own most of its own liquidity. The protocol possesses more than 99% liquidity of the OHM-DAI bond.

2. Complicated user interfaces and expensive fees

Many DeFi protocols had very complicated user interfaces. And it has been very difficult for many beginners to navigate the apps, which has driven many users away. The protocols’ are also mostly based on the popular Ethereum blockchain, which now, still has a comparatively longer transaction time and higher gas fees.

Solution in DeFi 2.0

Most protocols are now looking to make their interfaces more user-friendly. Especially when they promise greater decentralization, which encourages more users to contribute to how things are run. Moving away from liquidity mining and linking up more blockchains will also lower gas fees significantly.

3. Insurance for Smart Contracts

Everything that happens on a blockchain gets stored on the blockchain, permanently. This means that when a smart contract is compromised, there is no way of going back to rectify it. Many less experienced investors have lost their tokens because the protocols did not provide them with an easy way of protecting their own assets.

Solution in DeFi 2.0

Insurance. DeFi 2.0 offers insurance policies (for a small fee) for investors so they can feel safer in entering smart contracts. Even if the contract is compromised and the payouts are forfeited, rest assured, the insurance will cover it.

4. Impermanent loss insurance

With DeFi 1.0, when a cypto investor locks in two coins into a protocol for liquidity mining, they might suffer a loss when the value ratio between these two coins changes. This is called impermanent loss in crypto terms, and it’s one of the biggest issues when speaking to investors about Defi.

Solution in Defi 2.0

DeFi 2.0 projects are changing the way things are done to minimize this risk for investors. Some protocols use the earnings from their fees to insure users against impermanent loss. They can also mint new coins to pay users for their losses. This is an important move to make DeFi 2.0 a safer environment for crypto investors.

5. Self-Repaying Loans

Traditionally on DeFi, like a regular loan from a friend, loans are repaid after an agreed period of time, along with the crypto interest. It’s not much of a problem, except that when your tokens are loaned out, you can’t really invest with them since they’re technically “not yours” at the time of the loan.

Solution in Defi 2.0

The DeFi 2.0 ecosystem allows loans to pay for themselves. When someone borrows from you, they will provide crypto collateral in the form of a small deposit. You can then invest this deposit and earn from it in the meantime. Once you have earned an equivalent of the loan, plus the interest, you return the deposit, and the borrower doesn’t need to pay you anything back.

A safer, more secure, more convenient, more decentralized environment

All in all, there are a lot of new developments to look forward to when it comes to DeFi 2.0. And of course, Bit.com is ready to be part of it. Download our app today at Bit.com and Switch on to The Future.