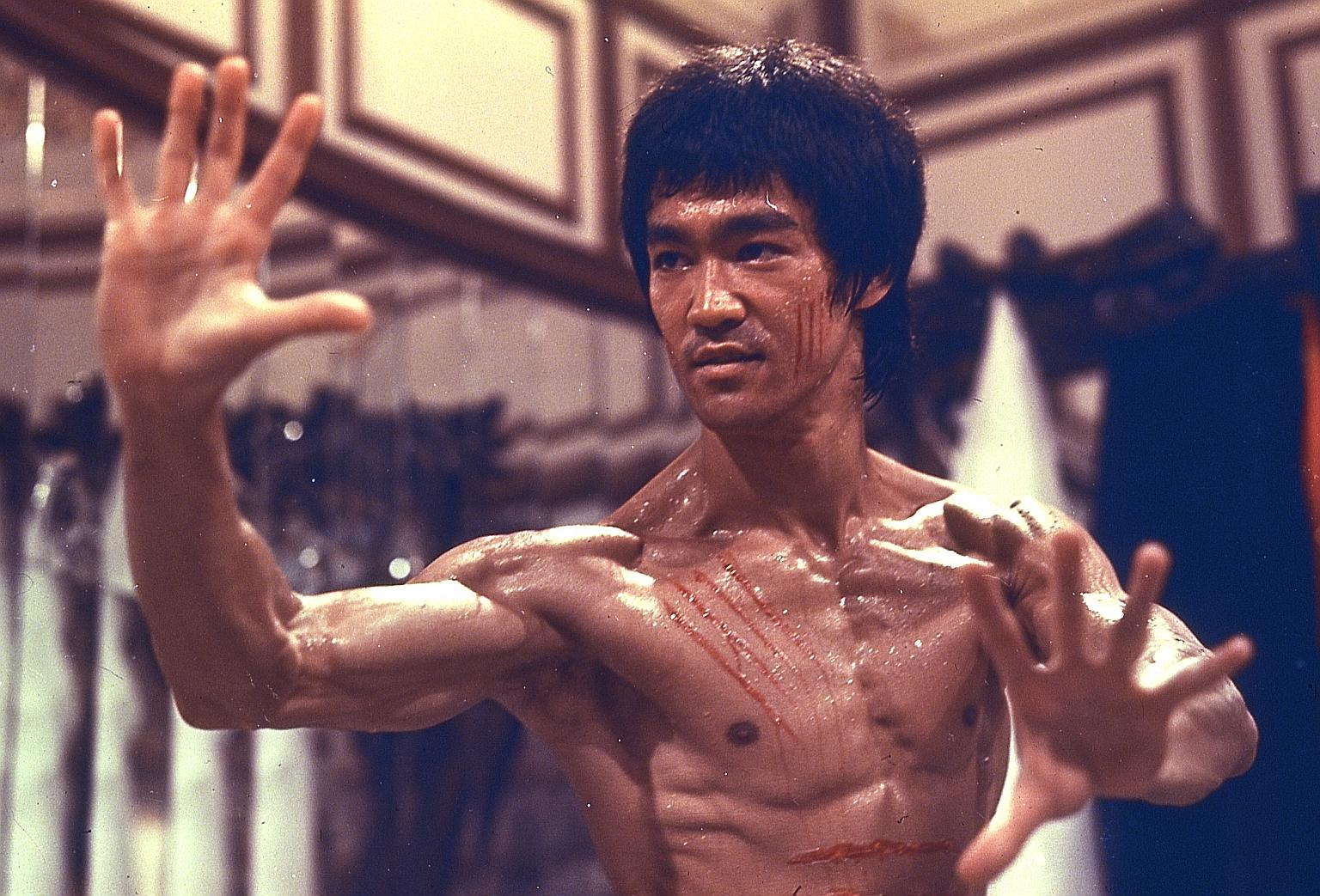

Enter the Bullish Dragon

“To hell with circumstances; I create opportunities.”

- Enter the Dragon

Enter the Bullish Dragon

While it may seem like a slow week ahead of the Chinese New Year, the dragon has already awoken. Bitcoin showed a sign of life, reaching a fresh four-week high just shy of $46,000 - back to the levels when the ETFs began trading.

Analysts on Twitter (muscle memory) pointed out earlier this week that increased selling by miners could have been a reason why BTC prices remained dampened recently.However, the opposite dynamic today may have finally taken over from coal diggers as whales in particular increased their bags. The number of Bitcoin wallets holding over 1,000 tokens (roughly $44.5 million) rose over 3% the last 2 weeks, adding 73 new whales according to Glassnode data.

In the background, the BTC ETFs are doing better than their similar-but-different cousins, the Gold ETFs. The net inflows during the first month have surpassed what the GLD ETF achieved in its first month, and it’s also offered at a much cheaper rate.

GLD, the biggest gold ETF, has an expense ratio of 0.4%. All but one of the 10 newly approved bitcoin ETFs (Grayscale's GBTC is the exception) have a lower expense ratio. Just after a few confirmations, the supposed digital gold is cheaper to buy than the OG paper gold.About the other ETFIn a move that was 100% expected, the SEC has once again postponed its verdict on a proposed spot ether ETF, delaying admission into the ether for Invesco and Galaxy Digital.

On Feb 6, the SEC announced its intention to open the proposal to public commentary, extending the decision-making period by an additional 35 days from its publication in the Federal Register. The SEC can push the final decision up to 240 days from the filing date in October 2023, which means the final potential deadline is July 2024 for the SEC’s ruling.

Meanwhile, Ark Invest and 21Shares amended their joint spot ETH ETF filing, featuring a cash creation and redemption mechanism which the SEC favored for the BTC approvals.It doesn’t increase or diminish the chances of the ETFs being approved, but that didn’t stop Ethereum's price from reacting positively, giving the silver coin more ounce to the bounce.Oh mama, mama, mama, I just shot a manlet downDespite all the speed and agility, there’s always been one major thing holding Solana back: its historic jankiness. During DeFi summer, when SOL was reaching its zenith, there were more than one instances when the whole network went down.The manlets deep in the chain would shrug it off, but for those still on the fence it always gave them reason to stay sat on that fence a little longer before jumping in. Also, the coin would always tank for a few days after, with the 2 day unstaking wait time putting a laggy drag on the market.

We were almost reaching a milestone: 365 days without any accidents. It was even called out in the Coinbase Institutional report last week: "Solana is fast approaching its first full year mark without any downtime, showcasing its significant ecosystem progress, especially when compared to an early history of crashes that halted the chain for days at a time."

But instead of blowing out candles on the anniversary cake, developers found themselves blowing on the cartridges to get back in the game.The network went dark for five hours, as the chain stopped producing blocks and all the apps froze in time. Yet, panic was minimal and SOL prices held up surprisingly well. I suppose that’s the upside of the 10th downtime?

Twitterari that like to pick sides were quick with the jabs. But even when Solana is completely down and out, it’s still only processing 14 fewer transactions per second than Ethereum. And how many genuine daily active users on VeChain would be affected by a halt? There is a deserted 20-lane highway that runs through Myanmar's brand new capital Naypyidaw. It was a purpose-built city unveiled years ago, but nobody lives there so the roads remain empty. Another pothole won’t affect anyone. (It does make for an easy ride when you coup the 'tat during an Aerobics class.)

One thing that was rightly pointed out, is that annoying little Beta asterisk on Solana's status.It’s a bit of a weak PR game that we are only reminded that Solana is still in Beta when the network goes down. It’s been long enough. Cookies are cooked, cookies are tested. There’s real daily active users now, and Solana is a legitimate contender in the race.No more Beta, just get better.My friend’s tech overnight successAll of a sudden, we need to talk about Farcaster. If you’ve been paying attention to DeSoc, then you’d know this wasn’t an overnight success, but for some it certainly seems so.Since it was founded in 2020, Farcaster has been slowing stacking users interested in the decentralized version of Crypto Twitter. It helped that Persons of Interest like Ethereum’s Vitalik Buterin signed up, but what really brought Farcaster to the center of attention is the project's release of its new "Frames" feature – essentially allowing apps to run within posts, so users don't have to click off to another site.

According to a dashboard on Dune Analytics, average daily users on Farcaster shot up from fewer than 2,000 in January to nearly 20,000 today. I’ve seen many Cryptonites telling their Twitter followers that they are now also on Farcaster.

Whether this is the start of a glorious new app that straddles both the chain side and the mainstream web, or a short-lived boom and bust like Friend.tech and Clubhouse remains to be seen.For the casual explorer, all I can say for now is that it’s not incredibly inviting to figure out how it works. Maybe airdrop a few more readers my way and then we’ll talk.There’s a dragon loose in the woodsA quick final note. We are getting ready for Chinese New Year over here, entering the Year of The Dragon. As we head into the preparations, celebrations, and libations, crypto activity in this part of the world may be a little quieter than usual.

This particular year combines the growth and renewal-oriented energy of the Wood element with the power and dynamism of the playful Dragon. It is inscribed as a Year of expansion, innovation, and vitality in collective efforts.

That neatly sums up the bullish dragon market I had in mind anyway.

Kung hei fat choi.

Meanwhile...

Something's lurking in the waters...

• New product release: the Shark Fin.

• Guaranteed base return in any market condition

• 7-Day short-term maturity

Open the BIT app and subscribe today!

In the Spotlight: Ethscriptions (ETHS)

Ethscriptions (ETHS) surged by 18% in the past 24 hours trading on the BIT app. Here's a refresher on Ethereum's response to Ordinals, the groundbreaking ETHS protocol reshaping the Web3 landscape.

Top 5 tokens by profit using the Rebalancing Market Maker Strategy (RMM)

Automatically buy low and sell high with BIT's RMM tool.

Learn how to get strategic:

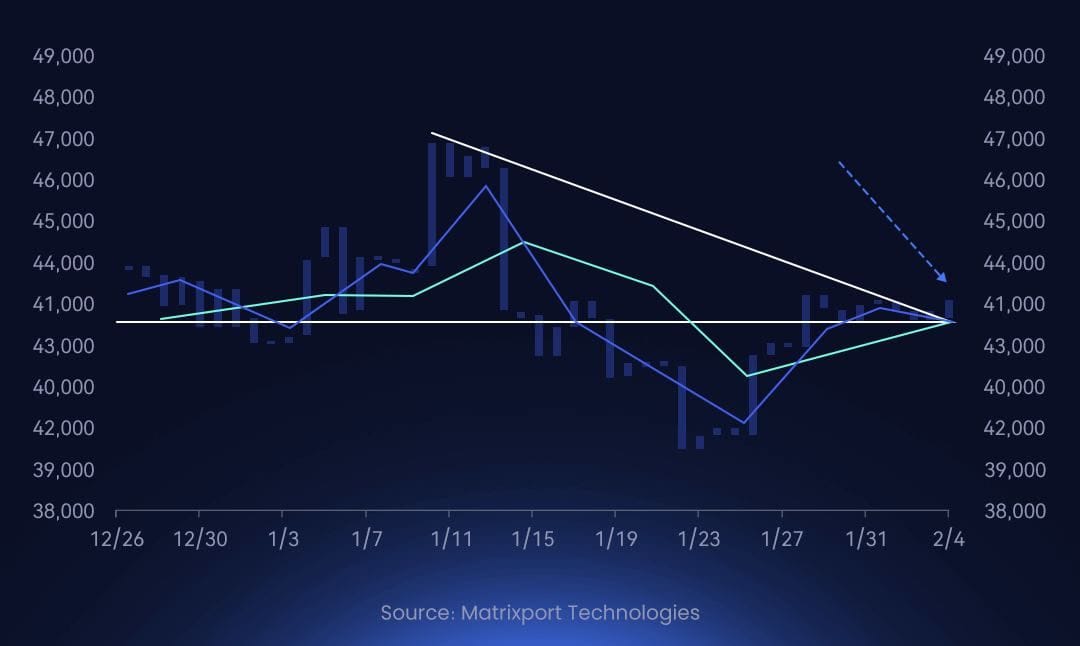

Technically Speaking

Market analyses from our partners

Chart of the Day - 7 Feb

Since mid-December, BTC has been trapped in a broad consolidation pattern around the $43,000 level. A breakout attempt in mid-January followed a breakdown in later January before Bitcoin moved back into the $43,000/44,000 range.We are noticing that Bitcoin is attempting to break higher, above the downtrend line (black). This could set up the market bullish over the next few days and weeks.

Required Reading

Most Memorable Meme