What is Rebalancing Market Making (RMM) strategy?

Cryptocurrency is a decentralized finance system that has become very popular with businesses and investors. It grants people outside the finance industry access to unlock new investment opportunities.

The crypto market is volatile; hence it is hard to seize the opportunities that come with it.

Rebalancing market-making (RMM) strategy is an innovative tool used to place orders automatically. RMM helps crypto investors rebalance their portfolios automatically to the initial fixed ratio.

What is Rebalancing Market Making (RMM) strategy?

Rebalancing Market Making strategy is used in calculating the ratio of two crypto assets available in the investor's portfolio based on the initial total funds, including virtual and real or actual funds, and placing orders based on the configured threshold and the balanced ratio.

When there is a price change, the ratio of a currency exceeds its threshold. A limit order will be filled to set the ratios back to their initial level, thus obtaining an automatic rebalancing.

What is Portfolio Rebalancing?

Portfolio rebalancing is the ability to adjust the allocations of a portfolio. Assets tend to change value with time. Hence, this change affects the original weightings of assets.

The main purpose of rebalancing is to balance these weightings and help optimize the portfolio. For better understanding, you have two assets, say Bitcoin and USDC, and you have different allocations for each.

If your Bitcoin jumps 200% in value, you can move this profit to USDC since it hasn't moved much - or at all. With this, you're trying to balance your portfolio. Portfolio rebalancing allows investors to check their risk level and adjust their holdings to the initial levels.

Types of Crypto Rebalancing Strategy

- Constant Proportion Portfolio Insurance (CPPI):

Constant proportion portfolio insurance (CPPI) is a rebalancing strategy based on the assumption that the higher the wealth, the higher the risk. Hence investors need to safeguard their wealth from risk by allocating a portion of it to cold hand cash or stable coins. By doing this, they rest assured that their portfolio is not exposed to higher volatility.

For instance, if Investors hold all of their capital in crypto and the market breaks records. It will be a lovely boost to their portfolio. But on any slight retrace, their portfolio might experience some significant loss. Thus, if an investor wants to ensure that their capital and profits are secured, it is vital to exchange portfolios of their tokens for stablecoin.

More precisely, an investor has $200,000 in Tether (USDT) and another $200,000 in crypto. If the market crashes by a certain percentage, say 50%, this will only affect the investor's crypto holdings, eventually leading to a $50,000 loss and a balance of $150,000 in the investor's portfolio.

If he has all of his money in crypto, that will be a double loss of $100,000 and a balance of $100,000 in his Portfolio. But by holding stablecoins, the investor can evade loss and also have the opportunity to rebalance his Portfolio by investing these stablecoins in crypto.

- Threshold Rebalancing:

Threshold rebalancing is another type of rebalancing strategy that allows the application of tolerance bands to an investor's holdings. A specific allocation percentage is assigned to an asset which prevents it from degenerating excessively.

Investors can allow an asset to move 10% up or down. But that asset should be bought or sold as soon as the change in price breaks 10%. For a better understanding, let's assume investors have an investing plan of holding Bitcoin and USDC and intend to reserve half of their portfolio in USDC and the remaining half in Bitcoin.

If they agree to have a 50/50 split, they can use a threshold balancing strategy. All they need to do is set a 5% tolerance band, ensuring that the portfolio deviates to 45/55. If by any means one asset performs better than the other, investors will have to sell that asset to buy the other one.

- Calendar Rebalancing:

Calendar rebalancing is a rebalancing strategy that focuses on time rather than allocations or value. It allows the specification of convenient time intervals to rebalance. This can be on a daily, weekly, monthly, or yearly basis.

Unlike the other two types of rebalancing strategies, calendar rebalancing is easier. Investors are not required to monitor tolerance bands or calculate any risk as the case may be. The only job is to rebalance their portfolio at their desired time.

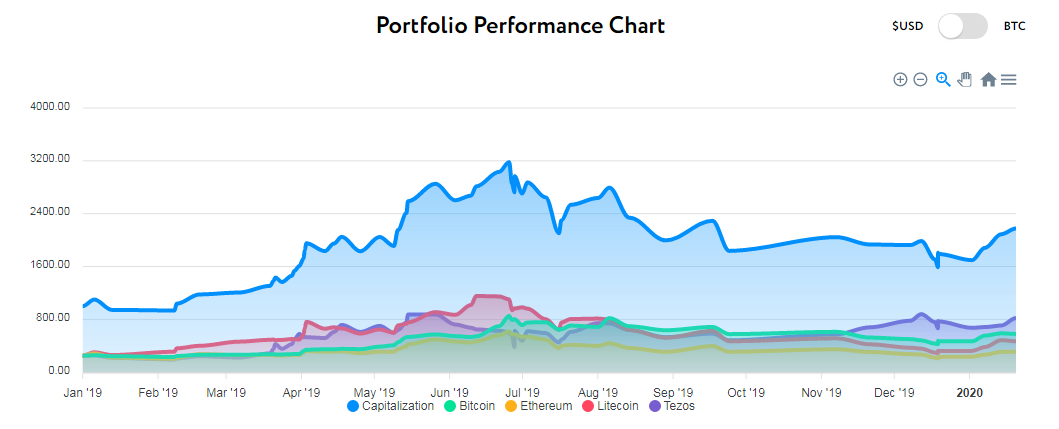

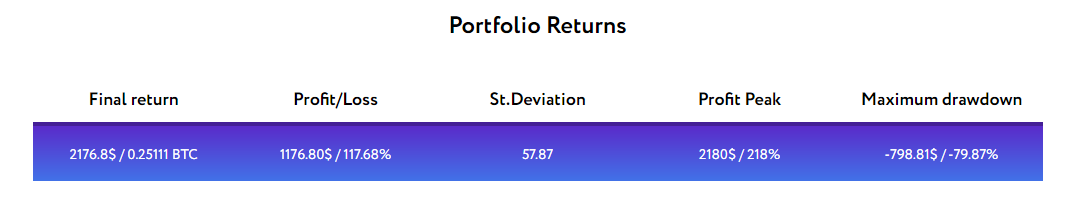

Advantages of Rebalancing Market Making (RMM) strategy

- It helps reduce portfolio volatility.

- It assists investors in capturing price fluctuations by buying low and automatically selling high.

- It also helps to achieve long-term portfolio growth in a highly volatile market.

- It allows investors to earn maker fees by providing liquidity to the market.

Closing Thoughts

The functions of the RMM strategy cannot be over-emphasized. It has proven to be a valuable strategy for crypto investors while playing a unique role in balancing portfolios and ensuring investors buy at lower prices and sell at higher prices.

Bit.com’s Rebalancing Market Making feature

Now that you have learned about the Rebalancing Market Making strategy, you might want to explore Bit.com’s RMM features.

With the mission to create an entire ecosystem for blockchain-based financial transactions, Bit.com stands as the world’s 2nd largest crypto exchange and trading platform.

Sign up on Bit.com to get started.