What is COMP? - Borrow or lend crypto on the Ethereum blockchain

Back in July, we spoke about Aave, the largest crypto loan provider. Today, we’d like to cover a little bit about Compound (COMP), another loan giant in the Decentralized Finance (DeFi) industry.

COMP is a decentralized cryptocurrency borrowing and lending platform for cryptocurrencies without a middleman or a bank. Unlike Aave, which supports multiple blockchains, COMP is only compatible with Ethereum.

The current coins that you can lend, borrow, buy, or sell on COMP are:

How does it work?

How does COMP work? On a decentralized lending platform, lenders put coins into a pool and allow people to borrow them, earning crypto interest in the process; borrowers put up collateral in one coin, borrow another coin they’d like, and pay interest when they return. Straightforward.

The beauty of a decentralized lending and borrowing platform like COMP is the idea that there isn’t a middleman (like a bank) to reap any profits from your crypto transactions. There’s just the lender, and the borrower. The protocols use smart contracts – blockchain technology that automates the execution of lending and borrowing services once it meets certain criteria.

Who is COMP?

Strictly speaking, COMP isn’t 100% decentralized. The entire protocol is somewhat governed by Compound Labs Inc, founded by Robert Leshner (CEO) and Geoff Hayes (CTO) in San Francisco in 2017. The company has full control of the smart contracts and other parts of the system, but allows certain users (those who own more than 1% of the total supply of COMP coins) to propose and vote on changes and policies.

Major players have seen the potential of COMP and invested heavily in its growth. The companies that joined it as investors include Coinbase – a leading crypto exchange, and large crypto investment funds such as Polychain Capital, Dragonfly Capital Partners, Paradigm, Andreessen Horowitz / a16z, and Bain Capital Ventures.

So now that we’ve had a little bit of an introduction to COMP, it’s worth revisiting the basic principles of decentralized lending.

The Borrower

To borrow, you’ll have to put up collateral in another cryptocurrency, and usually higher in value than what you’d like to borrow. On COMP, the amount you can borrow is capped at 66% of the collateral. For example, if a user deposits $10,000 in ETH, they can lend up to $6,600 of any other currencies supported by the platform.

So if you don’t pay back your loan, COMP will take away your collateral to make sure that the lender gets their money plus interest back. So no collateral, no borrowing.

The Lender

As a lender, the smart contract makes sure that you’ll be paid automatically, plus the crypto interest you earn. You don’t need to trust the borrower. It’s not so much peer-to-peer lending, more like pool-to-peer lending.

In other words, to become a lender on the COMP platform, you deposit crypto tokens into a “liquidity pool”, which is a collective pool of tokens that the platform uses to give out loans. What you get back in interest is earned from how much you have put into the pool. Interest rates depend on demand and supply. High demand + low supply = High interest. Low demand + high supply = Low interest.

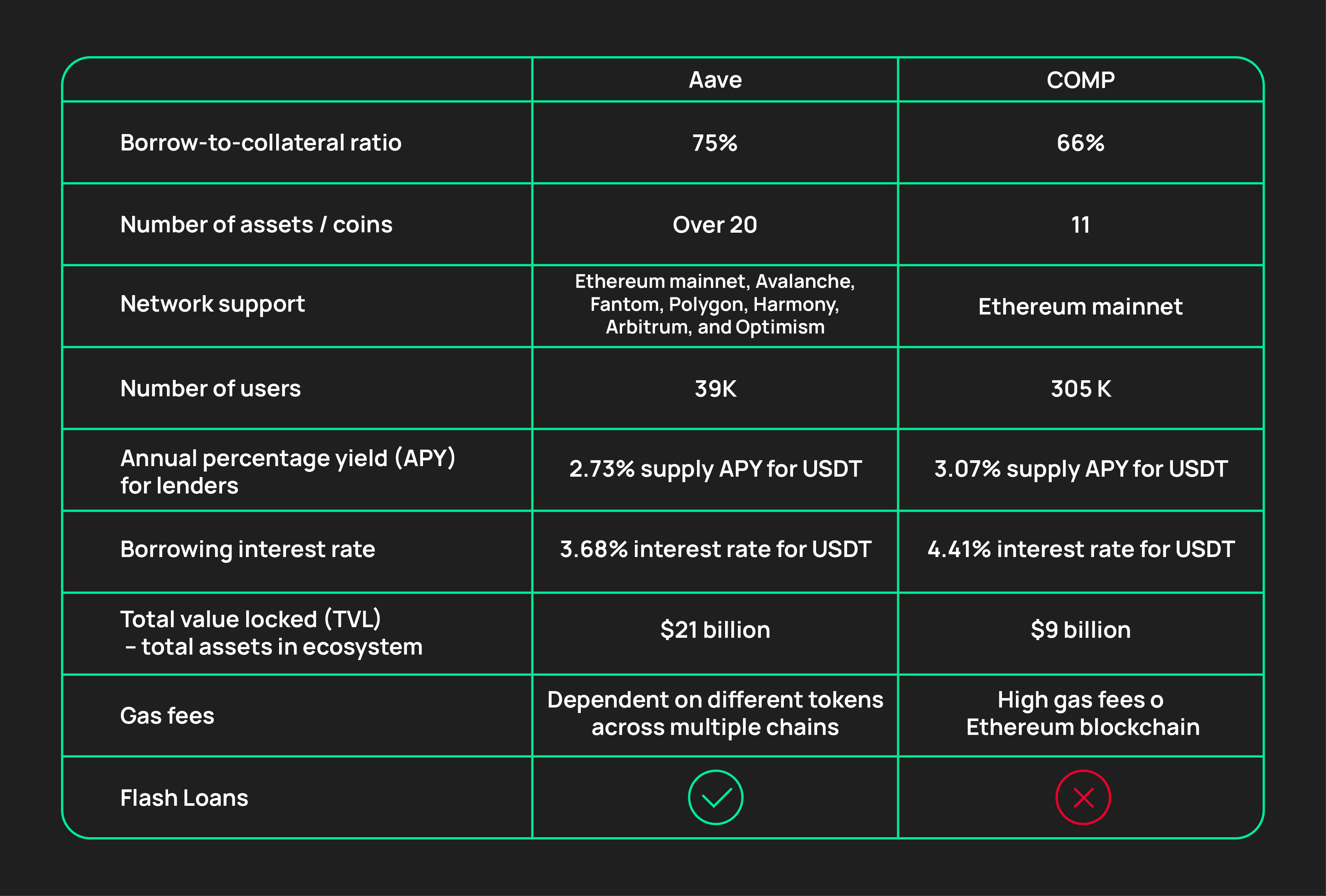

Difference between COMP and Aave

The COMP Token

When we put these two platforms beside each other, Aave is stronger than COMP in its innovation and features. Aave is also more diversified and it allows you to choose from a bigger variety of coins on different blockchains, which means that you can choose to avoid Ethereum’s high gas fees for your transactions.

We’ll let you draw your own conclusions as to whether Aave or COMP fits your investment portfolio better. But we’d like you to know that the COMP token, Compound’s own coin, and AAVE, can be traded today on Bit.com.

Get ahead with DeFi lending and borrowing, download our app today and Switch on to The Future.