The Tree of Altcoins

“Nature only wants to please itself. To have its own way.”

- Tree of Life

The ginkgo biloba tree is a living fossil whose ancestors have been around for millions of years. Known as 'the oldest lady in the forest,' it stands out from the modern trees surrounding it, which give it a wide berth as if they know it doesn't quite belong here but respect it all the same.

Its leaves are thick and waxy, resembling a fan blade. The veins in a leaf do not branch and spider out; instead, they are tiny, nearly parallel lines converging at the base of the leaf like a calculus problem - the veins grow infinitely closer but never quite touch.

In autumn, the leaves turn a bright yellow and then fall suddenly all at once. Sometimes in a single day. You would have to be incredibly lucky to catch that very moment when dozens of leaves rain down every minute, fluttering to the ground in long helices.

Such Golden Window moments exist in many forms in the natural world.

The Rose of Jericho looks like a half-dead mossy clump, rolling in the desert winds for months in this dehydrated crispy state until it finds water, revives, and blooms. People from all over the world travel to Japan in spring to capture the fleeting cherry blossom season.

In our unnatural world of crypto, we are entering a similar moment.

The Golden Window for altcoins

If history is any indication, the Golden Window for cycle-defining altcoins that suddenly burst to life is only a few months before and after the Bitcoin Halving.

The previous Halving was in May 2020. Axie Infinity and Solana launched shortly before, and Avalanche, Gala, and Shib shortly after (to name just a few).

Of course, many other coins launched at different times and still melted faces off. But this Golden Window around the Halving does seem like a particularly good time to enter the chat.

As we approach the next BTC Halving in April 2024, the market undergoes a shift in dynamics. The Halving not only affects Bitcoin's price but also creates a sense of urgency and opportunity. Or more precisely, it creates the feeling of opportunity slipping by.

It’s the same as when people say “we’ll never see Bitcoin under x price again.” Only it’s not speculation; it’s a mathematical fact.

After April 2024, we’ll never see 6.5 BTC block rewards ever again.

All that extra attention and sense of urgency create the Golden Window for new tokens to launch and take hold. This means we shouldn't sleep on new things coming out between today and Aug 2024.

New coin, who dis?

For the current cycle, this might include the wave of airdrops incoming over the next few months as new projects launch tokens after finally switching up their less appreciated points systems for the real on-chain thing.

Dymension (DYM), Zeta Markets (ZETA), Manta Network (MANTA), SatoshiVM (SAVM), Berachain (BERA) are all dropping coinage, and many more are coming.

It could be narrative-driven tokens. The previous class of high-flying alts were Layer 1 Ethereum killers and GameFi tokens. Perhaps this cycle, the RWA story remains relevant (especially as our TradFi cousins and their ETFs move on to the next thing and talk a good game about tokenization).

Or maybe new DePin tokens take the limelight, benefiting from the momentum existing tokens in this sector have had recently such as GPU sharing Render, road mapping Hivemapper, and decentralized hotspotting Helium.

Lastly, just like it took a while for many to accept NFT profile pics as a thing, this cycle we could be looking at a similar dynamic in the inscriptions category.

Many of us still don’t fully get it or even agree with things like Ordinals as something that should exist in the first place. But that hasn’t stopped the BRC20 community from launching a whole swarm of Orange offspring. BRC20 tokens like 1000RATS, 1000SATS, BTCs, CSAS are going strong, and it’s still very early.

BIT just recently enabled a trading zone complete with deposit and withdrawal features in a collab with Cobo, and while that may seem like a mundane thing, it is only one of a handful of exchanges to make this available. The BRC20 game is still early, and it just so happens to get going during the Golden Window.

Going back to our majestic tree. A few weeks each year, the ginkgos drop their fleshy fruits, which, when crushed by forest dwellers, release a stank of vomit and death. But crypto winter is over, so that's not our concern.

Just be there when all the leaves fall at once.

Meanwhile...

BRC20 Trading Zone, Made with Cobo

BIT has partnered with Cobo, a prominent digital asset custody technology provider to launch a BRC20 token spot trading zone, allowing users to showcase their positions and allocations enabled by Cobo's wallet-as-a-service solution.

As the world's first omni-custody platform, Cobo is pioneering institutional-grade custody solutions that support the new BRC20 token standard.

Through this collaboration, users can easily deposit, withdraw, and trade BRC20 tokens on BIT, facilitating seamless participation in the BRC20 token ecosystem.

Furthermore, users can also benefit from savings on gas fees when trading, significantly lowering entry barriers for more user to participate.

In the Spotlight: KLAY gets sticky

KLAY has surged by 27% in the last 24 hours, hitting $0.24.

Let's explore the world of Klaytn, its unique features, and the recent news moving the markets.

Technically Speaking

Market analyses from our partners

Ethereum broke above its $2,400 resistance line on January 10, and while initially rallying up to $2,700, Ethereum retraced back to its $2,500 support level.

We expect that the $2,400/$2,500 support level will prevent prices from falling lower, and Ethereum could rally to its more significant resistance level at $3,000 during the next few weeks.

Greek.Live

The immediate impact of the ETF approval has subsided, reflected in BTC's decreased volatility, hitting a one-month low.

Both Realized Volatility (RV) and Implied Volatility (IV) for major terms have notably declined, with short-term IV plummeting below 45%. Institutional data signals an expectation of a narrow range until February, as the market absorbs the implications of the ETF.

The post-approval period may entail a consolidation phase as participants assess the new landscape. Stay attuned to evolving market dynamics during this digestion period.

Required Reading

- ETF Wif Hat - Crypto Hayes

- BlackRock: the tokenization of every financial asset - Larry Fink on CNBC

- 'Satashi' will come back and make more Bitcoin - Jamie Dimon at Davos

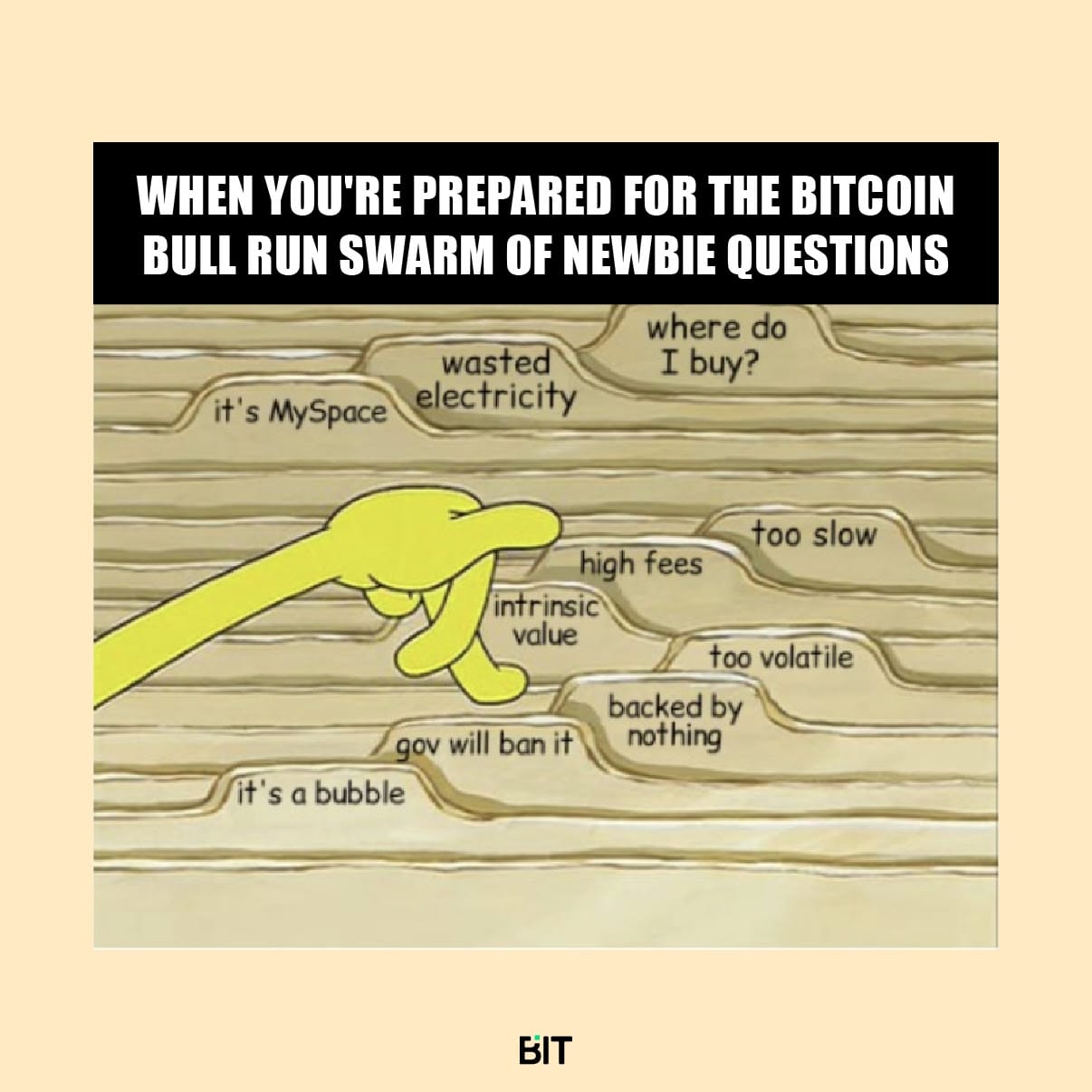

Most Memorable Meme