What are USDT-margined futures, and how do they work?

USDT-margined futures are a derivatives instrument in which the profit is calculated using USDT as the margin. To fully understand this concept, we have to reiterate what future margins are.

What is futures margin?

Futures are essential derivatives because they allow users to bet on an underlying digital asset without keeping it.

Futures margin is the amount you must deposit with a broker when opening a future position. It is usually a smaller percentage of the notional value of a contract.

What are USDT-margined futures?

USDT is a stablecoin pegged to the value of the US Dollar. USDT-margined futures are linear future products with their margin denominated in USDT, thereby making trading of different derivatives accessible.

Traders that utilize USDT as their margin asset can trade several contracts without having to buy various assets. Of course, earnings and losses are determined in USDT when consumers trade USDT-margined futures, making it easier for investors to benchmark and calculate profits.

Characteristics of Bit.com’s USDT-margined futures

Bit.com offers a unified margin system where all assets are utilized in trading the derivatives. This makes it easy to trade across all the products available. Other key characteristics include:

Settlement in USD-pegged assets: Since your contracts are denominated and settled in USDT, you can quickly compute your returns in fiat currency. USDT-Margined futures become more intuitive as a result of this. For example, if you make a profit of 800 USDT, you can estimate that the gain is worth around $800 because the value of 1 USDT is closely tied to the value of 1 USD.

Furthermore, a universal settlement currency, such as the USDT, offers greater flexibility. The same settlement currency can be used for many futures contracts (i.e., BTC, ETH, XRP, etc.). With unified margin mode on bit.com, you don’t even need to hold USDT to open a position. All your assets will be calculated as their USDT value with a haircut ratio and work as margin. USDT-margined futures can also help lessen the danger of significant price movements during periods of extreme volatility. As a result, you don’t have to be concerned about hedging their underlying collateral risk.

Clear pricing rules: each futures contract defines the quantity of the underlying asset delivered for a single contract, referred to as the “Contract Unit.” For example, like spot markets, BTC/USDT, ETH/USDT, and BCH/USDT futures contracts represent only one unit of the corresponding base asset.

Cross-margin: The cross margin method allows you to avoid liquidation by utilizing your available balance’s total amount of funds. In essence, any realized P&L from other positions can add margin should you be in a losing position. Cross-margin is particularly helpful for new traders because of its straightforwardness.

The cross margin ranges from 1 to 50, so this offers you easy market access with a maximum of 2,000,000 USD for all open positions.

What are the differences between USDT-margined futures and Coin margined futures?

While USDT-margined futures are margined and settled using a fiat currency like typical standard futures, COIN-margined futures are settled with the asset. If a trader chooses the COIN-margined futures option, the contracts are margined and agreed with the asset itself. A COIN-margined Ethereum futures contract, for example, will be settled in Ethereum.

• Quotation Unit: A contract in USDT is denominated in USDT, whereas a contract in USD is denominated in USD.

• Margin Currency: USDT is the margin currency for all USDT-margined contracts. USDT could be used to trade a variety of USDT-margined contracts. Users must hold the matching token to trade all coin-margined contracts since the underlying asset of each contract is used as a margin. For example, to trade BTC/USD swaps, customers must first send BTC as a margin. When token values decline, the margin depreciation risk of a USDT-margined future differs from that of a coin-margined contract due to the differing margin currency. To be more exact, the underlying asset will impact the margin of a coin margined contract. The value of USDT is unaffected by the rise or decrease of token prices; hence the margin of a USDT-margined contract is unchanged.

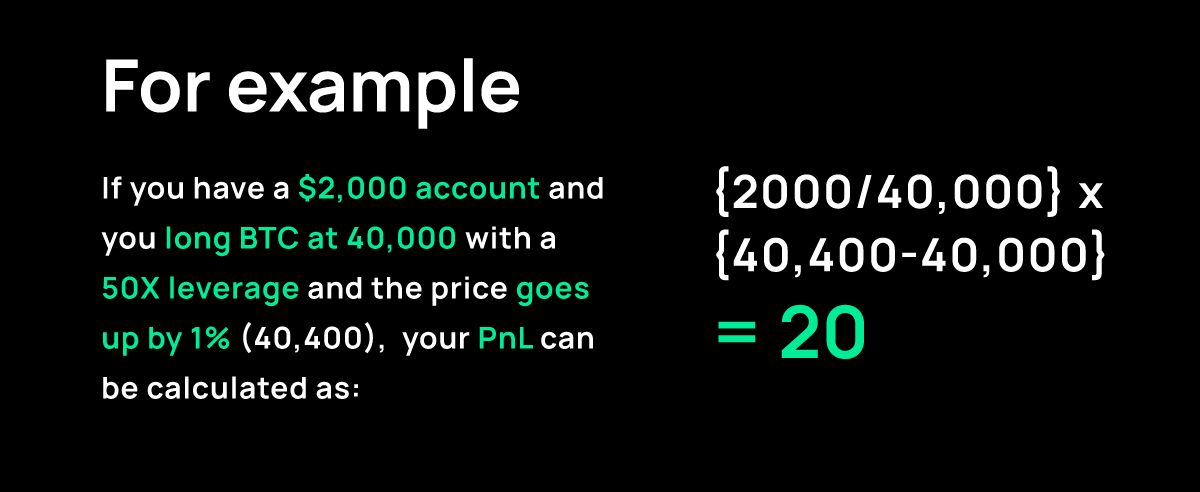

• Currency Used to Calculate PnL: All USDT-marginated contracts use USDT to calculate PnL, whereas coin-marginated contracts utilize the underlying asset.

The Profit and Loss (PnL) is calculated as {future exit price- future entry price} x position size/future entry price

Trade USDT-margined futures on Bit.com

Bit.com’s unified margin system might be a great place to start if you want an uncomplicated introduction to USDT- margined futures trading. Bit.com’s USDT-margined futures rules and contract specifications are easily accessible on our website here.