Ethereum's Shapella Upgrade: Withdrawals and Decreasing Supply

Ethereum has been making waves in the crypto space with updates from its recent Shapella upgrade. Speculation was rife that staked Ether withdrawals could send the native asset's price spiraling downward. However, emerging data suggests that these concerns were unfounded, as the impact of withdrawals on Ethereum's price has turned out to be rather inconsequential.

Shapella Upgrade Proves the Naysayers Wrong, ETH Price Remains Resilient

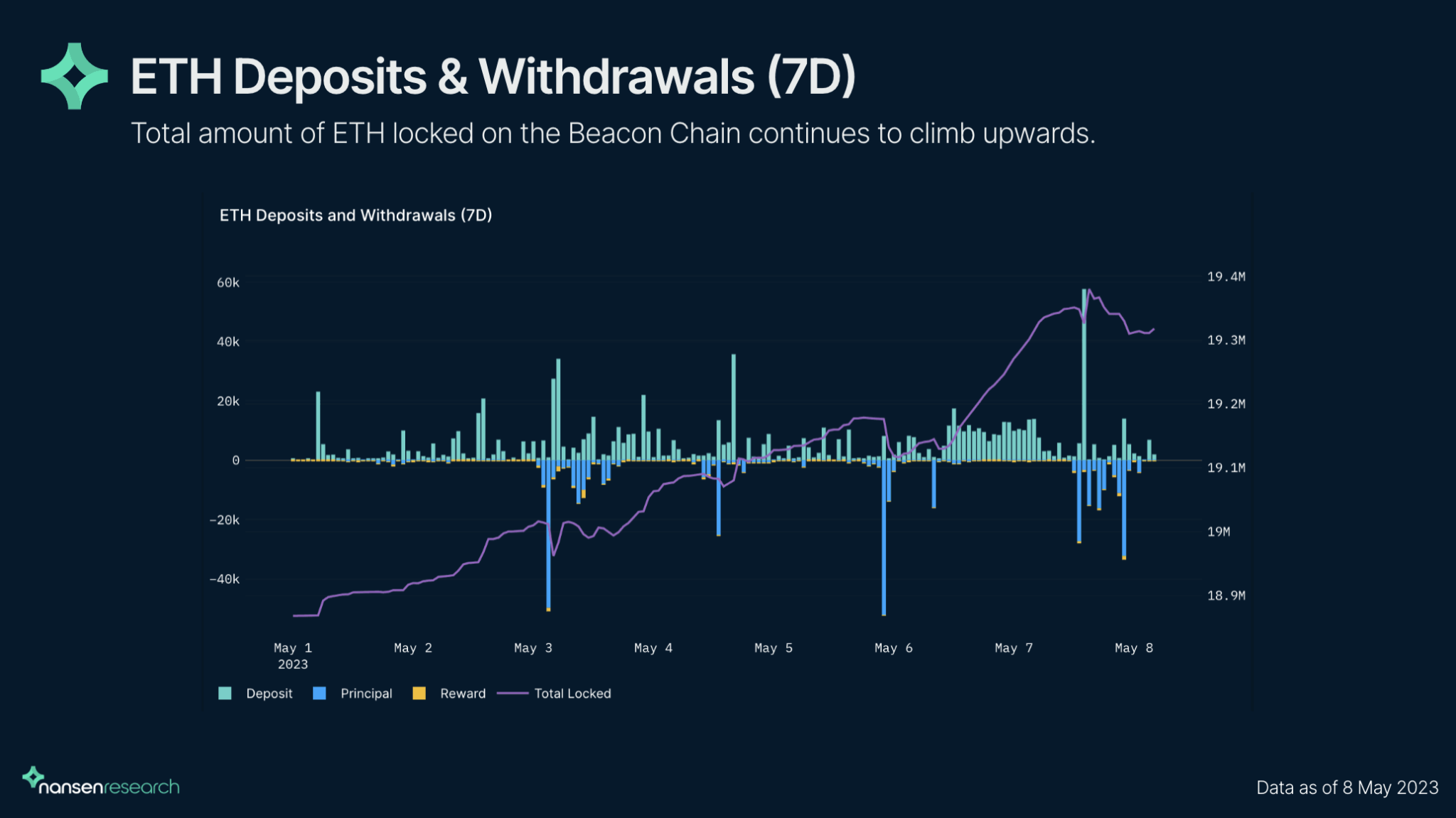

The eagerly anticipated Shapella upgrade marked a significant milestone for Ethereum, allowing staked ETH to be withdrawn from the Beacon Chain for the first time. This development triggered widespread speculation among crypto pundits, with many expressing concerns about the potential sell-off of unstaked ETH flooding the market.

However, recent analysis by Nansen, a leading blockchain analytics firm, reveals that the elimination of unstaking risks has effectively balanced out the selling pressure caused by withdrawals. Adding to the bullish sentiment, a considerable portion of the withdrawn ETH is not intended for immediate sale. Market participants are opting to retain their ETH holdings or deploy them within the Ethereum ecosystem, painting a positive picture of the asset's value moving forward.

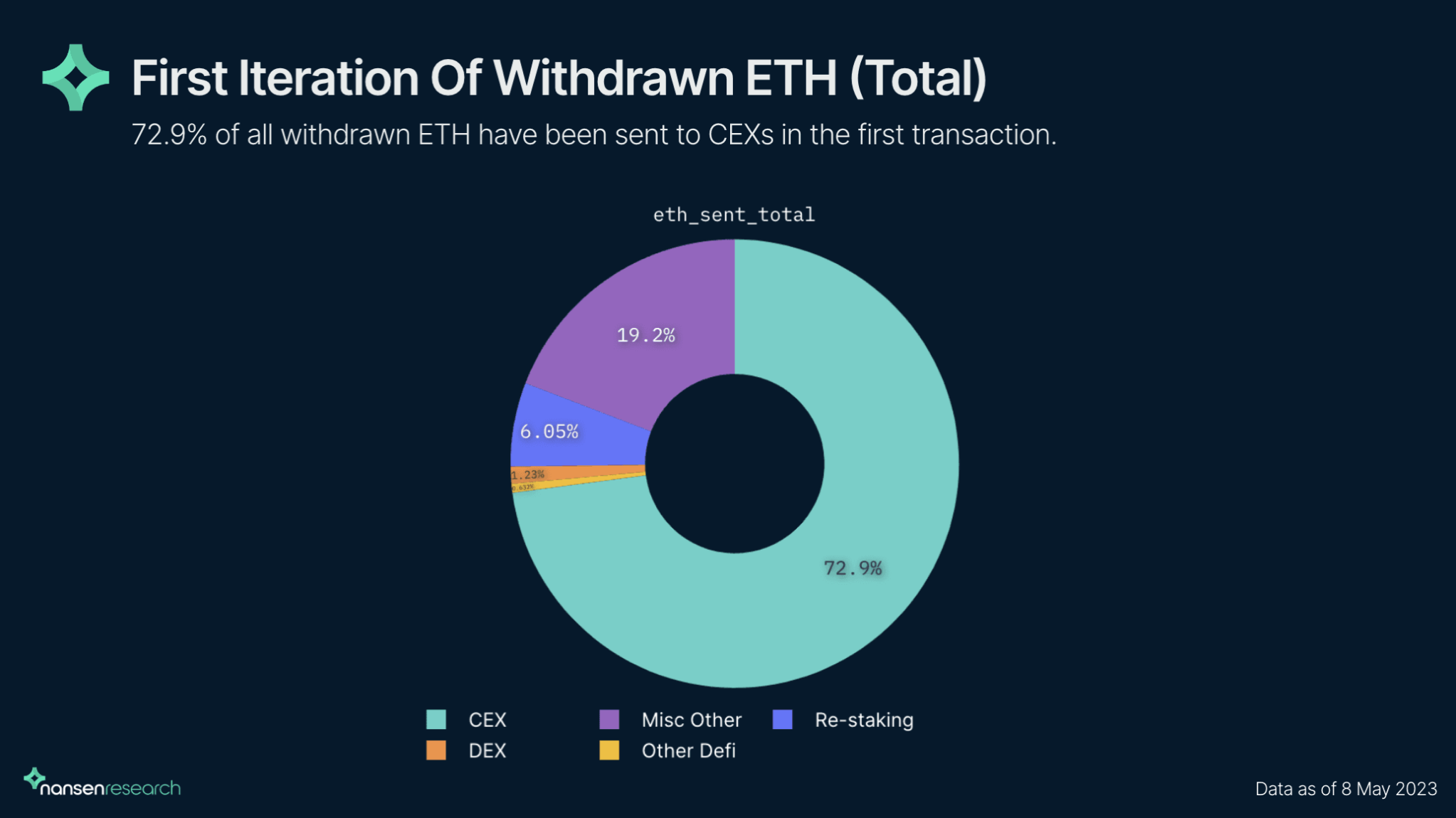

Centralized Exchanges: The Main Recipients of Withdrawn ETH

A closer look at the distribution channels of the withdrawn ETH sheds light on where the majority of these tokens have found their new homes. Nansen's report indicates that approximately 73% of the ETH withdrawn from the Beacon Chain has made its way to centralized exchanges (CEXs). However, it is essential to recognize that these tokens are predominantly earmarked for internal operations within the exchanges rather than being immediately dumped on the market.

On the other hand, decentralized exchanges (DEXs) have only captured a minuscule 1.23% of the withdrawn ETH. Interestingly, roughly 20% of the withdrawn ETH has been directed toward miscellaneous addresses not labeled as CEX, DEX, Staking, or DeFi. Additionally, around 6% of the withdrawn ETH has been restaked, underscoring the continued faith in Ethereum's staking mechanism.

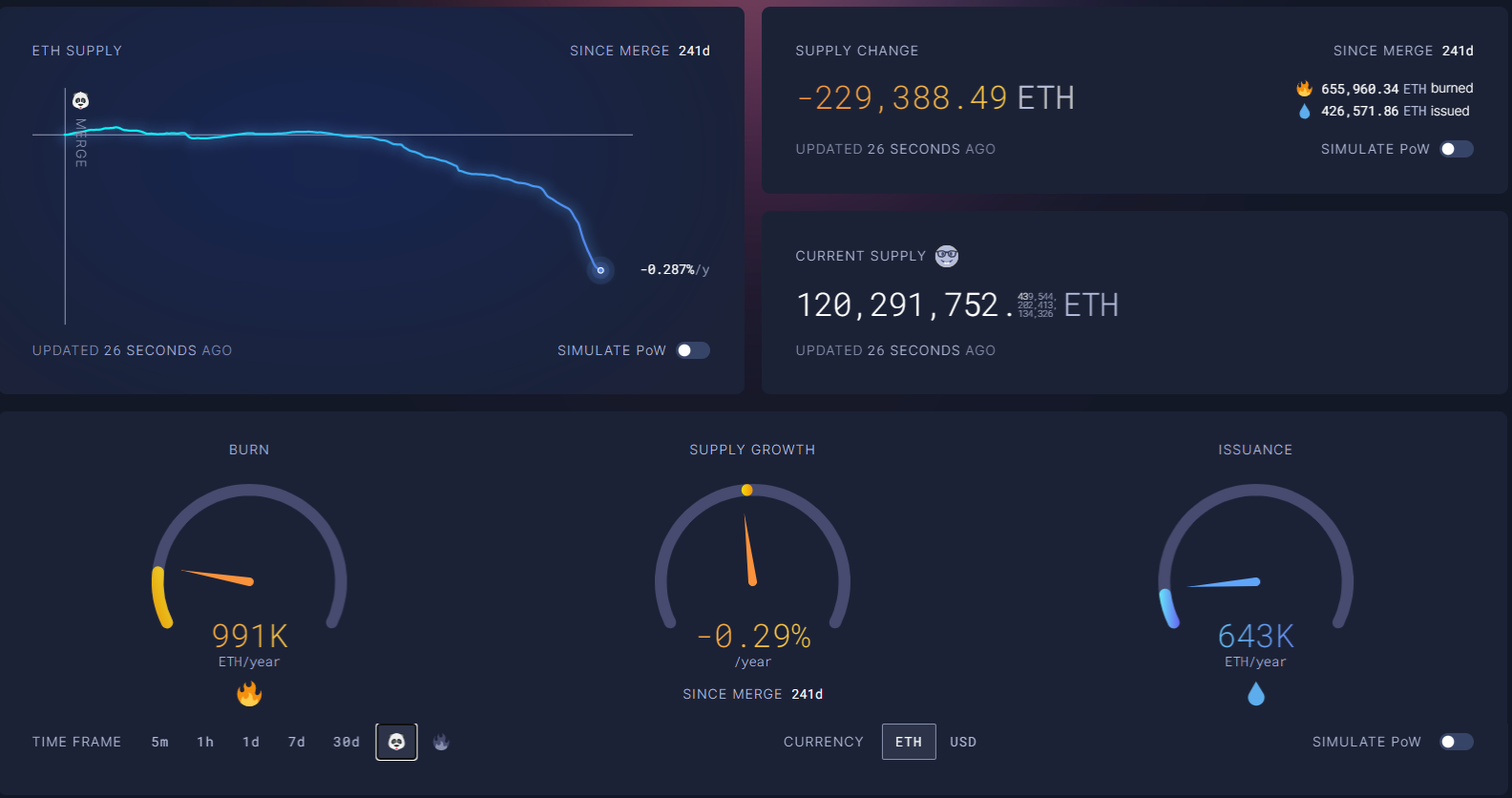

Decreasing Total Supply: The Post-Merge Trend

Since the highly anticipated Merge event on September 15, 2022, which ushered in Ethereum 2.0 and the transition from proof-of-work (PoW) to proof-of-stake (PoS), Ethereum's total supply has experienced a downward trajectory.

According to data from ultrasound.money, an Ethereum supply analytics platform, approximately 655,968 ETH has been burned, surpassing the 426,571 ETH minted during the past eight months. This significant imbalance in supply has resulted in a net negative change of approximately -229,388.49 ETH. What makes this trend even more intriguing is that ultrasound.money predicts that if the Merge had not occurred, the total supply of ETH would have witnessed an annual increase of 3.2%.

The ongoing deflationary trend in Ethereum's total supply carries promising implications for long-term ETH investors. As the supply of ETH decreases, the scarcity of the asset intensifies, often leading to a potential increase in its value. This phenomenon aligns with basic economic principles: when the supply of a commodity diminishes while demand remains steady or increases, the value of that commodity tends to rise.

Thus, the decreasing supply of ETH sets the stage for an optimistic outlook among long-term investors, who eagerly anticipate the potential appreciation of their holdings.

Ethereum Is in a Bearish Bind

Speaking of outlooks, Ethereum’s price action this past week left much to be desired. The blue-chip cryptocurrency fell to a low of $1,737 on May 12, its lowest point since March 28. This decline came as a result of external market factors—factors completely unassociated with Ethereum itself. One of the major external factors affecting ETH at the moment is the lingering Bitcoin congestion, which brought the price of the benchmark cryptocurrency and most of the crypto market to its knees.

While the cryptocurrency currently holds above the $1,800 support level, many crypto enthusiasts believe a more bearish pinch is on the horizon, with some predicting a drop to at least $1,700. With volatility still at relatively high levels—as highlighted by the ATR indicator—ETH could be in for a bumpy ride this week.

ETH Statistics Data

ETH Current Price: $1,800

ETH Market Cap: $221B

ETH Circulating Supply: 122.9M

ETH Total Supply: 122.9M

ETH Market Ranking: #2

Feeling confident? Trade your idea on ETH now.

Disclaimer

This article should not be taken as financial advice. It is essential to conduct research before making any investment decisions.