What is Crypto Options Trading?

Crypto options trading is a form of investment in which traders speculate on the future price of digital currencies. They do this by buying and selling call or put options on these currencies. However before you jump into this type of investment, you need to know how it works. So read on for a basic guide.

What Are Options?

Crypto options trading is based on options contracts. An option contract gives the holder the right but not the obligation to buy or sell an asset at a strike price (a certain price at an agreed date). In this case, the asset is digital currency such as bitcoin and ethereum. These assets are referred to as underlying assets in crypto options trading. The trader has to pay a “premium” to have this right.

When the holder exercises their right to buy or sell the underlying asset, they receive an amount of cash that is the difference between the strike price(set at the time of purchase) and the settlement price. The terms for these options are listed in the form of a contract.

Options contracts can be used to hedge risk against current holdings of cryptocurrency or simply speculate on whether the price will rise or fall. In either case, you need to know how to use the various functions of a crypto options platform.

How Crypto Options Work

Crypto options allow you to buy call, buy put, sell call or sell put. These options are based on the price of a specific cryptocurrency such as Bitcoin or Ethereum. To simplify it, in most cases, if you buy a call option, your investment can yield a return if the price of that cryptocurrency goes up. On the other hand, a put option allows you to earn money if the price of a specific cryptocurrency goes down.

A call option is a contract that gives the holder the right, but no obligation, to buy a digital asset, such as Bitcoin, at a specific price at a particular time. The cost of an option is called a premium. An option’s premium is dependent on factors such as volatility of the asset, time remaining on the contract, interest rates, and the current price of the asset. For example, the premium will be relatively high if you want to buy an option with a strike price lower than the asset’s current value. This is because the contract already has intrinsic value.

If the crypto price is above the strike price at the time of expiration, you can exercise the right to make a profit as an option holder. If the crypto price falls below the strike price at the time of expiration, you can decide not to exercise the right to avoid making a loss.

Let’s assume the price of Bitcoin at the beginning of March is $35,000, but you think the price will be much higher by the end of the month. Let’s also assume you buy a call option of 1 BTC at a strike price of $40,000 with a premium of $400 to expire on March 25. If Bitcoin’s price is above the strike price by the agreed date (let’s say $45,000), you can exercise your call option and make a $5000 profit (45,000-40,000). If we subtract the premium ($400), you’d be making $4600. Conversely, if Bitcoin’s price is $36000 by the agreed date, you may decide not to exercise the call option. In essence, you’d be losing only the premium ($400).

A put option is the opposite of a call option. The put option owner can sell the crypto at the strike price, but only if the market price is below the strike price. The buyer of a put option expects the underlying asset’s price to fall. The seller of a put option, on the other hand, expects the price of the underlying asset to increase.

Using the example we used earlier, you can buy a put option on Bitcoin if you think the price of Bitcoin will fall below the strike price by the date of expiry of the contract. So if the price drops by $5000, your profit will be “the contract’s premium subtracted from $5000”. On the other hand, if the strike price is higher than the new price of the asset, you could allow the contract to expire and lose only the premium.

Advantages of options over other trading derivatives

The major advantage of buying cryptocurrency call options over other types of derivatives is quite apparent.

There is no obligation to exercise the contract as a call buyer if you don’t want to. There is no need to worry much about the market moving against you since the risk is limited to the price you paid for the premium.

What Crypto Options Trading Can Offer You

Crypto options trading can offer traders the ability to speculate on the price of cryptocurrencies. They can also use options to hedge their positions in cryptocurrencies. Many traders are using Bitcoin to do that.

The use of options allows them to get involved in crypto even when they are unwilling to make a significant investment upfront. Options also allow traders to take advantage of the crypto market by selling options on top coins to invest in other cryptos. Some experts also believe that the market is currently undervalued and that a recovery is just around the corner.

If you hold a prominent bitcoin long position in the futures market, you can add a Bitcoin long put position to reduce your risk. If the strike price is lower than the market price, you will lose your option fee while profiting in the futures market; if the strike price is greater than the market price, you will get the difference in payout, which may cover the loss.

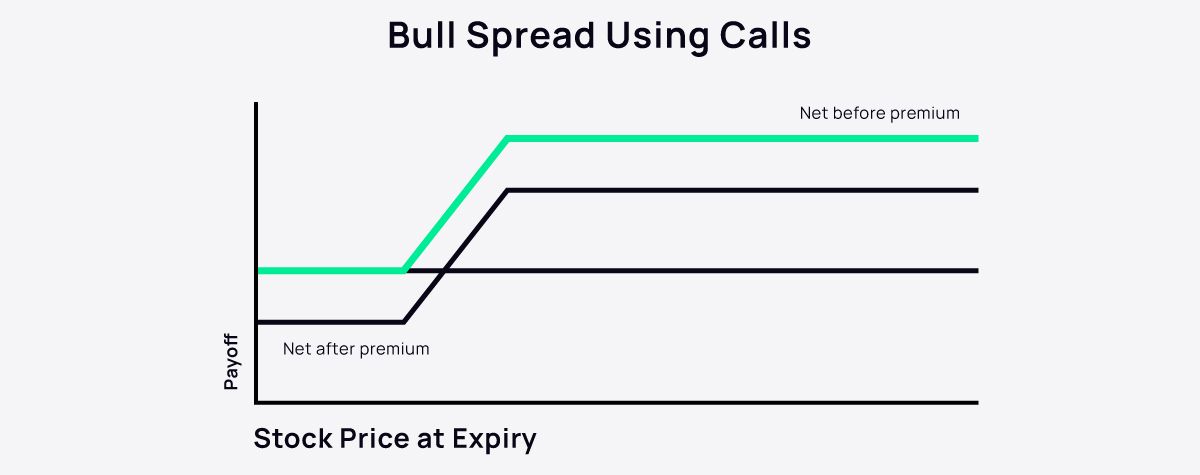

Another way to make money with crypto options trading is by employing the ‘bull spread’ option. How does this work? Let’s say you want to go long with Bitcoin, but you don’t think it would go beyond the $14,000 mark in the next three months. So, instead of just buying a simple call option, you can buy a call option partly financed by selling a call option with a higher strike price. This way, you would have a lower downside loss than a simple call option.

As a miner that wants to lock in a selling price to ensure that your overall mining costs are covered, you can write a put option. If the strike price is greater than the market price, the counterparty may forfeit the right, allowing you to keep your bitcoin and collect the option fee.

A straddle strategy can also offer means to profit. A straddle is an options strategy that involves buying both a put and a call option on the same underlying asset with the same expiration date and strike price. For example, let’s say you are not sure of where Bitcoin is headed but sure of its volatility, you can buy both put and call options at the same strike price, so if the price moves up or down, you would still have a payout.

Another strategy is the strangle strategy. Unlike the straddle strategy, strangle strategy involves holding both put and call options on the same underlying asset and expiration date but different strike price.

With the Iron butterfly strategy, you can sell the upside on both options with two more options. You will get a payout whether Bitcoin “moons” or “tanks.”

The Risks of Crypto Options Trading

Crypto options trading is a high-risk investment activity. Volatility is a risk that comes with cryptocurrency options. Even when the markets are relatively calm, prices can still move by a significant amount. This means that a trader’s option position could be worth much less than before. This is where stop-losses are essential.

Fraud is another risk that comes with cryptocurrency options. You should never invest money that you cannot afford to lose, and you should do your research before selecting a broker. Past performance does not guarantee future results.

Mistakes to Avoid When Trading Crypto Options

Cryptocurrency options are a great way to make money, but there are a few things you need to avoid if you want to be successful. First, don’t trade options that are too close to the current price. If the price of the underlying cryptocurrency moves too much, your option may not be worth anything. Second, don’t trade options that are too far in the future. If the option is too far out, it may be worth less than you think.

These two factors should help you decide whether or not to sell a specific option.

Trade Crypto Options on Bit.com

Now that you know everything about crypto options trading, you might as well get started. If you’re interested in speculating the future prices of digital assets, Bit.com is a great place to start