Filecoin Set to Play Pivotal Role in Booming AI Economy

Every financial boom is marked by the rise of a groundbreaking technology that captures investors' attention and draws in substantial capital. After the 2008 Global Financial Crisis, central banks around the world pumped money into the economy, leading to a surge in investments in Web 2.0 advertising, social media, and the burgeoning sharing economy. Similarly, in the 1920s, technologies developed during World War I, such as radios, became the focal point of investment enthusiasm.

In our current era, it's evident that technology related to artificial intelligence (AI) is poised to take center stage.

AI is currently experiencing an unprecedented surge in adoption. Despite discussions and research dating back to the mid-20th century when computers were invented, it's only in recent years that AI applications have become truly valuable to millions of people. The pace of transformation in our lives due to the capabilities of thinking machines is set to be truly remarkable.

With trillions of dollars in free capital available, a diverse range of entities, including politicians, hedge fund managers, and tech-focused venture capitalists, are eager to invest in anything even remotely connected to AI.

Some critics may dismiss recent fluctuations in the stock price of companies like NVIDIA as evidence of a bubble. However, this perspective overlooks historical trends and the evolutionary nature of financial bubbles. The AI revolution is still in its infancy, and the potential for major central banks to inject even more money into the economy to support their governments is on the horizon. This influx of capital and attention into this "new" technological frontier will be unprecedented in human history.

Considering the uncertainty around which AI business models will come out on top, trying to pick the winners right now is near-impossible. So, what's the smart move during this AI boom?

Think of it like a gold rush – invest in the companies that provide the essential tools, just like selling shovels to gold prospectors. This means focusing on supporting the core elements that AI relies on to work its magic. In simple terms, it's about investing in either computing power or cloud data storage. And in both cases, it's clear that AI is leaning towards and craving decentralized tech infrastructure.

Why AI needs decentralization

When it comes to creating useful and inclusive AI tools, one of the big things to think about is the data they're built on. Today, AI models rely heavily on huge datasets collected by various entities, like governments, businesses, and universities.

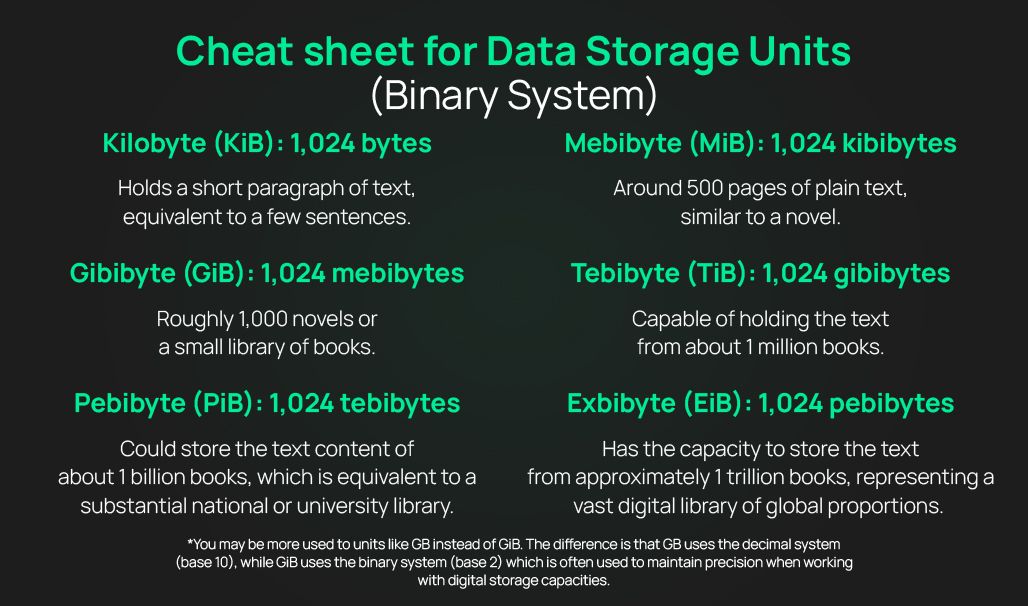

These datasets are the lifeblood of AI, fueling its capabilities, and they are growing in size rapidly. ImageNet with a staggering 14 million images trained on 140 GiB of data, The Pile was created with an 767 GiB collection of language examples, ChatGPT-3 relied on a 41 TiB dataset, and ChatGPT-4 is trained on 1 PiB.

As the AI industry continues to expand, safeguarding these datasets for future generations becomes crucial. Typically, we store them on cloud platforms like AWS or Azure. However, the centralized nature of these repositories poses significant concerns.

Imagine a scenario where a company like Amazon decides to shut down access to a dataset, maybe because a government asks them to. In a centralized system, this can happen, and it could seriously mess up AI development. This is where decentralized networks shine. They offer censorship-resistant environments, ensuring that data remains accessible and unaltered.

Data breaches, privacy issues, and dirty data can mess up AI models big time. Attackers may introduce malicious data into training sets or misuse trained models for malicious purposes. And when data lives in just a few centralized databases, it's easier for troublemakers to cause havoc.

In critical areas like medicine or finance, a messed-up AI model can lead to huge problems. Even in less critical applications, a corrupted model becomes worthless, wasting valuable resources and damaging reputations. The opacity of data sources further compounds the problem, as it becomes impossible to verify data accuracy.

Decentralized data storage, where data is distributed across a network of nodes rather than concentrated in a central database, offers the privacy, security, and transparency that AI needs. There is no single point of failure, and breaches don't hit the jackpot because data is scattered all over. Users and organizations stay in control of their data, and they can access it when they need it, with the right permissions of course.

Cryptographic verification, often using blockchain, helps users spot any data tampering, ensuring the data is trustworthy. This transparency lets users check data sources for accountability, accuracy, and completeness. What's great is that decentralized data access makes it safe to grab data from many sources without revealing secrets or risking security issues. This means better accuracy, especially in areas where data is hard to find, as AI models can get a richer mix of data.

In this context, Filecoin's decentralized data storage network emerges as a pivotal player in the rising AI economy.

What is Filecoin

Filecoin is a unique peer-to-peer network designed for storing files securely over time. It uses economic incentives and cryptography to ensure that files remain accessible and unaltered.

In Filecoin, users pay storage providers to store their files. These storage providers, essentially computers, are responsible for storing and proving the correctness of stored files over time. Anyone can join Filecoin, either to store their own files or earn by storing files for others. What's exciting is that Filecoin operates in open markets, so no single company controls the available storage or its price. It's a level playing field open to everyone.

Filecoin is built on top of the same software that powers the IPFS protocol, a peer-to-peer distributed storage network. IPFS uses content addressing, which means you can permanently reference data without relying on specific devices or cloud servers. However, Filecoin takes it a step further by adding crypto-incentives to ensure data reliability and accessibility.

FIL: the native cryptocurrency

Filecoin is the protocol’s native currency. It is a utility token that motivates users to provide persistent storage on the Filecoin network. Storage providers earn FIL by offering reliable storage services or committing storage capacity. There's a maximum supply of 2 billion FIL, meaning there won't be more than that ever.

Filecoin's issuance aligns with the network's utility and growth. It follows a dual minting model for block rewards:

1. Baseline minting: Up to 770 million FIL tokens can be minted based on network performance. These tokens are only fully released if Filecoin reaches a Yottabyte of storage capacity in under 20 years, which is about 1000 times larger than current cloud storage capacity.

2. Simple minting: 330 million FIL tokens are released over a 6-year half-life period, which means about 97% of these tokens will be available in approximately 30 years.

Additionally, 300 million FIL tokens are held in a mining reserve to incentivize future types of mining.

Mining rewards undergo a vesting schedule to promote long-term alignment with the network. For example, 75% of block rewards vest linearly over 180 days, while 25% are made immediately available to improve miner cash flow. The remaining FIL tokens are vested to Protocol Labs teams, Filecoin Foundation, and SAFT investors over 3 to 6 years.

The Trading Opportunity

Now, let's look at the trading opportunity for FIL. It's currently trading at a fraction of its all-time high (ATH), down nearly 99% from its April 2021 ATH. The Price / Storage Capacity and Price / Storage Utilization ratios have also dropped significantly. Some back of the napkin math illustrates the following:

In April 2021:

- FIL ATH: $237.24

- Filecoin storage capacity: 4 EiB (exbibyte)

- Storage utilization: 0.2%

As of Q2 2023:

- FIL price: $3.40

- Filecoin storage capacity: 12.2 EiB

- Storage utilization: 7.6%

The ratios have changed drastically:

- ATH Price / Capacity in April 2021 = $19.45 per EiB

- ATH Price / Storage Utilization in April 2021 = $1,186 per percentage

Current ratios:

- Current price / Capacity = $0.27 per EiB

- Current price / Storage Utilization = $0.44 per percentage

Investing after multiples take a hit is often wise. If the Price / Capacity ratio rebounds even to 25% of its April 2021 level, at $4.86 per EiB, the FIL token price could rise to $59.29, almost 17 times the current level.

You can seize trading opportunities by trading FIL trusted crypto exchanges such as BIT Exchange. In response to the increasing demand from institutional investors, miners, and hedge funds, BIT has recently launched FIL options to provide everyone within the Filecoin ecosystem with a powerful tool to manage and hedge their portfolio risks through advanced trading strategies.

Crypto options trading offers a cost-effective and relatively low-risk way to engage with digital assets. Alongside other crypto derivatives, options trading enables traders to control their exposure to digital assets and speculate on their future prices. BIT, as a key player, is leading the expansion of this segment and is at the forefront of this rapidly growing digital asset trading market, which is expected to continue its growth in the coming years.