What is a ‘Short Put’ Option in Crypto Options Trading?

To make the best out of any crypto trade, a trader may employ numerous strategies based on their choice of crypto trading pool. For example, in crypto options trading, the four primary methods to choose from include long call, long put, short put, and short call.

This article will discuss everything you need to know about the short put strategy in crypto options trading. But first, let us recap the definition of crypto options.

What is Options Trading?

An option contract grants you the right, but not the obligation, to buy or sell a crypto asset at a given price by a specific date. Consider crypto options as a tool to speculate on the potential price movements of digital assets like Bitcoin (BTC), Ethereum (ETH), and others. The two speculative techniques for crypto options are the call and put options, and the focus of this article is the short put strategy.

Short Put Options — Defined

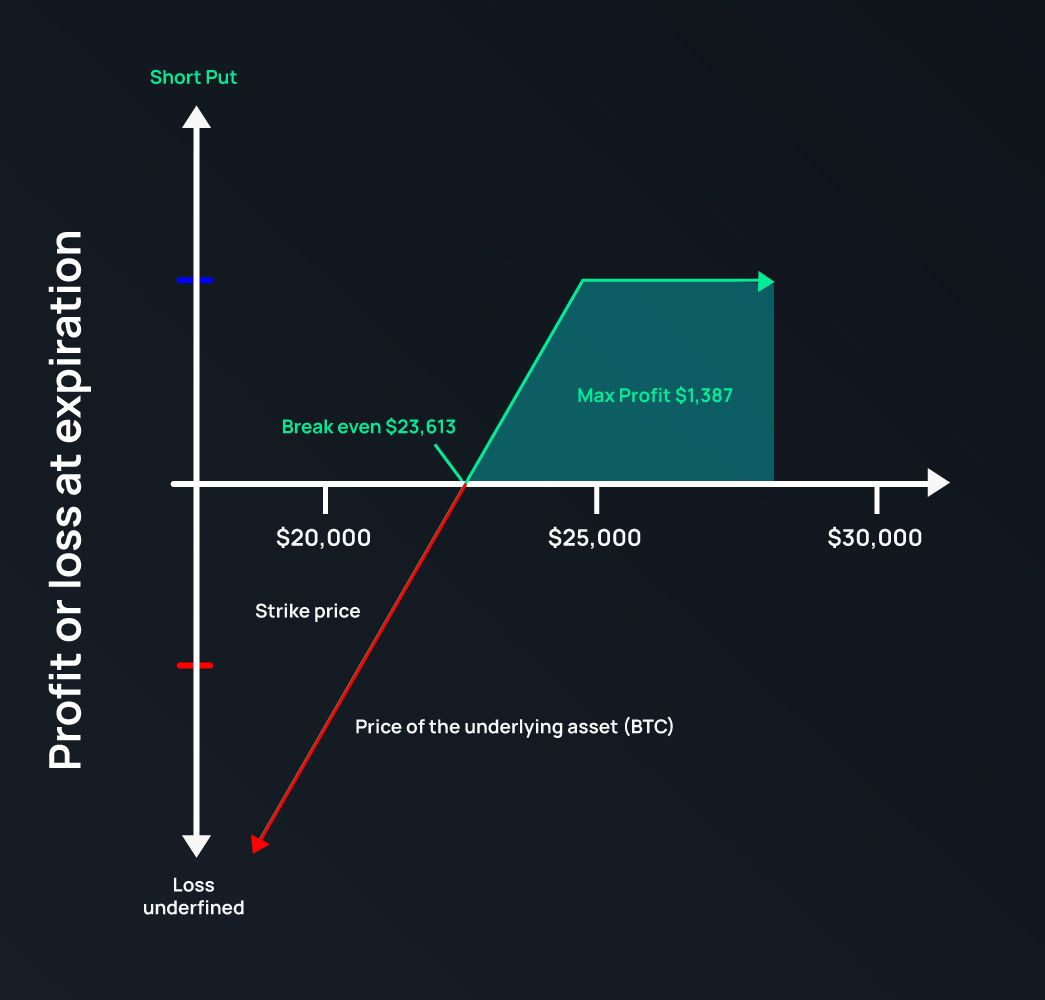

The short-put options strategy is when a trader opens a trade by selling a ‘put’ option, expecting the crypto asset's price to appreciate. In technical terms, it is a single-leg, bullish strategy with limited profit and uncapped risk potential.

“Bullish” implies the upward movement of the coin, which makes the short put similar to the ‘long call’ options, as both are bullish strategies. However, the method also means a trader is taking a substantial risk because there is no risk mitigation when the coin goes against their position.

When an investor writes a put option, they are obligated to buy shares of the crypto assets if the contract buyer exercises their right.

Short Put Layout

Recall we earlier said the short put has limited profit, which is so because whenever you sold the short put, you hoped the price of the crypto would rise above a certain amount within a given timeframe. This amount is the strike price or, say, entry price.

Your profit on the trade is the premium you will receive from buyers. And usually, the charge is higher when the strike price is close to the asset's price.

For example, let’s assume you sold Bitcoin options at a strike price of $25,000, although BTC trades at $26,000, and you charged the buyer $1387. This contract implies that you pledged to buy 1 BTC at $25k from the option buyer at expiry if all terms are fulfilled.

Profit and loss calculation

Case One

Let’s assume you charged a premium fee of $1387 for a contract with a strike price of $25,000.

Your profit on this trade maxes at $1,387, your premium fee.

If BTC appreciates as much as $100,000, you earn nothing more than $1387.

Case Two

However, if BTC dropped to $24,000, the $1,387 premium you received would cover your loss because your break-even point is $23,613. Therefore, your actual loss begins from that point.

And when BTC plummets further to $20,000, before your contract expires, your loss will be 25000 - 20000 = 5000 - 1387 = $3,613. You will incur more significant losses depending on how much BTC drops.

Short Put Payoff Diagram

The payoff diagram for the short put is a straightforward graph indicating maximum profit and unlimited potential loss.

Time Decay Impact on a Short Put

The time left until a contract expires impacts the premium price. With more time until expiration, options contracts will have higher prices because there is more time for the underlying asset to experience significant price movement, putting the seller at greater risk. Conversely, the option price decreases as time decrease, implying that time decay works against options buyers.

Hedging a Short Put

Hedging simply means offsetting losses. You hedge by entering another trade opposite your losing position with the same strike price and expiration date. If the underlying crypto stock price falls below the strike price, your gain will offset the loss of the short put.

To hedge a short put, you may sell a ‘call’ with the same strike price and expiration date, creating a short straddle. While this style will widen the break-even price with an additional premium fee received, the risk is still undefined and potentially substantial.

Disclaimer

This article should not be taken as financial or investment advice. Making an investment or financial decision is a choice. Do your research!

Trade Crypto Options on BIT

Now that you have learned about the short put in crypto options trading, you should put it into practice by trading on BIT.

About BIT

BIT is a full-featured cryptocurrency exchange that is designed for use by professionals. It provides services such as the execution of trading strategies, price discovery, liquidity provision. BIT is always working to encourage the creation of new financial products, improve trading tools available to users, and offer wide variety of tokens. Trade with confidence, knowing the platform is built with institutional-grade security and risk management measures in place. Sign up for BIT and switch on your future.

Sign up on BIT, and switch on your future.