Our Crypto Portfolio Unveiled: How to Achieve +112% Upside Potential

Executive Summary

Bitcoin prices have rallied by +71% this quarter and the leading cryptocurrency has outperformed most major digital asset tokens. ‘Matrix on Target’ has been bullish this year and remains so as the macro-liquidity tailwinds continue. This has set up the market for some interesting relative value trades where Bitcoin can now be used as a funding or hedging instrument while other crypto assets could catch up.

We construct a diversified crypto asset portfolio that has a potential upside of +103% based on the current Bitcoin price of 28,405. Investors can even use the current contango structure of the CME Bitcoin futures market to add an additional +9% which would bring the potential return of this market-neutral portfolio to +112%. The CME Bitcoin futures for March trade at 28,405 while the April contract trades at 28,620 (a difference of +0.8% and equates to +9.1%annualised). Investors should buy now what is cheap and forgotten - relative to the strong rally that we have seen with Bitcoin as liquidity-focused multi-strategy funds and a flight to quality have caused Bitcoin to materially outperform. Either this rally is sustainable and the rest of the highly correlated crypto universe catches up, or Bitcoin’s rally was a one-off liquidity event and prices drop again. There are many undervalued assets available - choose carefully.

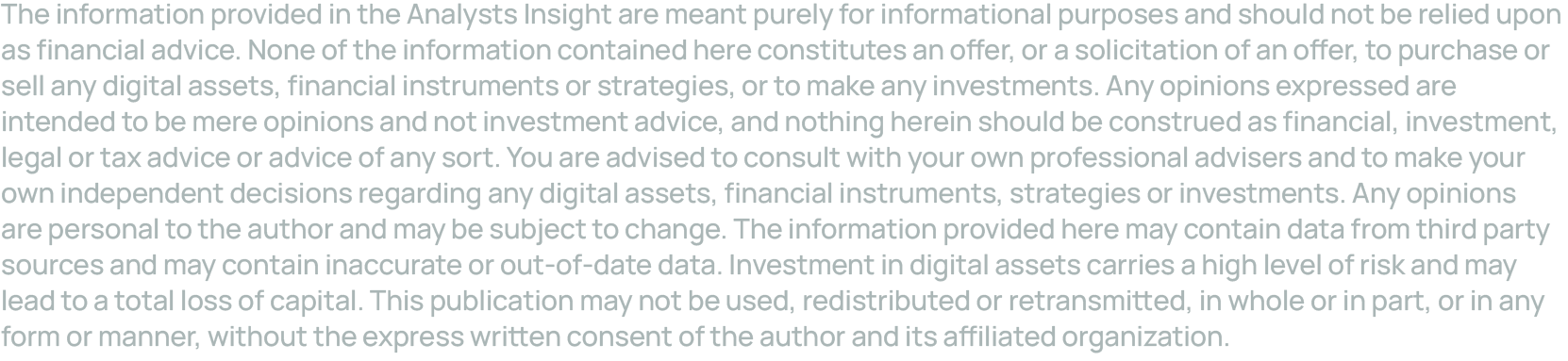

While the correlation and regression between Bitcoin and Ethereum have been exceptionally high with 0.95 (R-square), the discount of Ethereum is only 9%. While this level is near the bottom of the historic discount range, there are more attractive crypto jewels that we can select to construct a well-diversified crypto portfolio with plenty of upsides.

Exhibit 1: Bitcoin and Ethereum are highly correlated but Ethereum trades now below the trendline

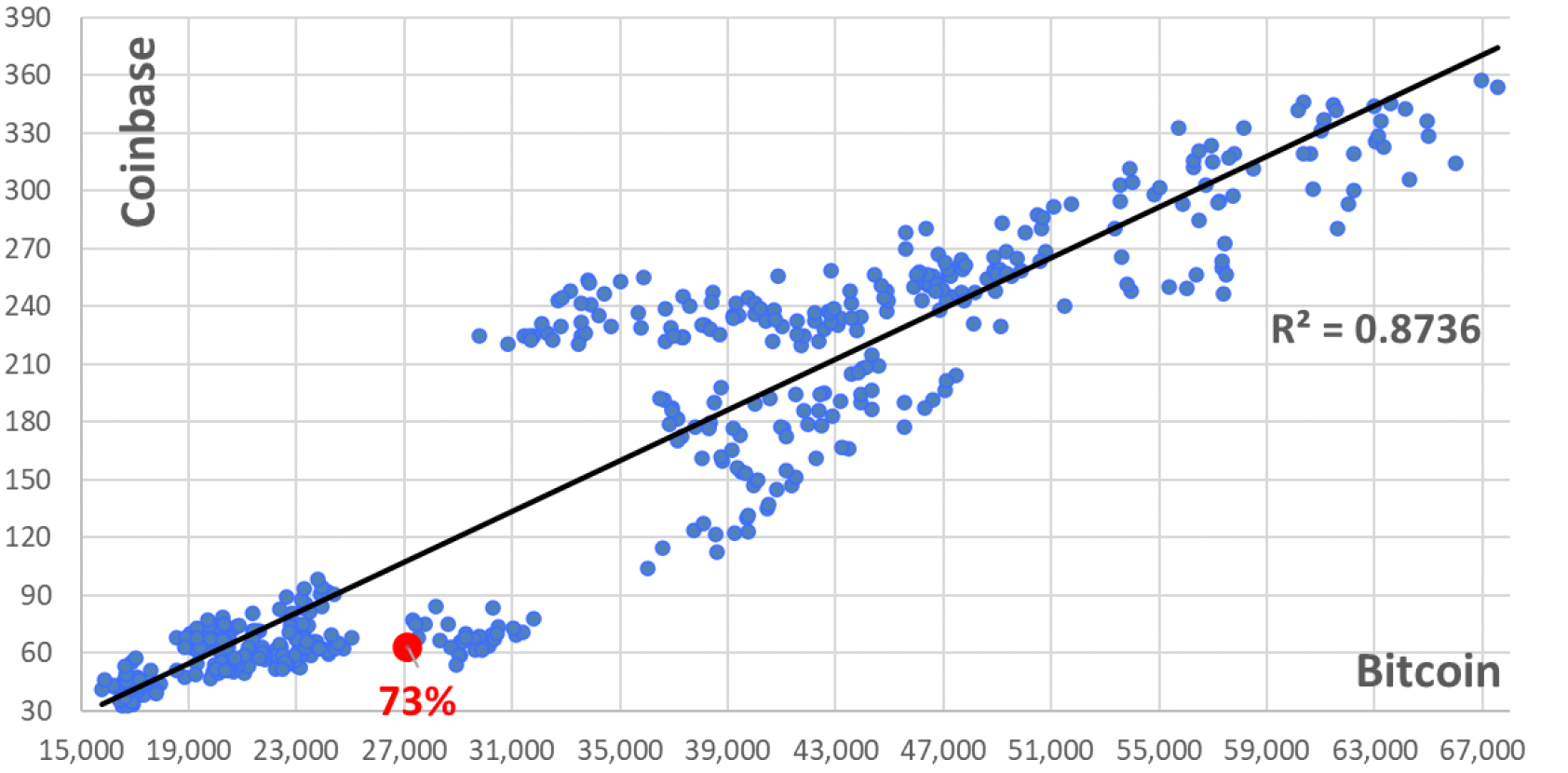

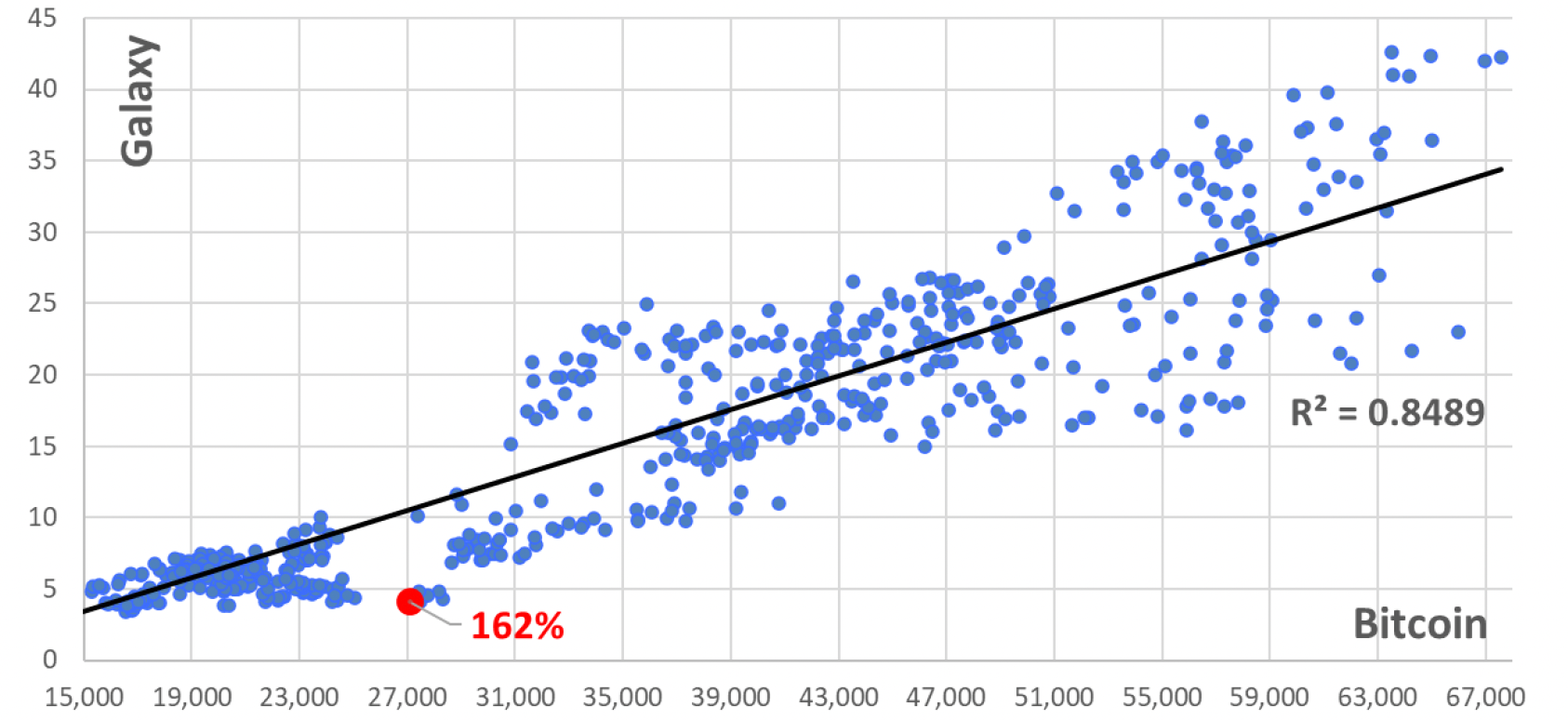

For example, Coinbase has a +73% upside based on our model and Galaxy Digital has a+162% upside. Crypto equities have underperformed due to a regulatory overhang as well as due to poor strategic decision-making around expansion near the top of the last bull market. But with a +162% upside based on the current Bitcoin price, it might be worth a shot on a twelve-month view. The portfolio is predominantly allocated to listed crypto equities and therefore can be taken advantage of by traditional finance (tradfi) investors.

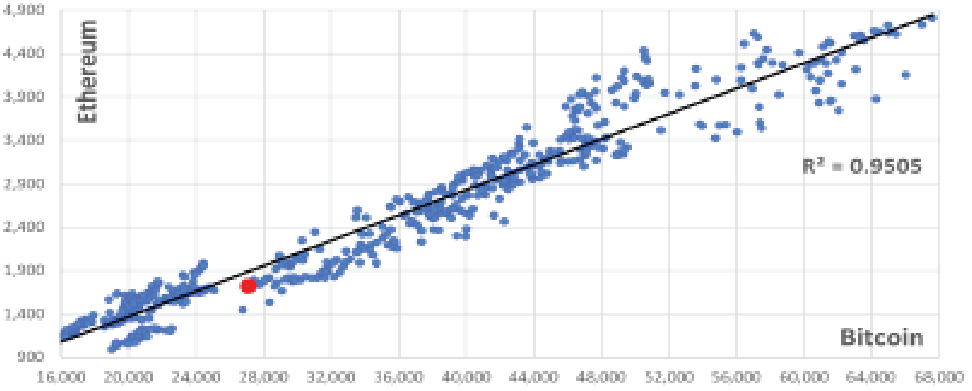

Our approach uses a regression analysis between Bitcoin and twenty-four crypto assets and selects the ones that have a high statistical relationship with Bitcoin (ranked by ‘reg’ regression). To ensure diversification, we suggest constructing an equally weighted portfolio where each position accounts for 10% of the portfolio.

Exhibit 2: Constituents of Our Crypto Portfolio, ranked by regression score

On average, each position trades at a -49% discount to Bitcoin and therefore has a +103%upside compared to the latest Bitcoin price of 28,405. If Bitcoin prices decline from here, this portfolio could outperform as the portfolio members have not priced in the bullish upside that Bitcoin is currently rallying upon. The portfolio itself has a regression of 88% with Bitcoin prices.

Of course, we can manage this portfolio for you - let us know.

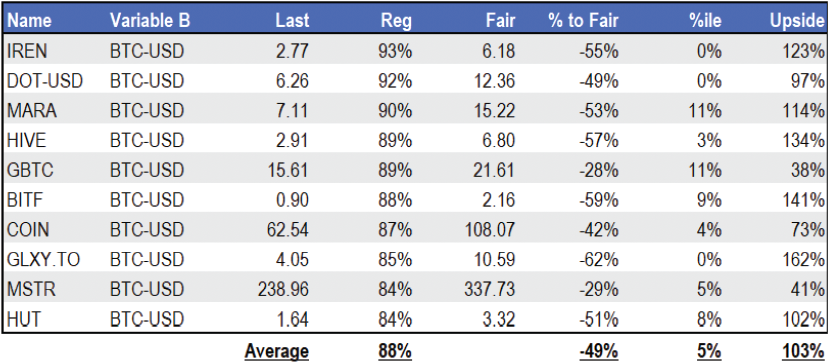

Exhibit 3: Our Crypto Portfolio (light blue) can catch up with Bitcoin (dark blue)

Portfolio Member Description

- Iris Energy Ltd operates as a renewable energy company and focuses on Bitcoin mining. The Company owns and operates real assets, including data center infrastructure, powered by renewable energy. Iris Energy serves clients in Australia.

- Polkadot is a blockchain platform and cryptocurrency. The native cryptocurrency for the Polkadot blockchain is the DOT. It is designed to allow blockchains to exchange messages and perform transactions with each other without a trusted third-party.

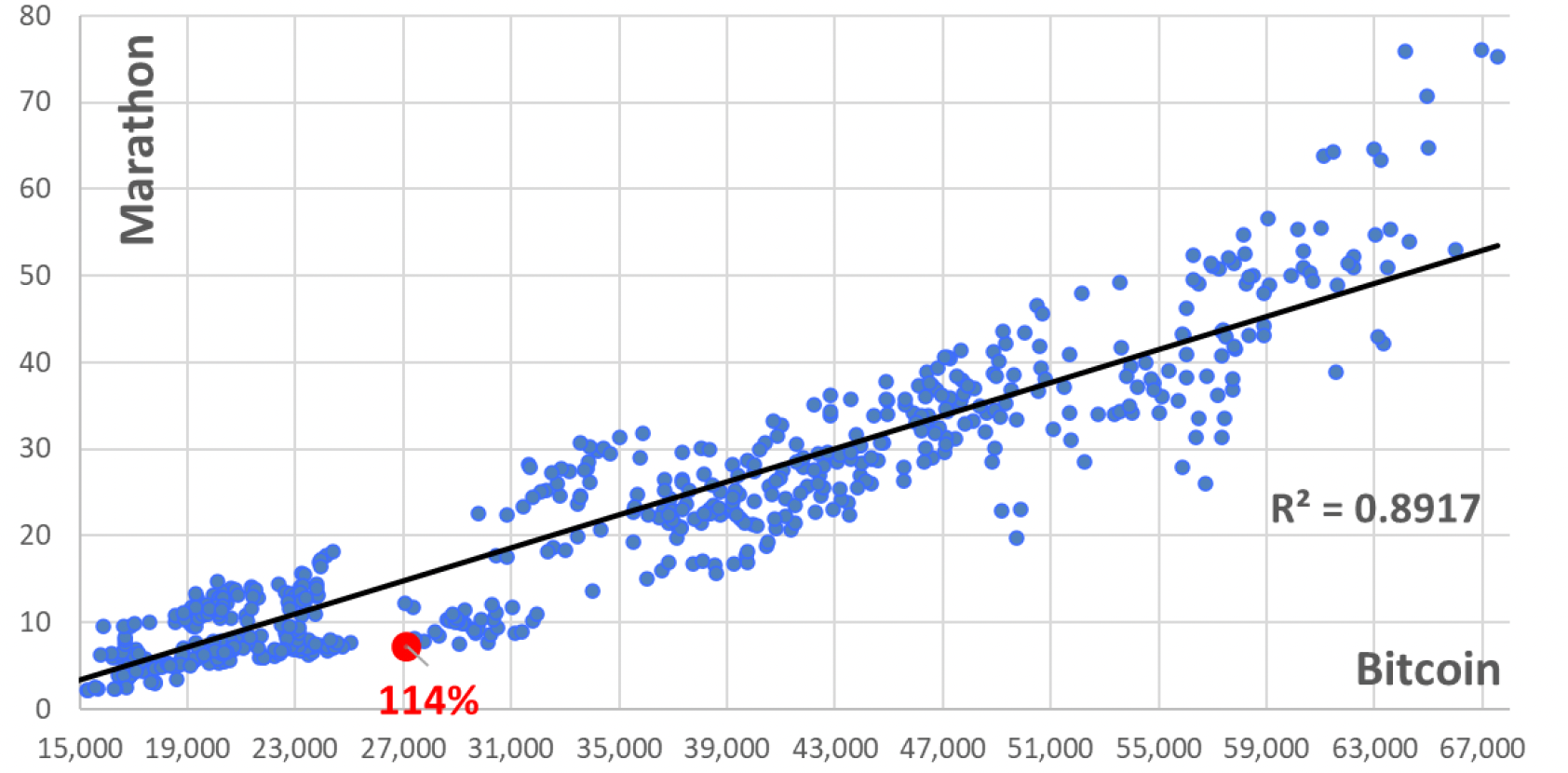

- Marathon Digital Holdings, Inc. operates as a digital asset technology company. The Company mines cryptocurrencies, with a focuses on the blockchain ecosystem and the generation of digital assets. Marathon Digital Holdings serves customers worldwide.

- HIVE Blockchain Technologies Ltd. operates as a cryptocurrency mining firm. The Company validates transactions on block chain networks, as well as provides crypto mining and builds bridges between crypto and traditional capital markets. HIVE Blockchain Technologies serves customers worldwide.

- Grayscale Bitcoin Trust (GBTC) is a grantor trust incorporated in Delaware. The Trust is one of the first securities solely invested in and deriving value from the price of BTC. The Trust is solely and passively invested in BTC, enabling investors to gain exposure to BTC in the form of a security while avoiding the challenges of buying, storing, and safekeeping BTC, directly.

- Bitfarms Ltd. of Canada operates as a cryptocurrency mining firm. The Company provides computing power to cryptocurrency networks such as Bitcoin, earning fees from each network for securing and processing transactions. Bitfarms serves customers in Quebec.

- Coinbase Global, Inc. provides financial solutions. The Company offers platform to buy and sell cryptocurrencies. Coinbase Global serves clients worldwide.

- Galaxy Digital Holdings Ltd. is a limited partner in Galaxy Digital LP, a merchant banking institution dedicated to the digital assets and blockchain technology sector. The firm operates across four business lines: asset management, trading, principle investments, and advisory services.

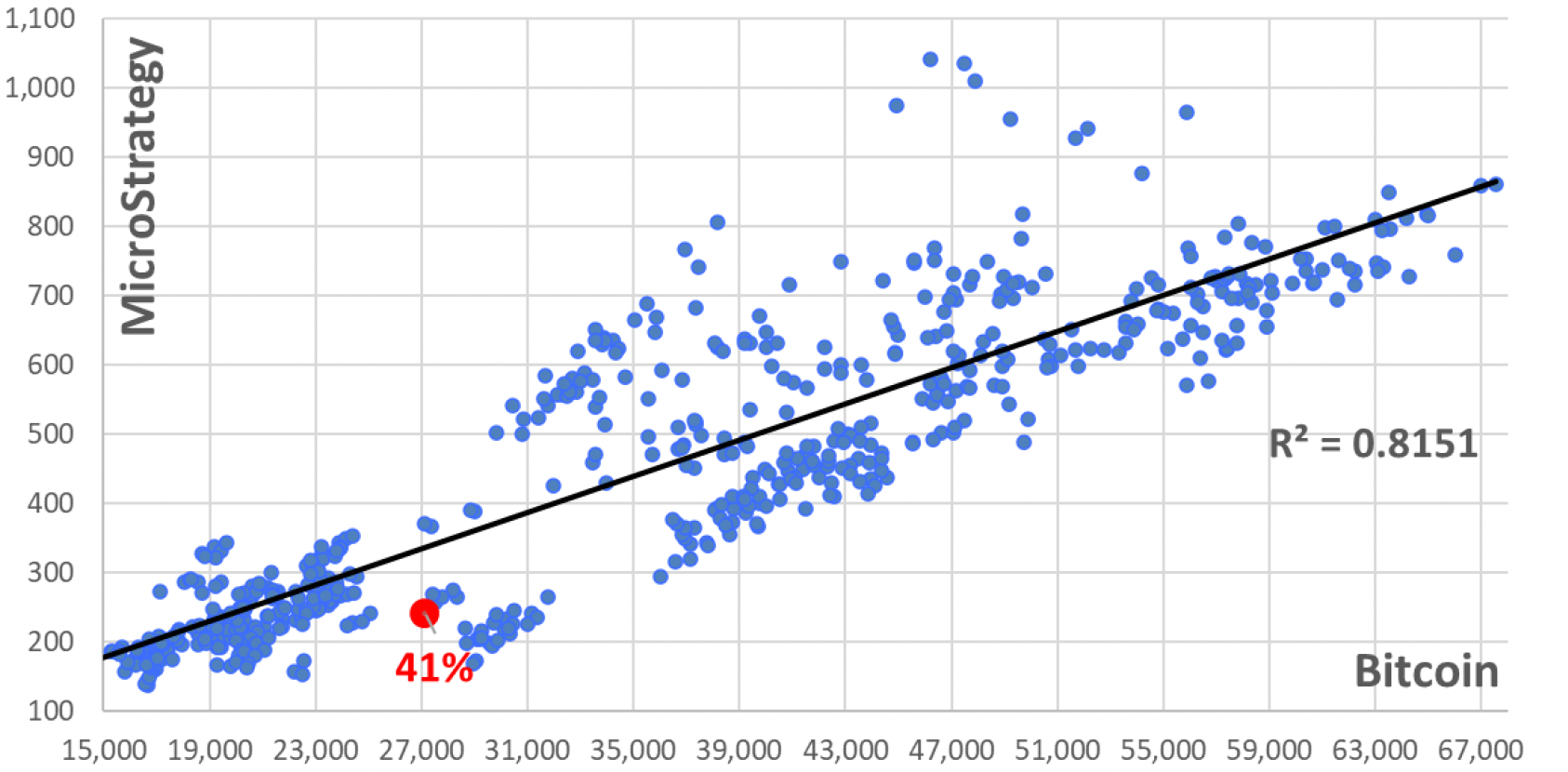

- MicroStrategy Incorporated provides business intelligence software and related services. The Company provides a platform that enables departments and enterprises to deploy web-based reporting and analysis solutions. MicroStrategy also offers consulting, training, and support services. MicroStrategy serves retail, finance, telecommunications, insurance, and healthcare sectors.

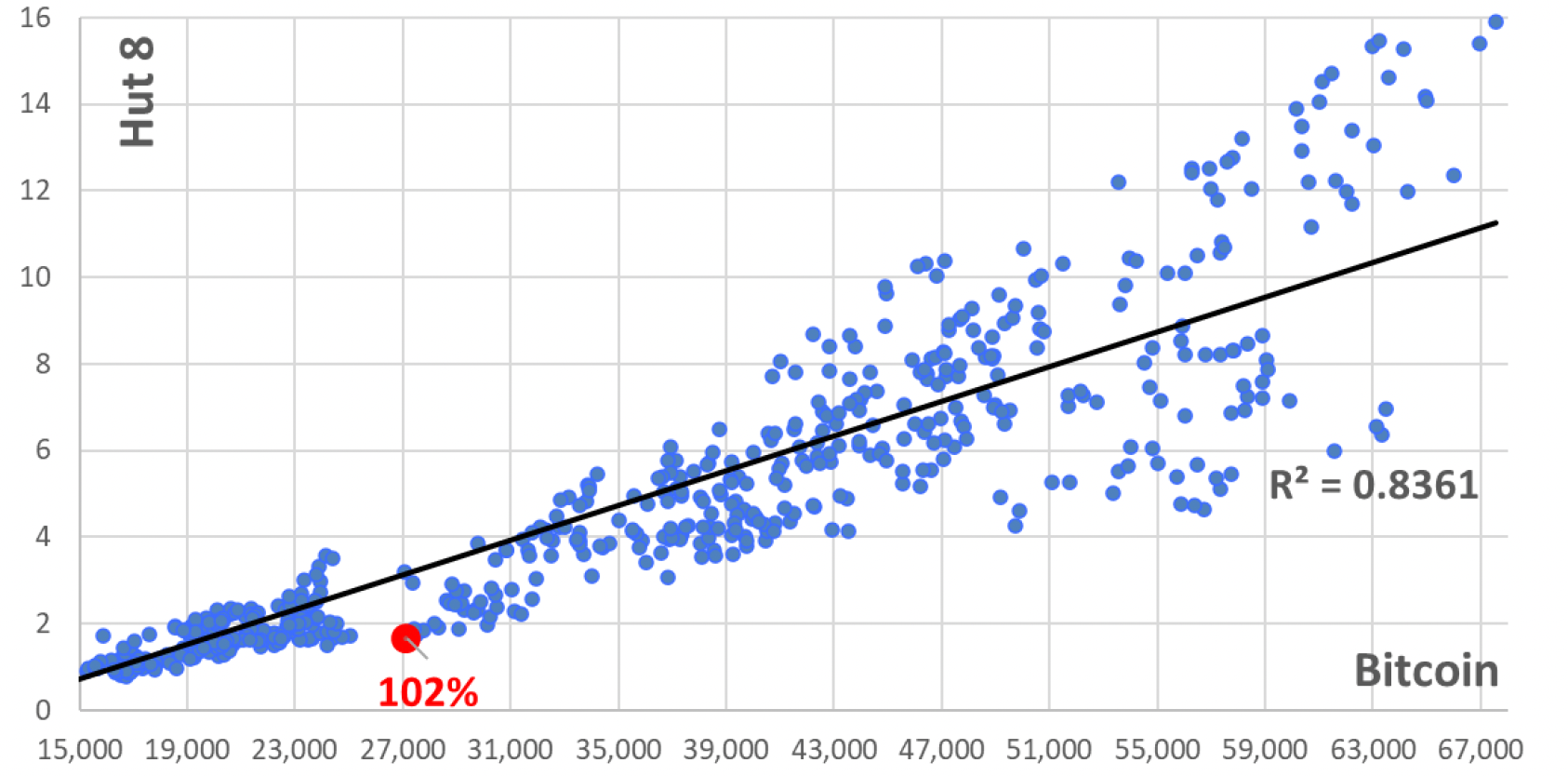

- Hut 8 Mining Corp. operates as a cryptocurrency mining company. The Company offers blockchain infrastructure and technology solutions. Hut 8 Mining serves customers in North America.

Description source: Bloomberg

Exhibit 4: Ethereum trades at a -9% discount relative to Bitcoin

Exhibit 5: Bitcoin and Coinbase are highly correlated but Coinbase trades now below the trendline

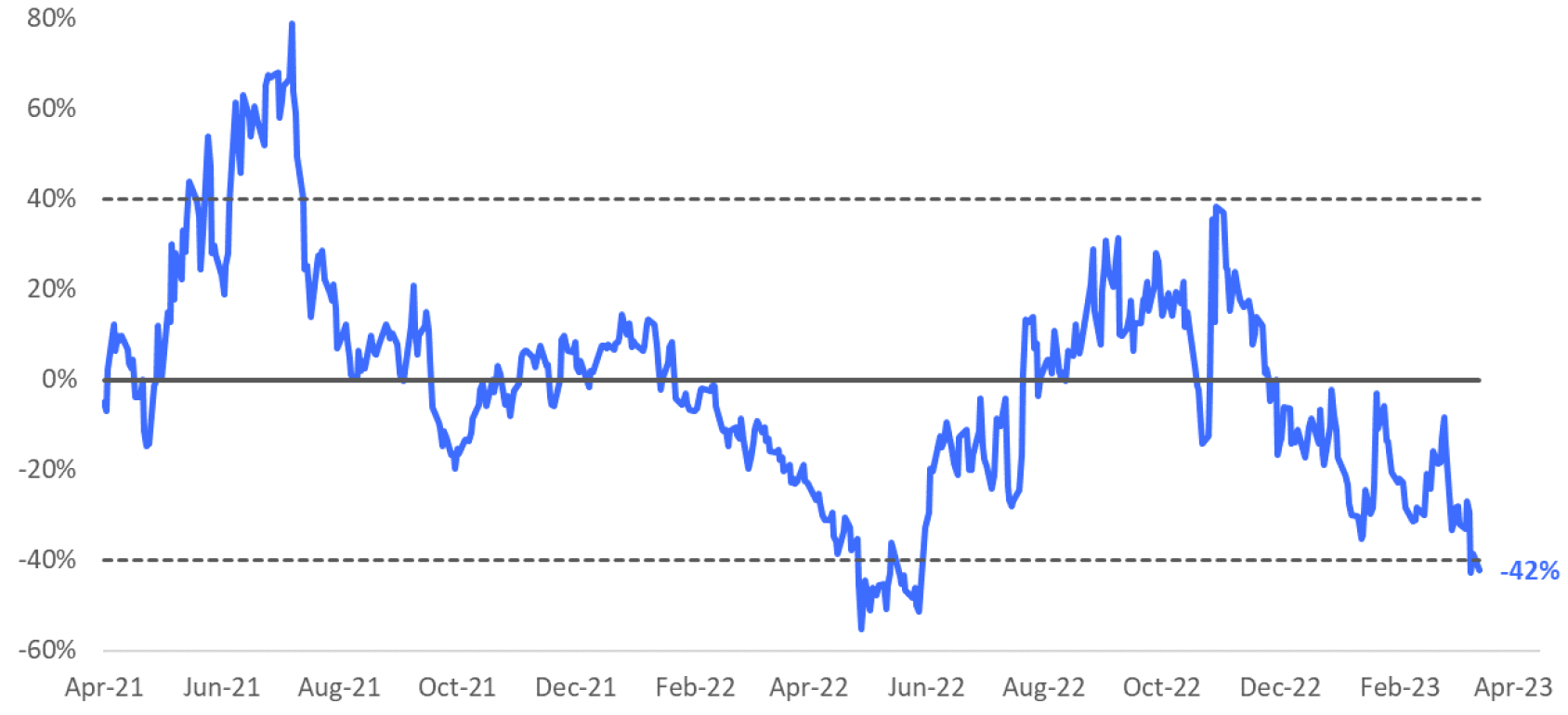

Exhibit 6: Coinbase trades at a -42% discount relative to Bitcoin

Exhibit 7: Bitcoin & MicroStrategy (MS) are highly correlated but MS trades now below the trendline

Exhibit 8: MicroStrategy trades at a -29% discount relative to Bitcoin

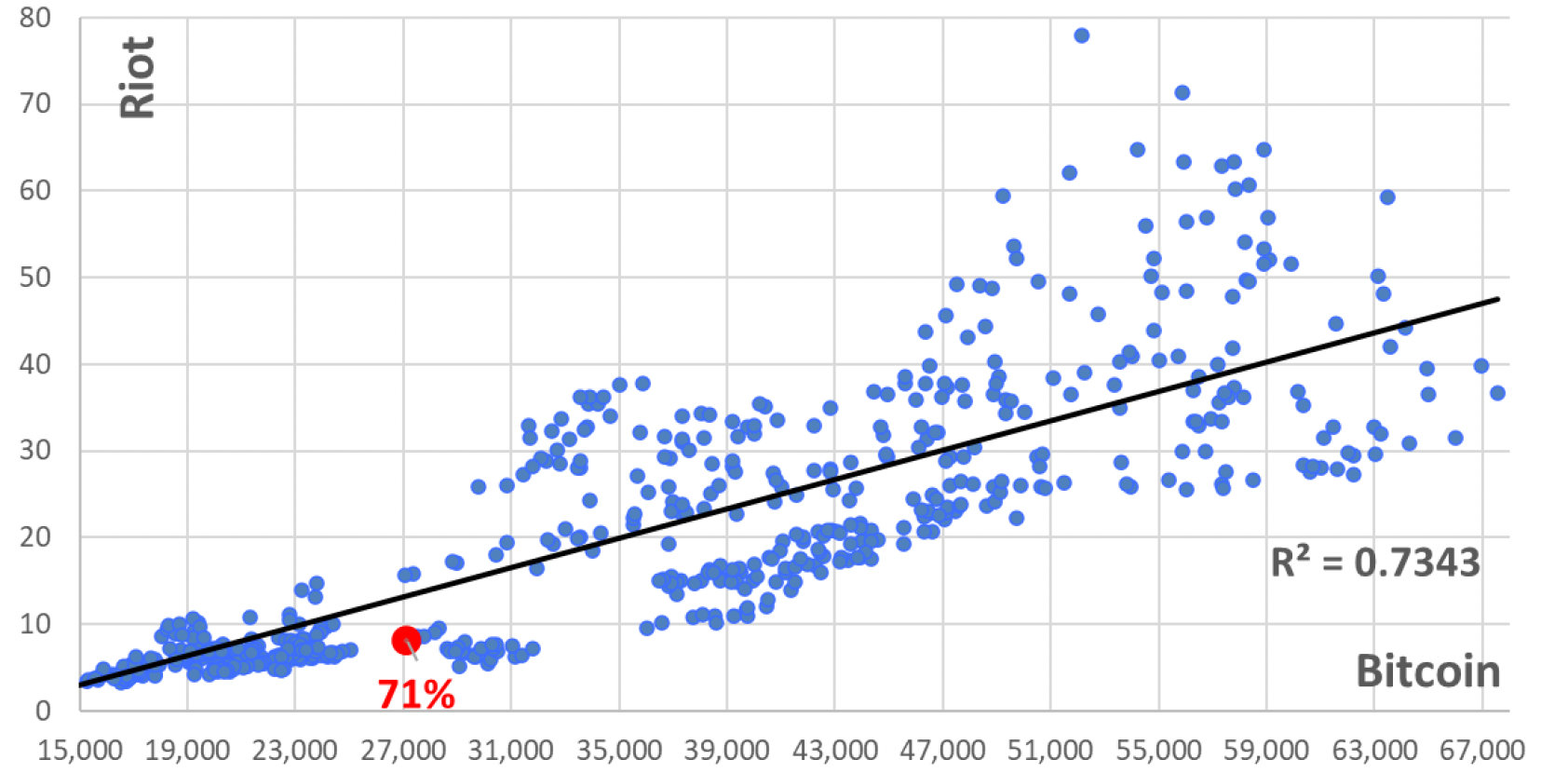

Exhibit 9: Bitcoin and Riot are highly correlated but Riot trades now below the trendline

Exhibit 10: Riot trades at a -41% discount relative to Bitcoin

Exhibit 11: Bitcoin and Galaxy Digital (GD) are highly correlated but GD trades now below the trendline

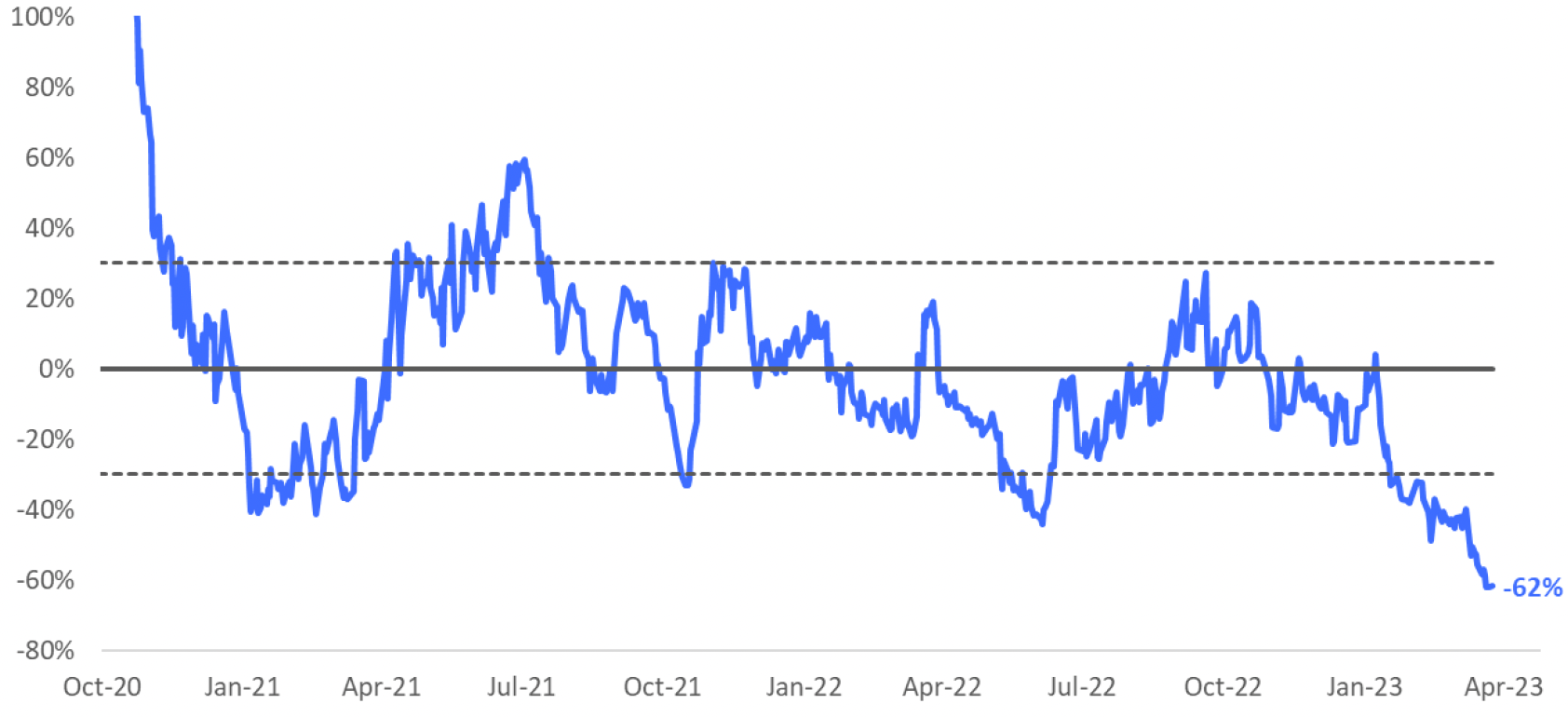

Exhibit 12: Galaxy Digital trades at a -62% discount relative to Bitcoin

Exhibit 13: Bitcoin and Marathon are highly correlated but Marathon trades now below the trendline

Exhibit 14: Marathon trades at a -53% discount relative to Bitcoin

Exhibit 15: Bitcoin and Hut 8 are highly correlated but Hut 8 trades now below the trendline

Exhibit 16: Hut 8 trades at a -51% discount relative to Bitcoin

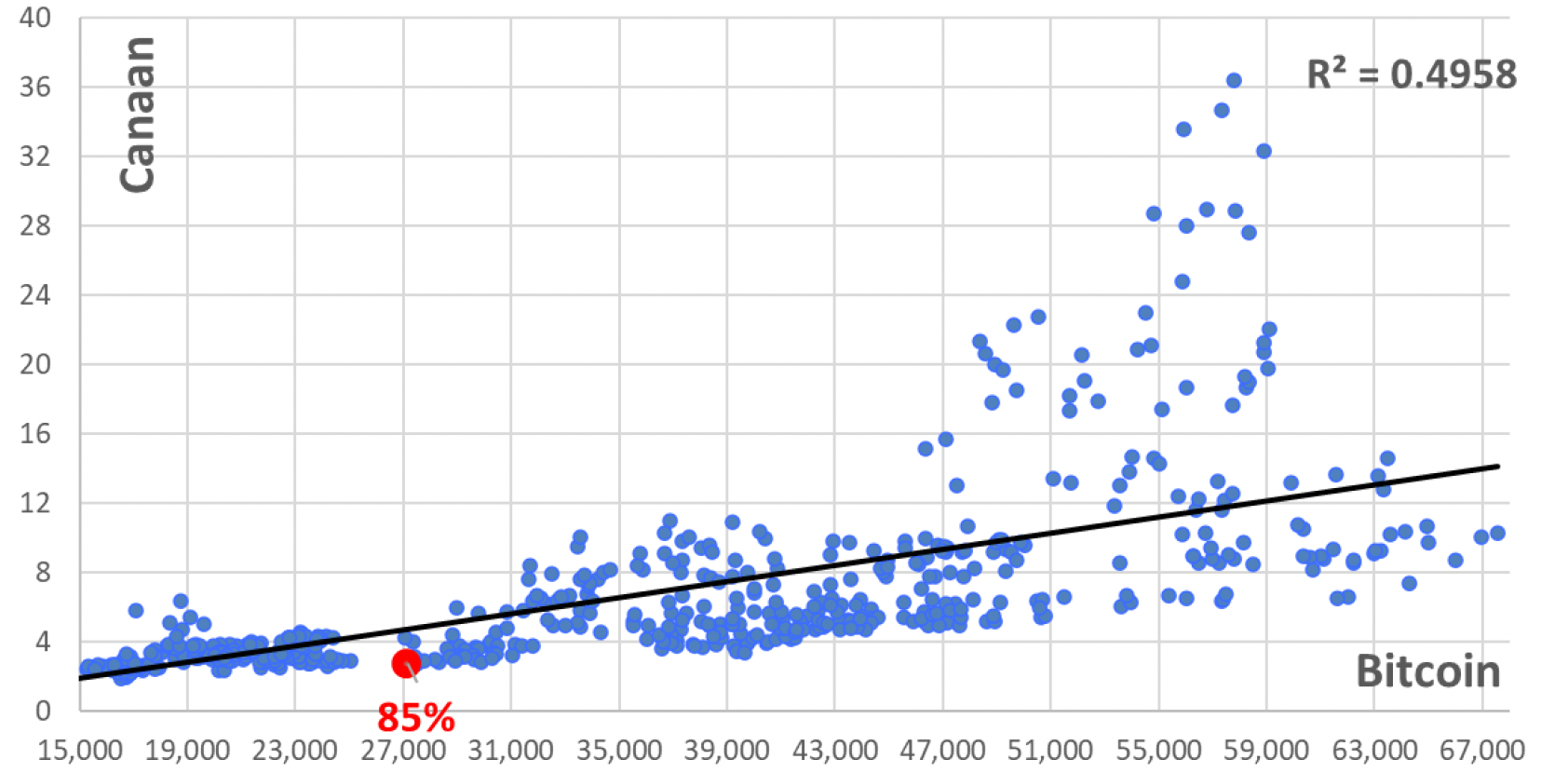

Exhibit 17: Bitcoin and Canaan are highly correlated but Canaan trades now below the trendline

Exhibit 18: Canaan trades at a -46% discount relative to Bitcoin