Ripple's XRPL Network: Q2 Activity Dips, CEO's Optimism Rises Amid SEC Case

According to a recent Messari report, the second quarter of 2023 brought a period of decline for Ripple's XRPL network as well as other prominent Layer-1 networks.

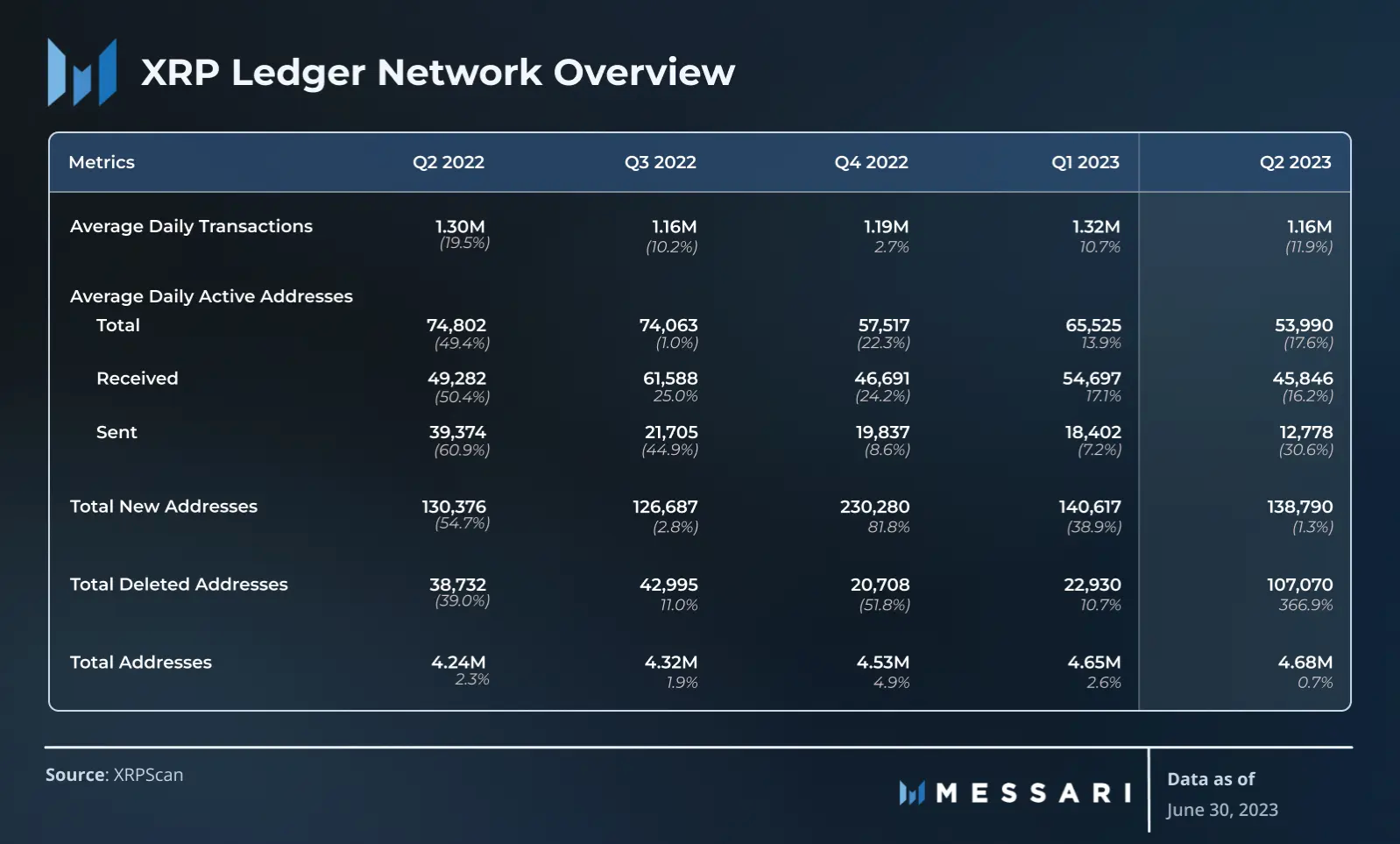

Across the board, average daily transactions on the XRPL decreased by 11.9% quarter-on-quarter (QoQ), settling at 1.16 million compared to 1.32 million in the previous quarter. This drop brought the activity level back to what was last seen in Q3 2022.

Furthermore, the average daily active addresses experienced a more significant decline, down by 17.6% QoQ from 66,000 to 54,000. Surprisingly, Q2 saw the lowest number of active addresses for the year.

Net Number of Accounts Increase, But Deletions Spike

The report showed that despite the decline in activity metrics, the net number of accounts on the XRPL managed to increase by approximately 30,000, resulting in a total of 4.68 million accounts during Q2. This accounts for a modest growth rate of 0.7%. However, the number of new addresses dipped by 1.3% to 138,800 when compared to the previous quarter.

On the other hand, deleted addresses spiked significantly, rising by 366.9% QoQ from 22,900 to 107,100.

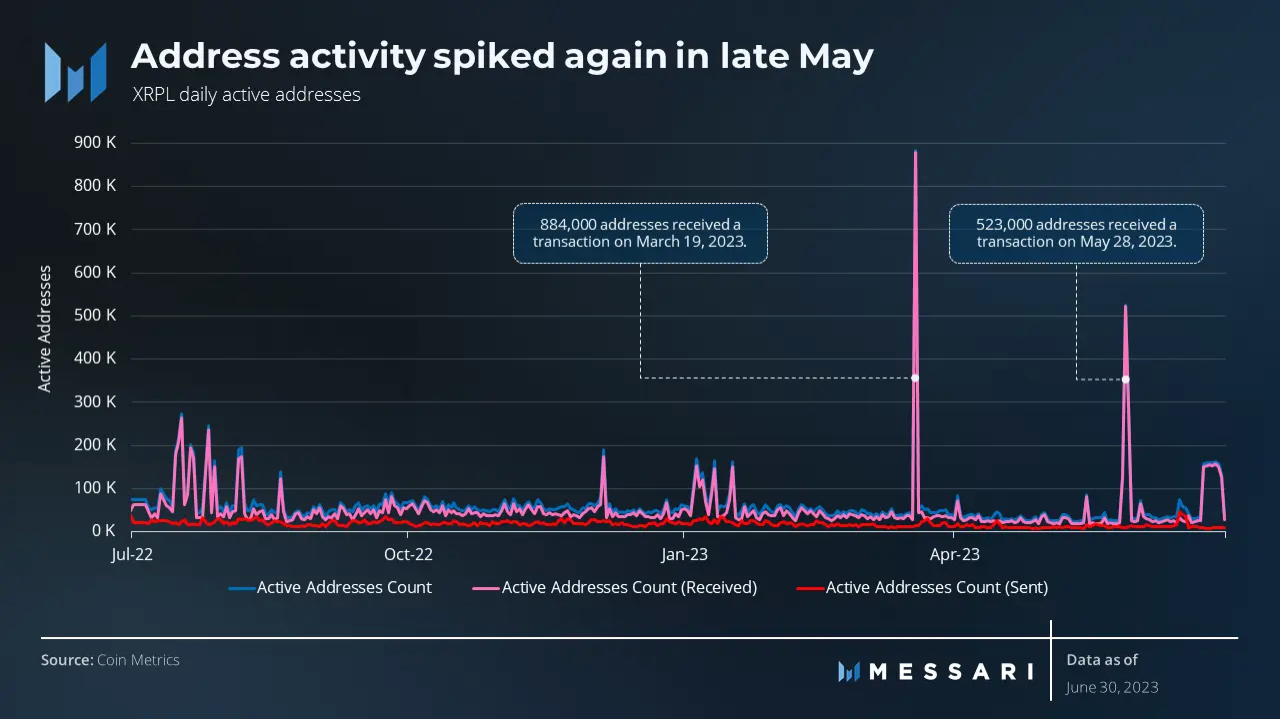

One striking observation from the Q2 report from Messari was the significant difference between the number of active recipient addresses and active sender addresses on the XRPL. This discrepancy can be attributed to centralized exchanges and custodians utilizing destination tags and sending Payment transactions.

Consequently, the number of addresses that received transactions experienced substantial spikes, while the number of addresses that sent transactions remained relatively stable. It appears that senders, most likely exchanges and custody solutions, were distributing tokens to large groups of previously inactive recipients.

Ripple CEO Expresses Confidence Amid SEC Lawsuit

In other related news, while addressing the ongoing lawsuit with the U.S. Securities and Exchange Commission (SEC) over XRP, Ripple CEO Brad Garlinghouse exudes optimism.

In a recent interview, Garlinghouse emphasized that even if XRP were deemed a security, it would only apply within the United States, while the rest of the world would continue to operate as if the case had been lost.

Confident in the facts and laws supporting Ripple, Garlinghouse expressed his belief in winning the case. He further highlighted the significance of the case for the entire industry, noting that many companies realize its importance.

Implications of Ripple's Case and Industry Impact

The lawsuit between Ripple and the SEC has garnered widespread attention, as its outcome could potentially shape the regulatory landscape for cryptocurrencies. Recent actions by the SEC, including charging two major exchanges, have implications that extend beyond Ripple.

While the industry awaits the resolution of this case, Ripple remains resilient and continues to focus on its growth and expansion.

XRP Trapped in Sideways Bias

XRP has remained confined within a range-bound pattern for the past few weeks as it oscillates between the $0.5000 mark and the $0.4600 support. This is despite the recent wave of bullish surges across the market.

Over the coming days, we expect to see a resumption of the bullish charge across the market amid the current favorable outlook on crypto, which should push XRP to retest the $0.5000 mark again. A successful breach and close above this level should put an end to the sideways movement for XRP and resume a recovery journey.

XRP Statistics Data

XRP Current Price: $0.4700

XRP Market Cap: $24.5B

XRP Circulating Supply: 52.2B

XRP Total Supply: 100B

XRP Market Ranking: #6

Feeling confident? Trade your ideas on XRP now.

Disclaimer

This article should not be taken as financial advice. It is essential to conduct research before making any investment decisions.