Genslor on the Brink of Second Approval for Bitcoin ETFs

“In any game, there are but two players: the one in control and the one who wants control.”

- Inside Man

It’s here. After two confirmations courtesy of the CoinTelegraph intern, the Bitcoin Spot ETF is finally here. It only took a quick decade between the first application, the many rejections over the past few years, and the good news this week that paper Bitcoin will be made available for the greater good.

If the SEC felt it was protecting people by dissuading them from getting into Bitcoin, they could not have chosen a worse path.We would not have had all the excitement and fanfare if they hadn’t blocked ETFs with so much theater, and by releasing all the hounds at once, they also created a highly coordinated promotional launch day for all these funds now trading on exchanges. Case in point, total trading volumes for BlackRock, Fidelity and Grayscale products exceeded $1 billion in the first 30 minutes of trading.

Everyone's excited, but what exactly are we celebrating?

Integration between TradFi and Crypto? That’s not really true. ETFs do not plug the Bank Tower into the chain. Mainstream adoption? Wrong again. ETFs do not directly lead to a massive surge in new and active wallets. A greater decentralized peer-to-peer economy? No dice. ETFs are obviously a move in the other direction.

What we should be celebrating is the increased mindshare and credibility Bitcoin gains with civilians.

As big and loud as things may seem on Telegram, Crypto Twitter, Discord, and your favorite crypto news publication, nobody on the outside cares yet. I told some nocoiners a few months ago that an ETF might be incoming, and today they asked me how I got this ‘insider information’.

While it was very public information, of course, the sentiment is right. It is kinda like insider information if nobody on the outside is there to listen. Nobody heard the tree fall. That’s what will change from today - precisely 15 years after Hal Finney joined the network, tweeting he started 'running bitcoin'.

Six degrees of separation from Bitcoin Bacon

We’ve been very good at talking to ourselves, marketing projects, bridging chains, conferencing new products, and panelizing our leading thoughts going deeper down the rabbit hole together.

But our chain of connections would be less than #. We haven’t really been able to break through to the other side just yet.

The collective marketing machine of big players like Blackrock, VanEck, Fidelity, et. al. will reach more people on Day 1 than we ever did. The Most Interesting Man in the World is irresistible.

Instead of the negative headlines about crypto that make it into everyone’s Sam-Bankman feed, this time civilians will learn about Bitcoin in a positive light.

Their card-carrying advisors slinging prospecti will need to educate them on programmed scarcity, mining dynamics, halving cycles, decentralized networks, and lightly touch on the peer-to-peer self-custodied nature of Bitty while emphasizing that it’s a troublesome effort for mere individuals to undertake.

If that leads to more people interested in at least getting price exposure to Bitcoin, that’s a step in the right direction.

For some, it might just be the start. The gateway drug to withdrawing wealth from the impoverished streets of the Fiat Empire and truly owning on-chain bearer assets. Some might even notice what the child has been saying all along; the emperor has no clothes.

It’s not the expression of financial sovereignty Satoshi would’ve had in mind, but does it matter that much? People buying into Bitcoin ‘the wrong way’ doesn’t affect anons doing it by the book.

Buying NVIDIA shares is not AI adoption, but it doesn’t hurt the sector either.

The BTC ticker on the bottom of your Bloomberg screen has an effect, and now the ETF being promoted to every US household and pension fund will work its magic. Your bags in cold storage will benefit one way or another from the increased mindshare.

Inscriptions presented the same mixed feelings when they took hold. Scribbling riddles and giggly squiggles riding blockspace like NFT stowaways are considered by some as an illegitimate use of the chain, but it doesn’t hurt the fundamentals of Bitcoin and its orange view of the world.

If anything, the increased transaction fees have been a lifeline for BTC miners, which are kind of an important element in the equation, so it’s not all bad.

All that glitters is not gold

What will the ETF mean for the BTC market in the short term? Probably nothing.

Sure, prices might go up as excitement overflows, and when profits get taken, it’ll go back down. It's gonna get choppy, which is the natural habitat for futures and options traders. Plus, if Crypto Hayes is right, we’re in for a Big Dip either way around March for BTFP reasons unrelated to the ETF.

Long term, it does create a seismic shift. Many comparisons with the gold ETFs that launched in 2004 have been made, and you can see the similarities.

Gold bugs will likely scoff at an ETF. Paper gold is not actual gold. It’s not a solid bar buried in the yard that remains intact as governments debase their fiat currencies and large corporations play musical chairs with pension funds and bank deposits.

But not everyone wants to have the responsibility of safeguarding metal at home. For some, it’s just about the idea that supports investing in gold, and gaining price exposure to the asset is sufficient.

In the end, it worked out for everyone. It became very convenient for anyone to add gold to their portfolio with a simple ‘buy’ button in their brokerage app, and that certainly helped the price of gold quadruple in the seven years following the gold ETF launch in 2004.

Today, over $100 billion is stashed in gold ETFs, and major financial institutions expect Bitcoin to enjoy similar price gains in perhaps an even shorter timeframe.

Compared to 2004, more people today understand what ETFs are, more investors have trading accounts on consumer-friendly apps, and amidst higher inflation rates, there is a greater appetite for fiat alternatives.

Who knows, maybe some ETF investors get orange-pilled along the way, minting a new generation of hodlers going full metal jacket.

Either way, this is a win for everyone.

Meanwhile...

Decision Time - Markus Thielen

Halving years see Bitcoin sell-off into March.

The average Bitcoin return during halving years (2012, 2016, & 2020) sees an initially rally of +17% (Dec 31, 2023 BTC @$42,265 +17% -> $49,450) – hence our $50,000 price target for January 2024.

Only to then quickly reverse and decline into a mid-March low of -14% ($36,350). This is why we worry about an early fakeout rally.

read more >

In the Spotlight: RNDR Makes Gains

Render (RNDR) has soared by 14.93% in the past 24 hours, currently priced at $4.19.Let's dive into why RNDR is making waves and explore its revolutionary role in decentralized GPU-based rendering solutions.

Technically Speaking

Market analyses from our partners

Greeks.Live on the BIT App

As 36,000 BTC options and 262,000 ETH options approach expiry on Jan 12, key insights emerge.BTC's Put Call Ratio stands at 0.9, Maxpain at $45,000, and notional value at $1.68 billion. For ETH, the Put Call Ratio is 0.64, Maxpain at $2,400, and notional value at $680 million.The Bitcoin Spot ETF's anticipated approval led to heightened volatility, impacting IVs. Short-term IVs spiked pre-ETF, followed by a retreat in all major terms due to subdued market volatility. While the ETF promises long-term capital influx, short-term uncertainties persist, with potential for continued sharp volatility.Stay vigilant amid evolving market dynamics.

AmberData on the BIT App

Recent developments include an exploit in the Radiant Capital protocol, offering lessons in code vulnerabilities. Notably, an NFT collection, "The Plague," is venturing into a groundbreaking trend—company equity for NFT holders.Solscan's acquisition by Etherscan signals Ethereum's expanding explorer network. In spot markets, SOL witnessed a remarkable December, rising over 70%, challenging ETH.DEX trading emphasizes USDC/WETH and WETH/USDT pairs, while Uniswap v3's most active date reveals shifts toward BTC exposure.In DeFi lending, DAI dominates deposits. Network-wise, Bitcoin's transaction counts and fees surge, challenging Ethereum's historical dominance.

Required Reading

- Signposts - Crypto Hayes

- Does BTC Appreciate 200% Per Year? - The Wolf Den

- BTC Fixes Money - Cole Walmsley

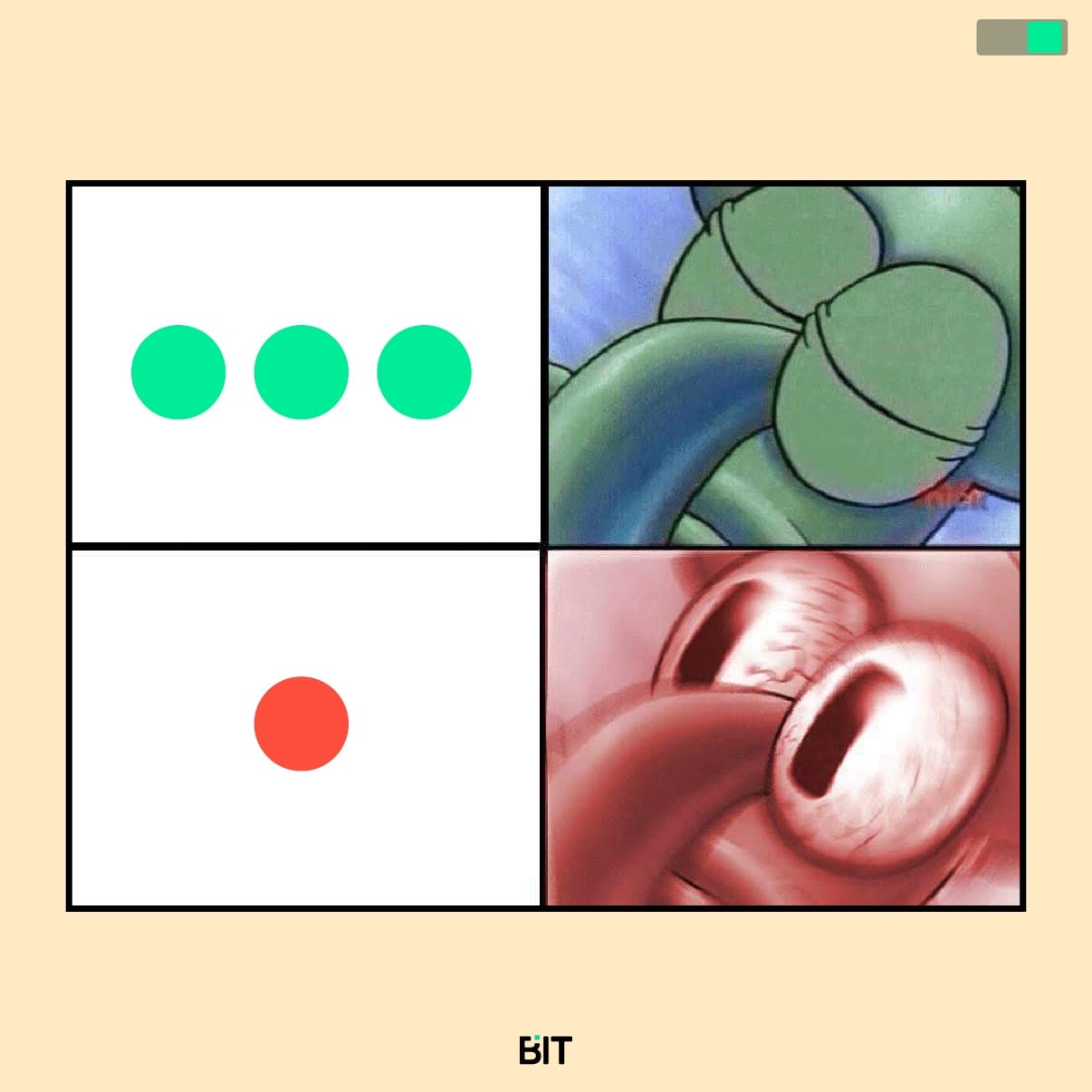

Most Memorable Meme