04: DAO Tokenomics Explained

A fusion of the words "token" and "economics", tokenomics refers to the elements that make a particular cryptocurrency valuable and attractive to investors, such as the total token supply and utility

It’s essential to consider tokenomics when investing because crypto projects with well-designed incentives to buy and hold tokens are more likely to outlast and outperform crypto projects that have not built ecosystems around their token.

Tokenomics are also central to evaluating DAOs, depending on the needs of each organization, their governance rules, and use of tokens.

What is a DAO?

A DAO (decentralized autonomous organization) is a community-oriented organization in which members work and build projects together. A DAO is fully decentralized in that no one stakeholder can make decisions unilaterally. If members want to bring about a change, start new projects, or access treasury, they have to vote on it.

That’s where things can get tricky. Building consensus and managing a group of strangers online is challenging without a centralized leader, so it’s essential to have a framework to guide the activities of a DAO in the right direction through a system of rewards and incentives.

DAO tokenomics are a key guiding factor in a DAO's operation.

DAO tokenomics

DAO tokenomics underly the economic principles that govern a DAO, and require an understanding of how the DAO token is created and managed.

So what is a token?

The word token may be used to describe any cryptocurrency besides Bitcoin and Ethereum or it can also refer to crypto-assets that run on top of another cryptocurrency's blockchain.

Tokens in the second category help decentralized applications to do everything from automating interest rates to selling virtual real estate. They can also be held or traded like any other cryptocurrency.

This type of token is different from native coins. For instance, the native coin for the Ethereum blockchain is ether and hence is not a token. But the GURU token allows you to trade on the Ethereum blockchain and is, therefore, a token.

Uses of DAO Tokens

Generally, tokens are the mechanism that allows DAOs to share their project's equity with its members. There are specific use cases for DAO tokens depending on the purpose of the DAO. Here are some of the common ones:

Ownership

DAO tokens represent a member's ownership or access. For instance, the owners of a certain number of the Uniswap DAO tokens (UNI) get voting rights in that DAO.

Value Exchange

Tokens may serve internal or external functions - such as performing tasks within a DAO or being traded like other cryptocurrencies. For instance, DAO members can exchange tokens in return for the value generated by the project.

Utility

Some DAOs have a specific use for their tokens. For example, Gala games raised $GALA tokens that do not represent any ownership but are used as a digital reward.

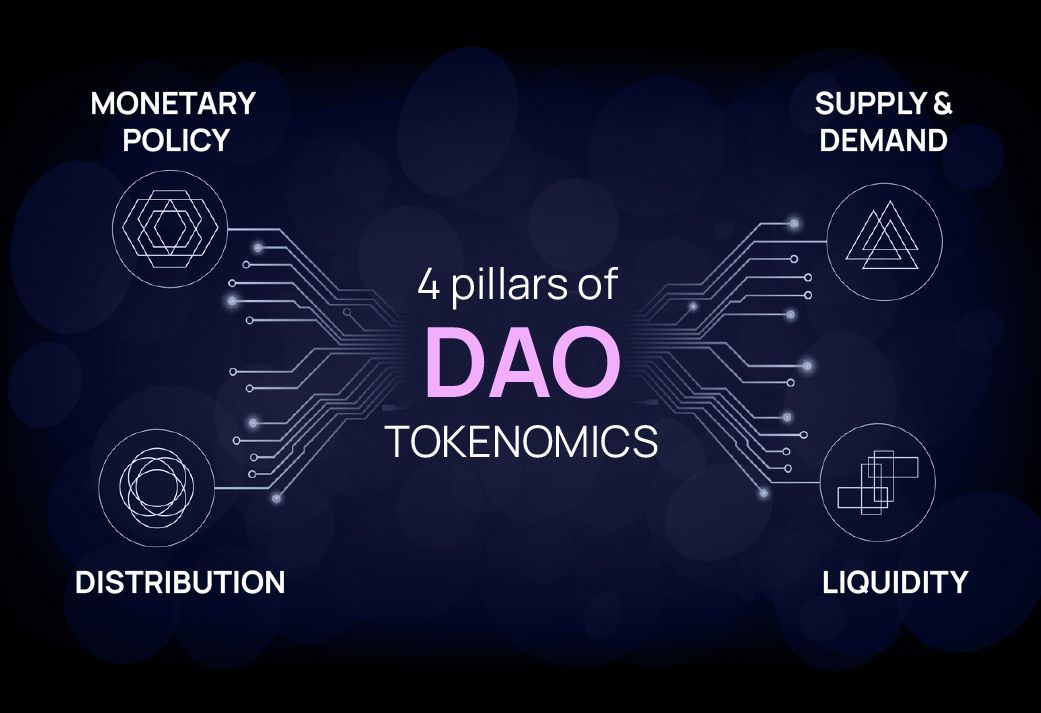

Exploring the four pillars of DAO tokenomics

Supply and demand

The initial supply of tokens (genesis supply) is distributed among the DAO members. Sometimes early contributors receive tokens. The DAO treasury always has some tokens stored to meet expenses such as funding projects and rewarding members.

Distribution

Distribution is the amount of a DAO’s token that each wallet contains. If 65% of tokens of a DAO rest with one individual, that’s not a good sign because the project would become centralized. Plus, if the DAO's creators sell all their tokens at once, the project's value would disappear.

Conversely, the proper distribution is when DAO tokens are spread out evenly among members. The easiest way to find a token's distribution is to check its white paper. Read the allocation details to find the distribution.

Monetary policy

The monetary policy is the direction a DAO chooses—inflationary or deflationary.

High inflation causes a drop in asset prices. Ideally, a low inflation rate is healthy for the DAO ecosystem.

Inflation and its effect

Inflation is a measure of new tokens in circulation. A token could have a fixed supply, or a DAO may keep producing new tokens. If the number of tokens keeps increasing, it will reduce the prices. Although their value stays the same, it reduces the transaction fee (in terms of fiat currency), encouraging more people to circulate the token and not hold it.

Deflation and its effect

Deflation tokenomics brings down the tokens in supply. When the token supply reduces, the scarcity rises, increasing prices.

On the other hand, rising prices cause the transaction fee to increase (although the DAO tokens' value remains the same), keeping buyers away from the DAO.

Liquidity

Liquidity is the quantity of DAO crypto tokens that can be bought or sold without bringing about a change in their price.

If a token has little buying and selling activity, even a tiny movement will trigger a price change.

Therefore, DAO projects try to raise liquidity by giving away incentives to liquidity creators.

DAO fees

The goal of DAOs is to keep the money flowing within it and not let it leak out. Having buyers and sellers for the token means the DAOs can charge a fee for all transactions and use it to cover their governance costs.

Value capture

Value capture is the amount of value a DAO protocol can capture and distribute.

In Web2, the value of every company went to its creators and was distributed internally. For example, Google and Facebook earn millions of dollars from users' data, but users make zero earnings.

Web3 is a whole different game, where each protocol generates value and distributes it to members making it a win-win for everyone involved.

A classic example of value capture is the Uniswap-Sushiswap fork. Uniswap offered lots of value, but they did not distribute it among members. But then Sushiswap came into being and made SUSHI tokens. The token holders had voting rights and earned transaction fees. So when it came to capturing value and distributing it, Sushiswap was better than Uniswap.

Conclusion

DAO tokenomics can potentially change our existing economic systems in the interest of shareholders, community members, operators, and nature. In a future where DAOs are likely to be prominent, we’ll wait and watch to examine how deeply they impact the overall business ecosystem.