What is "Know Your Customers" (KYC), and Why is it Important?

Introduction

Have you ever wondered why some crypto exchanges or platforms require you to fill out certain forms or follow an identification procedure to get started on their platforms? This can be baffling because anonymity is one of the cores of crypto assets and their trading. So why would anyone require you to put your real identity on your profile to trade crypto?

What is KYC?

KYC is simply a short form of "Know your Customers" or sometimes "Know your Clients." It is the governmental procedure for financial institutions to prevent money laundering, tax evasion, terrorist financing, and more. It was reported by Chainalysis, a leading blockchain analytics company, that about $8.6 billion was laundered in cryptocurrency in the year 2021, which is a 30% increase from the 2020 analysis. Adequate verification will hugely reduce fraudulent activities and increase trading reputation.

Financial institutions are required to verify every client upon registration. Most institutions employ a specialist to handle this task. The wide adoption of cryptocurrencies has facilitated the need for crypto exchanges to adopt these methods alongside other traditional financial institutions. This bridges the differences between fiat and crypto trading.

The procedure is necessary for institutions to function in some countries, and complying with it is the only way to operate therein. KYC is usually seen as a necessary evil but involves processes that are not entirely exposed or too strenuous for clients to complete.

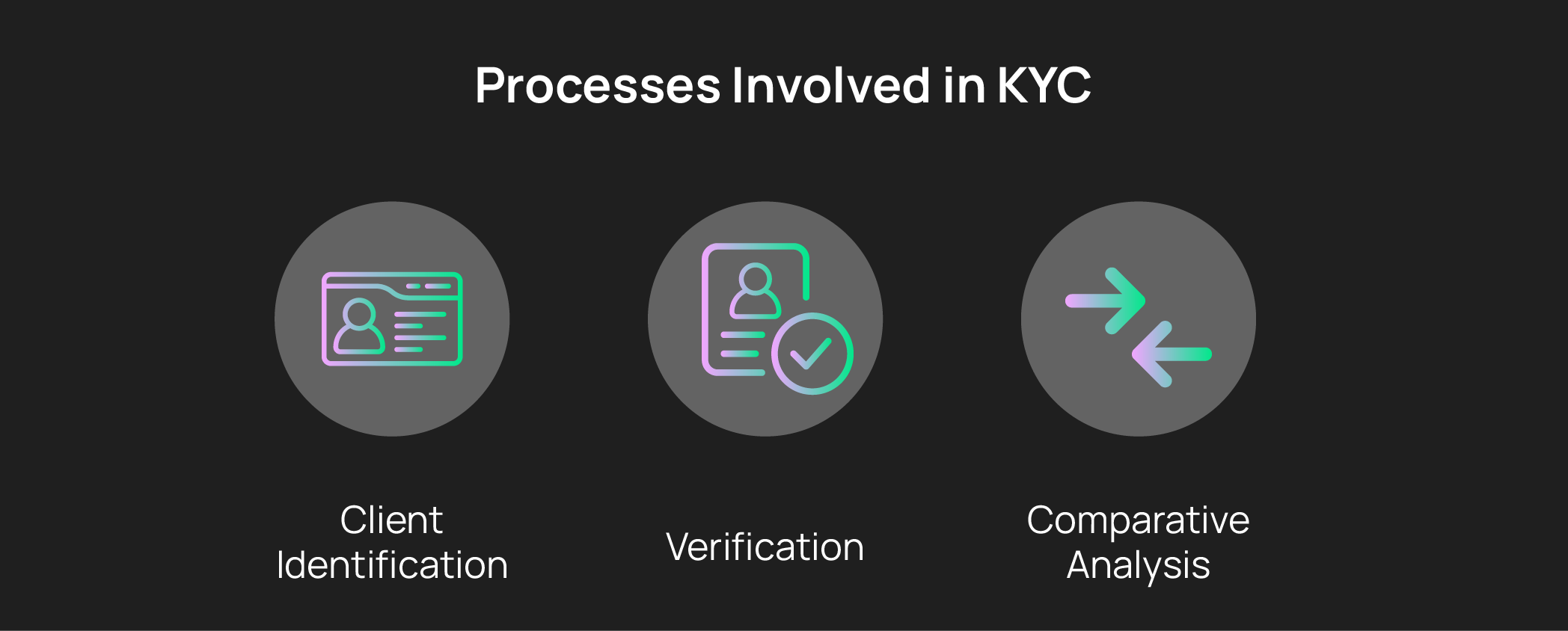

Processes Involved in KYC

Each financial institution goes with a preferred method of verification for its clients. Verifications are usually done upon registration and at periodic intervals. All verification follows a uniform three stages process as follows:

- Client identification: This is done through information collection such as names, social security numbers, addresses, valid IDs, and more. With each platform going with its preferred IDs and outlined questions, the core of this step is to identify the client with adequate information.

- Verification: It is not enough to take it as the clients say, and the platform has to verify all submitted information. This includes understanding the financial actions of the clients and fund sources. Verifying the legality of submitted identification and ascertaining the originality of everything the client said is what this stage entails.

- Comparative Analysis: Upon verification, the platform compares the information with official documents on Politically Exposed Persons (PEP) or sanctioned individuals to see if there's a match. This is needed to assess the client's money laundering and every other risk. The entire verification process goes a long way to screen clients and monitor their entire transactions online.

Benefits of KYC to Crypto Exchanges

KYC procedures pose lots of benefits to crypto exchanges. These are inclusive of the following;

- Identifying and verifying client bases allows a crypto exchange to legally extend its services to the law's full extent.

- It reduces the risks of criminal activities and money laundering on such platforms. In addition, reducing such activities increases these platforms' credibility and broadens their adoption.

- It facilitates service optimization for customer experience for customers that pose lower risks. As a result, they enjoy great service speed and efficiency.

Benefits of KYC to Clients

From a customer's perspective, a few minutes of filling out forms and submitting IDs might be more beneficial than we perceive. Some of the benefits are;

- It establishes your credibility on that platform. Regardless of similarity in name or location, KYC vindicates every client based on their identities and establishes credibility for each individual.

- It enhances smooth provided services: A clear verification is a gateway to maximally enjoying efficient services on such platforms.

- Every client gets to enjoy the benefits that come with KYC-verified platforms. Through this, every advantage the platform benefits from abiding with governmental policies in identity verification is benefitted by the clients.

The Twist in KYC Adoption and its Loopholes

Although it's mandatory in some countries that exchange platforms go through KYC procedures as they represent financial institutions, it's not fully adopted by the entire industry.

The core argument is that it seems to dispose of cryptocurrencies trading in its anonymity. Even though this poses more benefits than harms, some customers, mainly into crypto for anonymity, find the simple procedure extremely uncomfortable.

Closing Words

KYC is an important process in vetting all clients and performing due diligence on their potential risk and criminal activities. It's a necessary evil on all platforms to promote smooth running and minimize legal risks.

About Bit.com

Bit.com is a full-featured cryptocurrency exchange run by Matrixport, one of Asia's fastest-growing financial services platforms for digital assets. Bit.com is dedicated to offering services such as price discovery, trading strategy execution, and liquidity provision. Furthermore, Bit.com constantly promotes the development of new financial products, enhancing user trading instruments, and listing specific tokens. High-quality security and risk management measures are incorporated into the company's design to create an exceptional trading environment.

Sign up on Bit.com, and switch on your future.