01: The meaning of DAOs and how they might reconfigure the world as we know it.

Explore the potential of decentralized autonomous organizations.

DAOs, or Decentralized Autonomous Organizations, are an emerging form of organizations stirring up a storm across businesses and the crypto industry . DAOs may fundamentally disrupt how capital and control is structured -- or they may just be an innovative trend in the use of tokenization. The situation is evolving rapidly, and it’s too early to forecast the extent of change, but it’s likely that DAOs will have a lasting influence on how organizations are structured and managed.

So what is a DAO?

DAOs, entities enabled by blockchain technologies , are collectively owned and managed by members with a common vision. They are issued crypto tokens that come with rights to vote on decisions. These are entities with no central leadership. Decisions are made and governed by a community organized around a specific set of rules enforced on a blockchain.

The decentralized autonomous organization is comprised of a group of people who have entered into a contract with one another to reach a coordinated goal. The goal can be anything from collecting NFTs, to predicting stock market moves or running a company. DAOs usually exist to raise funds for a specific purpose.

For instance, in 2021, ConstitutionDAO, made up of 17,000 people, put together more than $40 million to bid on an early copy of the U.S. Constitution. They were outbid by hedge fund billionaire Kenneth Griffin, but the move showed the strength of what a DAO could do.

How DAOs could change organizational structures

Today, a majority of businesses are centralized, and only a handful of people are in-charge of influential business processes.

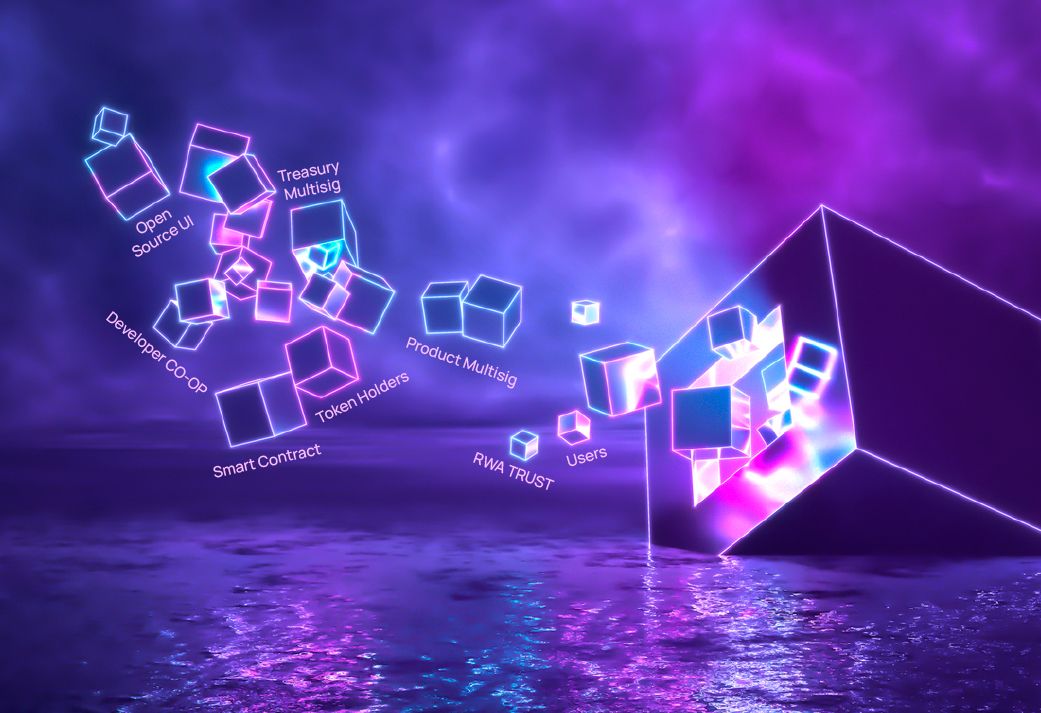

DAOs have the potential to democratize corporate governance in ways never seen before. All DAO members need to follow the rules driven by the code that governs the smart contract and oversees every task necessary for the organization to function. DAOs essentially create internet communities with a shared cap table and bank account.

When a DAO is first built, the rules are written in code and deployed as smart contracts into its parent blockchain. These contracts auto-initiate when certain actions occur. All those involved in the DAO agree to the rules. If there are violations, the funds auto-lock themselves, making the DAO non-functional. Each DAO has a treasury that stores its cryptocurrency, which can only be accessed by its members, with permission from the group. Decisions are made at a scheduled time, through a voting process.

What are the key features of DAOs?

When compared with traditional organizational structures, DAOs have some unique characteristics such as:

- Democratic organization

Traditional organizations follow a hierarchy, with most powers resting with a CEO or a board of directors. However, DAOs are decentralized, and all members have equal say within the organization. This means that unless a majority of the DAOs members cast votes, the rules cannot be changed.

- Transparency

DAOs operations are transparent. Within the DAO, all decisions are publicly discussed, voted upon, and documented.

- Financial transactions

Each financial transaction of the DAO is recorded on the home blockchain. Hence, there is no need to involve a third party in this accounting.

So what do DAOs do?

There are several types of DAOs, and each has a different mission, whether it is single-purpose or part of a larger project, and can be associated with any number of industries.

AMM or Protocol DAOs such as Uniswap, MakerDAO, use smart contract protocols to bring decentralised financial services to users.

With Grant DAOs, such as Aave Protocol, the community donates funds into the grant pool and collectively votes on allocating and distributing the funds. The purpose of these DAOs is to fund innovative new DeFi projects, with organizations submitting funding applications.

Investment / Collector DAOs are the second largest category. They range from venture investments into assets such as DeFi protocols or NFTs to increasingly ambitious efforts like buying rare historic documents or even professional sports franchises. They offer a fast approach to capital formation. PleasrDAO, MetaCartel Ventures, Flamingo, and Komerabi are all examples.

Social DAOs

These are platforms for social interactions and social networking. These are usually explicitly built to focus on a particular objective, such as preserving arts and culture or pursuing projects aligned with their community values. Examples include Friends With Benefits, Ape DAO, and even Decentraland DAO.

DAOs: Too futuristic or living reality?

Far from the future, the DAO universe is unfolding right at this very moment. DeepDAO, a dedicated DAO analytics firm, currently follows more than 4,832 DAO organizations today with $9.7B+ in assets under management and nearly 652,000 members.

With billions in assets, and a future irreversibly dominated by the internet, although DAOs may be at early stages of experimentation they have already proven to be a whole lot more than just clubhouses for crypto-philes.

Doubts about DAOs

DAOs are still very new and the potential downsides are not yet fully understood. One major concern is security vulnerability within the code. In an infamous incident in 2016, hackers broke into The DAO’s smart contract and stole over $50 million from the group’s accounts. While no money was lost in the end, the risk was huge considering that at the time, ‘The DAO’ was a heavily invested project and its contracts contained approximately 14% of all Ether (ETH) in circulation.

Even without a malignant hacker lurking around, simple security issues in the smart contract code of a DAO cannot be fixed unless the majority votes for a change in the code. This could make it vulnerable to attacks by hackers and malware.

There may also be hurdles around lack of legal/regulatory clarity, absence of efficient coordination mechanisms, inadequate infrastructure and smart contract, fragmentation, or sustainability risks.

Future of DAOs

While challenges exist, DAOs represent a paradigm shift in economic organization and capital formation.

There is increasing interest in new DAO models and applications, some of which may be the start of massive organizations that are built not on legal contracts but on code.

The wave of the future for organizational governance? A passing trend? At Bit.com we think the DAOs will drive a new hybrid that will enhance but not necessarily replace corporate structures. In any event, there is no doubt that DAOs are worth paying attention to in 2022. Watch this space for more from Bit.com and see how you can get started here.