Bitcoin Whales Accumulate as Critics Declare its Demise

Bitcoin, the undisputed champion of the cryptocurrency industry, has been making waves with its remarkable success and widespread acceptance. However, as with any disruptive innovation, there are prominent critics who argue that Bitcoin lacks inherent value. Yet, despite the naysayers, the cryptocurrency's resilience and market performance have continued to defy expectations.

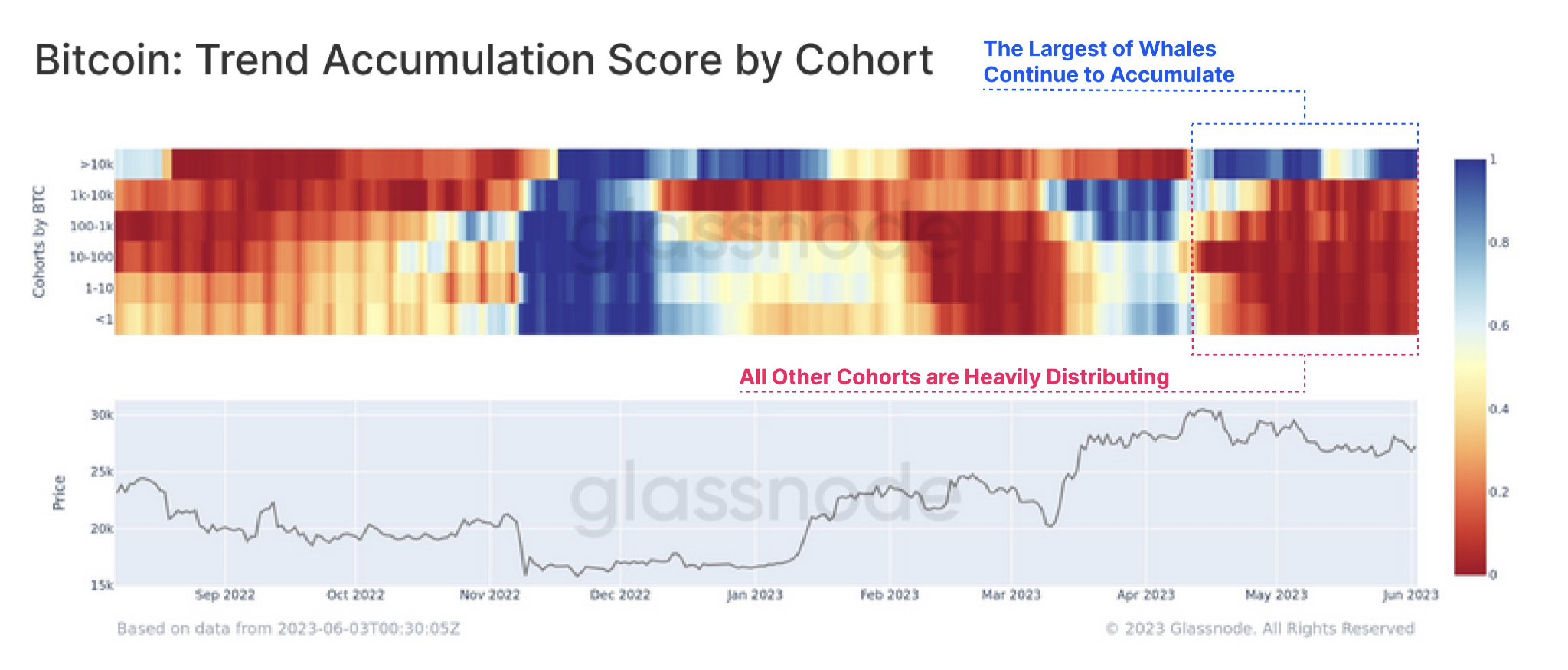

In the ever-changing landscape of the cryptocurrency market, one group of players stands out: the Bitcoin whales. These behemoth investors, often individuals or entities holding over 10,000 BTC, are making waves of their own. While the wider market trend leans toward distribution, these whales are determinedly accumulating Bitcoin, displaying a bullish sentiment that sets them apart.

Glassnode's Bitcoin Accumulation Trend Score serves as a spotlight on this intriguing phenomenon. It reveals a striking contrast between the whales, who are aggressively increasing their holdings, and other major cohorts, who are witnessing heavy distribution. This divergence in behavior hints at the underlying market dynamics at play.

What Exactly Is Driving This Dichotomy?

It appears that large investors view the current Bitcoin price level as an enticing entry point, seizing the opportunity to bolster their portfolios. Simultaneously, other market participants take advantage of the situation to secure profits. At the time of writing, Bitcoin's price stands at $27,210, according to CoinMarketCap, representing both an opportunity and a challenge for investors to navigate.

Adding another layer of intrigue to the evolving Bitcoin landscape, significant Bitcoin whales have been observed retreating from cryptocurrency exchanges. This retreat is evidenced by a decrease in the exchange-whale ratio. This ratio, derived by dividing the total Bitcoin volume of the top 10 transactions by the total Bitcoin volume flowing into exchanges, has slid to around 0.3, a level unseen since March.

It suggests that major Bitcoin holders are opting to retain their assets or explore alternative investments or private wallets. Such a move adds further complexity to market dynamics and potentially indicates a shift in the cryptocurrency landscape.

Bitcoin's Resilience in the Face of Critics

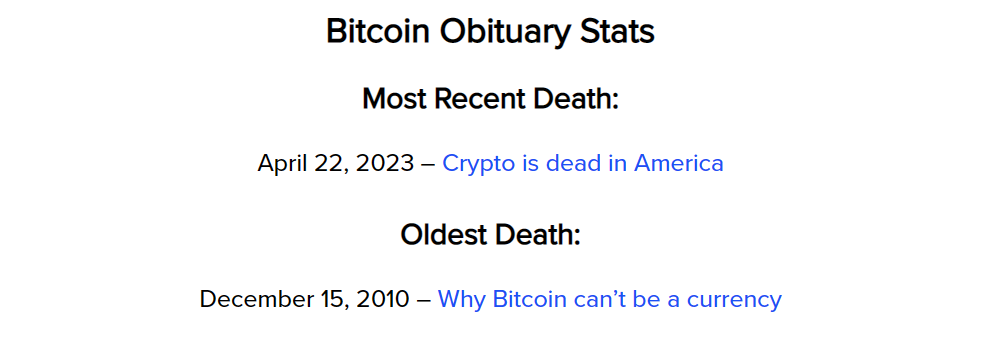

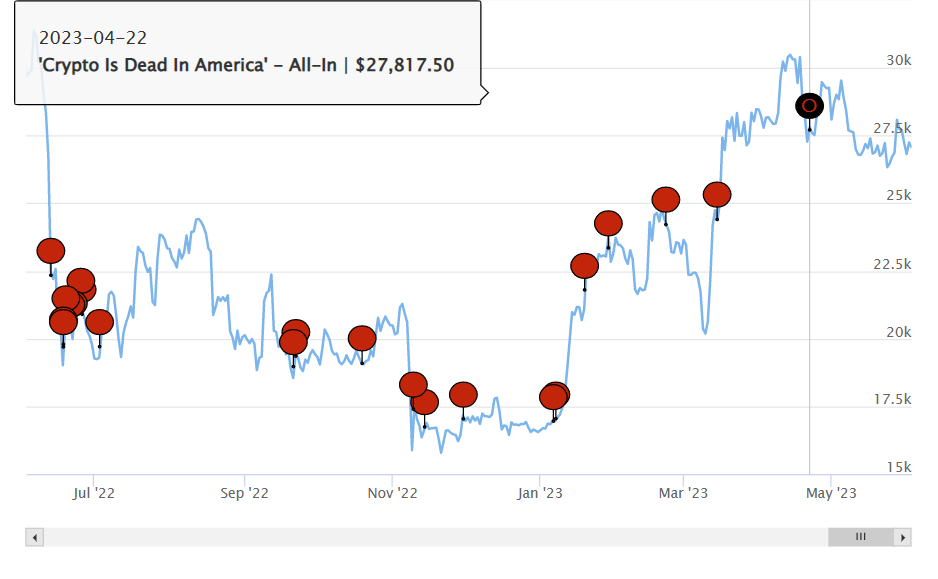

Bitcoin's detractors have not been shy about voicing their skepticism. According to 99bitcoins, a cryptocurrency information platform, the digital currency has faced a whopping 474 "death declarations" since its inception. These declarations, which must come from individuals with notable followings or sites with substantial traffic, explicitly state that Bitcoin is or will become worthless, leaving no room for ambiguity.

The journey of Bitcoin's obituaries has been fascinating. One of the earliest predictions of its demise came from businessman Jordan Tuwiner in December 2010. In an article titled "Why Bitcoin Can't Be a Currency—the Underground Economist," Tuwiner expressed doubts about its future.

Interestingly, Bitcoin was trading at a mere $0.23 back then. However, Tuwiner recognized Bitcoin's potential and later changed his stance, establishing BuyBitcoinWorldwide, an educational resource for those eager to delve into the world of cryptocurrencies.

Even during Bitcoin's peak success in November 2021, when its price soared to $69,000, Sam Leith of The Spectator wrote an article titled "The Bitcoin Delusion," likening Bitcoin to a ticking time bomb. The latest addition to the Bitcoin eulogies comes from renowned tech investor Chamath Palihapitiya, who declared in April that "Crypto is dead in America" when Bitcoin's price was at $27,817.

However, despite the skepticism and negative sentiment expressed by these critics, Bitcoin has proven time and again that it is here to stay. Its resilience and positive market performance have been nothing short of remarkable. Since Tuwiner's initial declaration in 2010, Bitcoin's value has skyrocketed over 11,700,000%, solidifying its position as a formidable player in the financial landscape.

Bitcoin Price Analysis

BTC maintained a somewhat bearish footing through the first week of June, as bulls found it difficult to retake the $28,000 resistance. At the same time, the benchmark cryptocurrency refuses to go below the $26,000 mark, which has left Bitcoin constrained within a $2,000 “box.”

When viewed from a larger perspective, a downward channel emerges, confirming that BTC is indeed in a bearish trend, albeit subtle. That said, the main level for bulls to target in order to negate this pattern is the $28,000 mark. It would be interesting to see if Bitcoin manages to challenge this ceiling this week.

BTC Statistics Data

BTC Current Price: $27,210

BTC Market Cap: $527.6B

BTC Circulating Supply: 19.3M

BTC Total Supply: 21M

BTC Market Ranking: #1

Feeling confident? Trade your idea on BTC now.

Disclaimer

This article should not be taken as financial advice. It is essential to conduct research before making any investment decisions.