Different Types of Stablecoins

The not-so-volatile cryptocurrency

One of the biggest barriers to many people when it comes to investing in cryptocurrencies is the volatility of the coin values. If you’re not well-informed, a $1,000 investment could either grow many folds or diminish into almost nothing in just a matter of days. Our team at Bit.com understands that it’s scary, and we’ve got loads of advice for that, such as diversifying your portfolio, staying updated with the latest crypto news, or checking out stablecoins.

As their name suggests, stablecoins are the “less volatile” cryptocurrencies. How? Their values are pegged against stable assets such as precious metals or fiat currencies such as the USD or EURO. Stablecoins are global, less volatile, decentralized, and operate without the involvement of third parties or any organization.

Why are stablecoins important? For investors, stablecoins allow holders to avoid the volatility of the crypto market without having to change to a fiat currency. It also becomes easier for businesses to accept payments in cryptocurrencies since the value doesn’t fluctuate as much. Decentralized, peer-to-peer transactions without volatility? Perhaps stablecoins would take over as the preferred crypto for everyday transactions and payments.

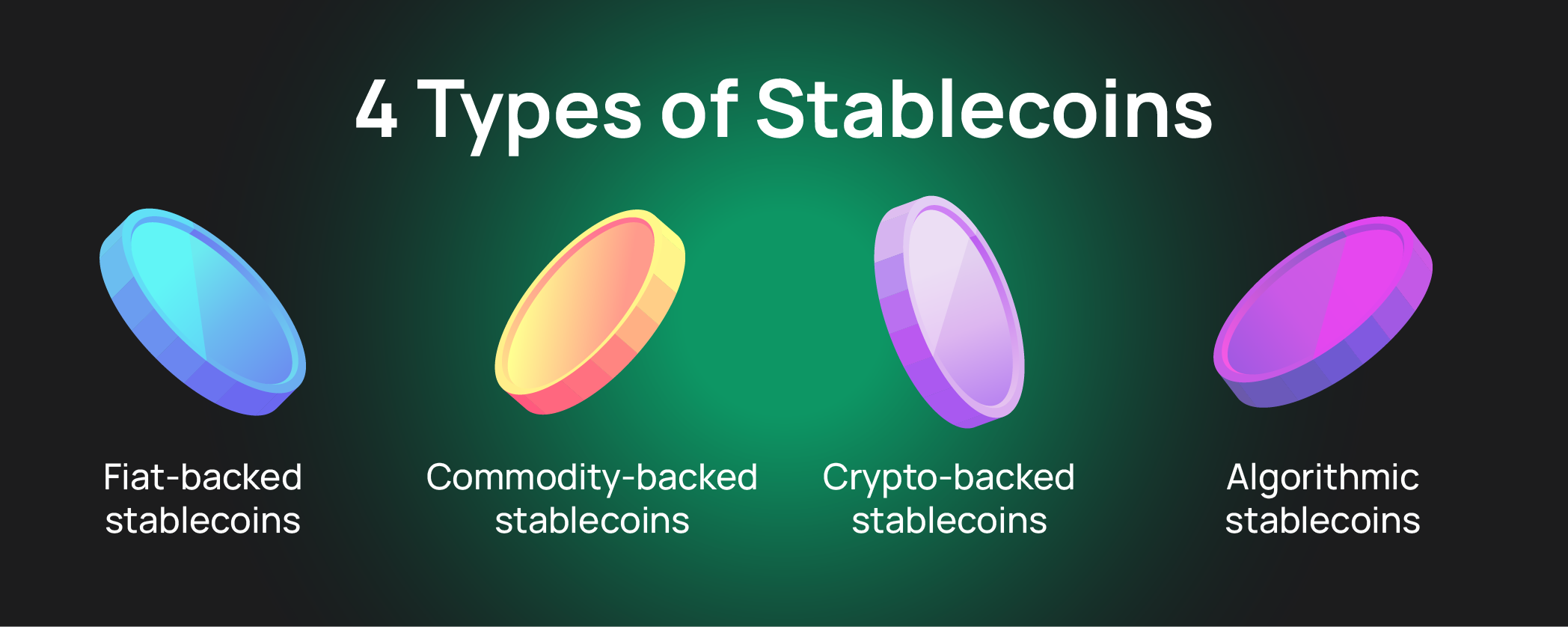

So what are the different types of stablecoins? Now that we understand the basics of stablecoins, the different stablecoins are, simply put, crypto that’s pegged against different assets.

They are:

- Fiat-backed stablecoins

- Commodity-backed stablecoins

- Crypto-backed stablecoins

- Algorithmic stablecoins

Fiat-backed stablecoins

These stablecoins are all backed with fiat money or equaivalent in a 1:1 ratio. For example, a coin issuer can choose to peg their coin against the USD. This issuer has to hold 1 million USD, and distribute 1 million tokens with a value of $1 USD each.

Every fiat-backed stablecoin has actual fiat currency or equivalent, such as bonds, in a bank account to back it up. If you want to redeem 1,000 coins, the issuer takes the corresponding amount of fiat currency (1,000 USD) from their reserve and sends it to your bank account. Once this is done, the 1,000 stablecoins are taken out of circulation or destroyed.

An important thing to note about fiat-backed stablecoins is that since they are pegged against an actual country’s currency, they use centralized servers rather than blockchain technology and third parties are involved in transactions (just like if you choose to transfer USD to someone else’s bank account, the bank has to be the intermediary). Fiat-pegged stablecoins also don’t require mining processes.

The most popular stablecoins are:

- Tether (USDT)

- USD coin (USDC)

- Binance USD (BUSD)

- EUROS (EURS)

Commodity-backed stablecoins

As the name clearly suggests, commodity-backed stablecoins are backed by different types of assets such as precious metals, real estate, oil, or a combination of these. The most common commodity used as collateral for commodity-backed stablecoins is gold.

The good thing about commodities is that they generally increase in value over time. And investing in commodity-backed stablecoins does not require you to “buy a whole house and wait for the price to appreciate”. Owning one coin can mean that you actually own a small portion of this house without needing millions to afford the entire property.

What commodity-backed stablecoins do is that they open up commodity investment to everyday investors. Now, you too can be an “oil trader”.

The most common example of a commodity-backed stablecoin is Digix Gold (DGX). It is an ERC-20 token backed by physical gold. One DGX is backed by one gram of gold held in reserves in Singapore. And guess what? You could even visit the reserves and redeem your physical gold.

Other popular commodity-backed stablecoins include:

- Gold – PAXGold (PAXG)

- Silver – SilverToken (SLVT)

- Diamonds – D1 Coin (d1)

Crypto-backed stablecoins

It seems counterintuitive to back crypto with crypto. But here’s why it works. Crypto-collateralized stablecoins give you greater decentralization compared to fiat-collateralized stablecoins. To minimize the risk from volatility, stablecoins are generally over-collateralized for absorbing price fluctuations. Usually, to get $100 worth of crypto-backed stablecoins, you might have to offer up $200 or more of ETH or BTC as collateral.

What crypto-backed stablecoins offer is decentralization – the elimination of regulations or third parties. And what’s more, a healthy combination of cryptocurrencies is usually involved as collateral for greater diversification and immunity against price fluctuations.

The most popular crypto-backed stablecoins are:

- Dai (DAI)

- Synthetix ($sUSD)

Algorithmic stablecoins

Algorithmic stablecoins do not have any assets or collateral for backing them. They are also called non-collateralized stablecoins. But how are they stable?

An algorithm controls the stablecoin supply. This is also known as seignorage shares. When demand rises, new stablecoins will be created to reduce the price to the normal level. In times of low demand, coins on the market are bought up to reduce the supply and push up prices.

Algorithmic stablecoins offer the highest level of decentralization. But since there is no collateral involved, it is also more volatile.

Popular algorithmic stablecoins include:

- Neutrino USD (USDN)

- Fei USD (FEI)

- sUSD

The different types of stablecoins offer investors varying levels of stability, balanced by corresponding levels of decentralization. In short, greater stability = less decentralization.

Feeling confident? Start trading on Bit.com and Switch On Your Future.